New CDTI Line: Global Innovation Line

New CDTI Line: Global Innovation Line

The CDTI launches the global innovation line to finance business projects that boost the growth of SMEs through investment in technological innovation.

New CDTI Line: Global Innovation Line

New CDTI Line: Global Innovation Line

The CDTI launches the global innovation line to finance business projects that boost the growth of SMEs through investment in technological innovation.

Acquisitions in the field of energy efficiency technologies

Acquisitions in the field of energy efficiency technologies

According to a report by Logic- Fin, the number of acquisitions in the sector has been growing gradually in recent years, although in 2008 there was only one acquisition, so far in 2014 there have been five.

Spain becomes the fourth country to regulate crowdfunding law.

Spain becomes the fourth country to regulate crowdfunding law.

The government approves the draft law on the Promotion of Business Financing, which includes a high level of regulation on crowdfunding. Among the new features of the law is the distinction between qualified and non-qualified investors.

The US market is interested in Latin America

The US market is interested in Latin America

According to TTR Record data, American investors are increasingly active in Latin America. Since 2012, the number of US investments in the country has gradually increased from 109 deals in 2012 to 140 in 2014. The number of divestments has also grown by 53% in the last two years, from 28 deals in the first half of 2012 to 60 in the first half of 2014.

Public funding and R&D&I deduction service

Public funding and R&D&I deduction service

ABRA INVEST has the support of a team of consultants specialised in R&D&I grants and deductions, the only activity that this team has carried out for more than 10 years, reaching a very high level of specialisation and achieving success rates above the market average.

New call for proposals Emprendetur R&D Programme

New call for proposals Emprendetur R&D Programme

Within the framework of the Spanish National Integral Tourism Plan (PNIT), the Secretary of State for Tourism has announced the Emprendetur R&D Programme, aimed at financing R&D projects related to technological innovation and tourism with the objective of supporting research and development applied to products in the tourism sector.

New call for applications for the Emprendetur Programme for young entrepreneurs

New call for applications for the Emprendetur Programme for young entrepreneurs

Within the framework of the Spanish National Integral Tourism Plan (PNIT), the Secretary of State for Tourism announced the Emprendetur Programme for young entrepreneurs, focused on financing R&D projects related to technological innovation and tourism with the aim of supporting research and development applied to products in the tourism sector. It seems that this November 2014 a new call will be opened in similar terms to the previous one.

M&A deals in biotech companies in Spain are on the rise

M&A deals in biotech companies in Spain are on the rise

Biotech companies in Spain are becoming more attractive to corporate investors. In some sectors, integration processes are taking place, such as that of Grifols. In other cases, the stock market is becoming an alternative for the biotechnology sector.

