Alternative financing, also called non-bank financing, is the set of financial markets and instruments that do not come from traditional banks. The sources of non-bank financing are diverse, but they all have in common the fact that there is no bank involved in the process. We are therefore in front of the "direct lending" - the owner of the money directly lends the capital, since he is the owner of the entity or the fund that makes the loan.

As a general idea, alternative financing can be classified into equity investors (venture capital, business angels, etc.) and debt alternatives (debt funds, venture debt, etc.).

Each of the options has its advantages and disadvantages depending on the situation and the project that the company has. Here we focus on debt financing, but we also offer the capital raising or strategic investor investors.

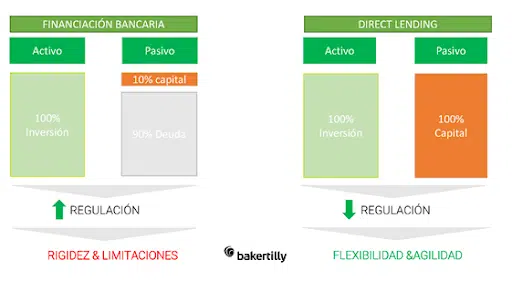

The main advantage of non-bank financing over traditional bank financing is the flexibility to adapt to the borrower's needs and cash flow generation.

Guarantees are clearly less demanding for companies than in bank loans. The repayment term is longer and is generally in bullet form, i.e. 100% repayment at the end of the period. Since non-bank financing is less regulated, it can be obtained more quickly.

On the other hand, there are also disadvantages of alternative financing, such as the higher cost of financing, which usually includes a variable portion. In most of the options it is necessary to carry out an audit (Due Diligence) and for the investor to obtain a seat on the board of directors, even without voting rights.

Alternative financing does not imply for a company the dilution of the participation of the current shareholders, as would be the case when a venture capital becomes part of the shareholding. It also avoids the whole process of entry and exit of the venture capital and therefore does not require a joint negotiated exit after the investment process.

The negotiation process is simpler and more agile and the cost is lower compared to venture capital. Equity is always the most expensive form of financing because it assumes more risk. Finally, if venture capital enters the company, it will interfere in the management of the company.

There is a fairly wide variety of sources in the market and the number of options available continues to grow. The suitability of each option depends on the company's purpose for financing.

It is a financing alternative based on a combination of venture capital investment and a traditional loan. In exchange for receiving a loan of X amount, a combination of interest is paid and the company's capital is delivered. Due to its modality, it is a medium-term financing.

This is medium and long-term financing. The collateral for the loan is the expected cash flows that the company will generate. It is mainly used for investments, purchase of assets, execution of projects and contracts.

This is the sale of a company asset, usually real estate, for subsequent long-term leasing. Long-term financing, basing the guarantee on the company's productive assets.

It is financing that is intended for the purchase of other companies or business units, customer portfolios or similar. The terms of the loan are determined by the creditworthiness of the purchased party and the expected development of the business plan.

This loan is intended for temporary and urgent financing needs, for example, the need to cover cash flow in a timely manner. Sometimes they can also be until a larger definitive loan is obtained. Its main characteristic is flexibility and agility.

It is dedicated to any cash need, whether one-time or recurring. It can be, for example, to finance purchases or to diversify and complement the sources of financing of working capital.

In non-recourse factoring, the company assigns the right to collect and the risk of its invoices in exchange for receiving the amount before the due date of the invoices. This financing improves solvency, debt and liquidity ratios. This financing does not appear on the company's balance sheet.

Alternative financing is mostly talked about only in the context of startups and small investments. On the contrary, however, it is also available for larger projects. In this context, compared to a bank loan or a venture capital investment, it has the great advantage that it does not count in CIRBE, given its non-bank status.

Many entrepreneurs and managers have doubts when it comes to achieving and implementing the objectives of seeking finance and raising funds in line with the defined strategy:

Baker Tilly International is a Top 10 ranked professional services firm, with a strong focus on the Mid-market, offering global reach and regional support, specialised service teams, and extensive experience in high-growth sectors.