Enterprise content managers get venture capital backing

Enterprise content managers get venture capital backing

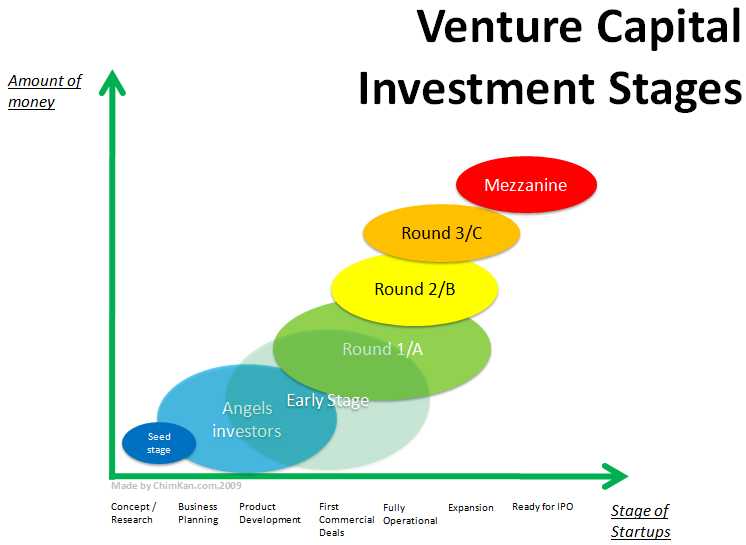

Enterprise content management platforms have been around for years, but since 2013 seven companies have received funding from investors to accelerate their growth, not only in the US but also in India and Europe.