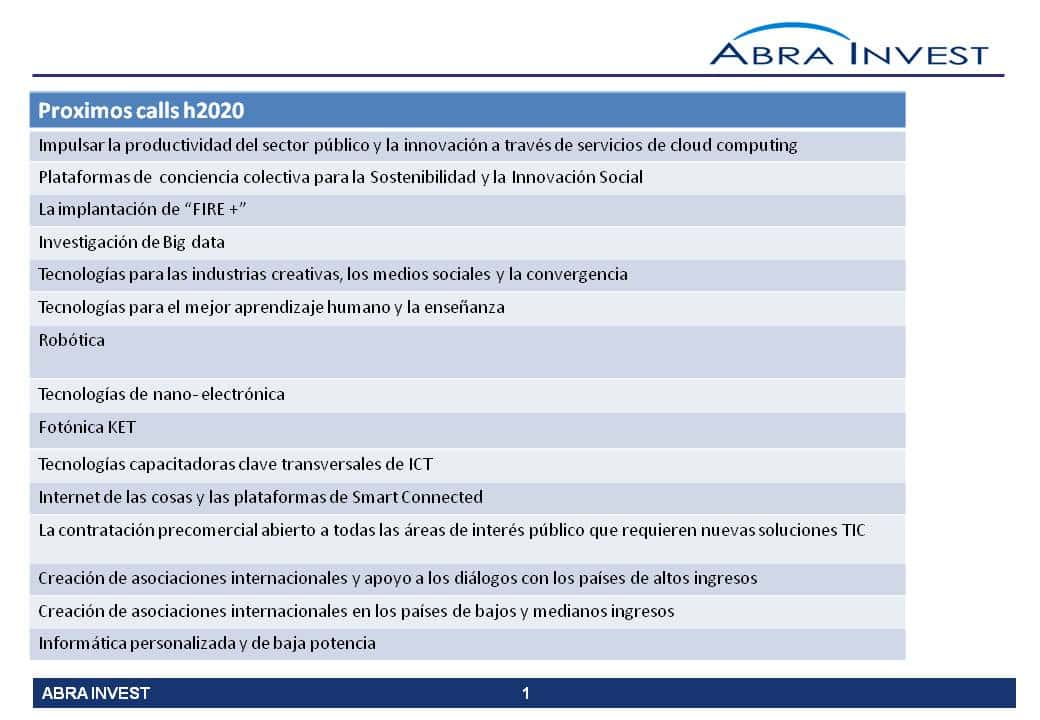

H2020 upcoming calls for the ICT sector in April 2015

H2020 upcoming calls for the ICT sector in April 2015

Horizon 2020 (H2020), the European Union's public funding programme for research and innovation for the period 2014-2020, presents its new calls for April 2015 in the field of "Information & Communication Technologies" with a budget of € 561M.

The technologies that make energy efficiency possible

The technologies that make energy efficiency possible

The technologies that make energy efficiency possible A recent study by McKinsey states that, over the next 20 years, at least $37 billion will be invested annually in energy efficiency, using the new technologies available. American investors have been investing in the sector for some years now, with very good results, such as Hannon Armstrong, which last year made its debut on the New York stock exchange, with notable success. In Spain, the first funds focused on this sector are already being created.

In which sectors does European venture capital invest?

In which sectors does European venture capital invest?

Since 2012, the biotechnology sector has received the most investment with 1.85Bn$ in 126 deals, accounting for 18% of the total amount invested in Venture capital. However, investments in ICT-related companies are currently gaining momentum, especially in sectors such as analytics, fintech and online food and hotel services, where large transactions have been carried out.

Biotechnology in Spain finds investors

Biotechnology in Spain finds investors

One of the main barriers to the growth of Spanish biotech companies is their small size (>95% less than 250 employees), which prevents them from accelerating their entry into foreign markets, for example. The main cause of this small size is due to the scarcity of funding or private investment. Although a specialised national biotech venture capital ecosystem is being generated and more and more deals are being closed with foreign investors, there is still much room for improvement.

The Basque Government supports new entrepreneurial SME initiatives

The Basque Government supports new entrepreneurial SME initiatives

The Basque Government and the Provincial Councils have launched a plan to support entrepreneurship with the aim of fostering the culture of entrepreneurship, increasing new business ideas and focusing on intra-entrepreneurship, as well as complementing the support plans for entrepreneurs and encouraging the emergence of new entrepreneurs.

Investment analysis in the Machine Learning sector

Investment analysis in the Machine Learning sector

"Machine learning is attracting a lot of interest from tech giants, who are spending a lot of money and effort to hire the best machine learning researchers. Companies in the sector are aware of this and are making a great effort to grow and offer highly advanced machine learning services that can be applied in a wide range of sectors.

The Basque Government's priorities: advanced manufacturing, energy and biosciences, to gain competitiveness in Europe.

The Basque Government's priorities: advanced manufacturing, energy and biosciences, to gain competitiveness in Europe.

The Basque Government has begun to explain to Basque companies the priorities for specialisation in certain fields in which to carry out a large part of the public funding in R&D in which three meta-priorities are set: Advanced Manufacturing, Energy and Micro-bio-nano Convergence for Health. The development of a smart specialisation strategy is already a prerequisite for any country or region to be able to access the funding offered by major European projects.

1 S 2014: Acquisitions in technology companies on the rise

1 S 2014: Acquisitions in technology companies on the rise

Corporate investors improve their confidence in Europe and opt for growth via the European Union acquisitions of technology companies, reaching the highest level since 2012. The first half of 2014, with 94 deals, shows the highest number of acquisitions of technology companies since 2012.

Investment analysis of the natural language industry

Investment analysis of the natural language industry

Natural language processing (NLP) is a field of ICT that studies the interactions between computers and human language. The level of performance has improved substantially in recent years. As a result of this phenomenon, more than 200 companies have been formed in recent years to develop NLP-related technology and to develop new technologies.

Most active VC investors in Europe in the first half of 2014

Most active VC investors in Europe in the first half of 2014

Index ventures with 11 transactions of type venture capital is led the list of the most active investors in the first half of 2014, and also completed five more deals in early-stage companies.

Cosme: improving the competitiveness of European enterprises

Cosme: improving the competitiveness of European enterprises

COSME with a budget of €2.3 billion to run between 2014 and 2020 is the EU's Competitiveness of Enterprises and SMEs programme that helps entrepreneurs and small and medium-sized enterprises to start up, access finance and internationalise, as well as supporting authorities to improve the business environment and facilitate economic growth in the European Union.

Profound success of Horizon SME instrument in Spain

Profound success of Horizon SME instrument in Spain

Spain is positioned as the first country in number of projects in Phase 1 of the SME Instrument of Horizon 2020, obtaining 39 of the 155 projects selected for funding. The next cut-off date for submitting new projects in phase 1 will be this September, here are some keys to take into account so that your project can be part of those selected.

H1 2014, How is VC evolving in Europe?

H1 2014, How is VC evolving in Europe?

In H1 2014, the investment of Venture capital in Europe grew by 27% in the number of transactions and 70% in the volume invested compared to the same half of 2013.

Will freelance platforms change the way we work?

Will freelance platforms change the way we work?

The difficulty of finding work in times of crisis has boosted freelance work and has led to the development of new ideas, such as freelance platforms, where freelancers and independent professionals present their services. In Spain, there are several companies dedicated to this activity that have been very well received, such as Geniuzz and Nubelo.

Acquisitions in the training sector

Acquisitions in the training sector

Although in recent years there have been a number of M&A activities in the education and training sector in Spain, the trend is decreasing, with only one operation having been carried out in 2014.

Mergers and acquisitions in the ICT sector have continued to grow during the crisis.

Mergers and acquisitions in the ICT sector have continued to grow during the crisis.

Mergers and acquisitions purchase of companies he information and communication technologies sector has not been affected by the crisis, although it is true that in 2009 there was a decrease in the number of operations, from 2010 onwards it began to grow, maintaining the pace in H1 2014.

E-COMMERCE IN CLOTHING IS IN TREND AND INVESTORS KNOW IT.

E-COMMERCE IN CLOTHING IS IN TREND AND INVESTORS KNOW IT.

According to data from the prestigious Kantar Worldpanel, online fashion sales in Spain grew at a dizzying rate of 32% in 2013, increasing its customer base by 600,000 new buyers. Last year, 3,100,000 Spaniards bought fashion online. Corporate investors know this and have not wanted to miss the opportunity.

Venture capital in the logistics sector

Venture capital in the logistics sector

After a period of drought suffered in the logistics sector in 2012, it seems that venture capital in the logistics sector in Spain is beginning to recover, and although the number of operations carried out is still small, during the first half of 2014 there have already been 5 operations, the same as in the whole of the previous year, which seems to indicate the growth of venture capital in this sector.

The world of fashion and venture capital

The world of fashion and venture capital

2014 shows a growth of VC deals in the textile sector, after 5 years of constant decline. While in 2012 there were 13 deals in the sector, year after year they have been decreasing until reaching 1 deal in 2012, but it seems that this year is going to be a good year for the sector. So far this year there have been 6 transactions, 50% more than all the transactions in 2013.

Venture capital makes Spanish IT competitiveness possible

Venture capital makes Spanish IT competitiveness possible

Spanish venture capital has been investing in the information technology sector in recent years. In 2013 and the first half of 2014, 187 operations were carried out in the sector, involving more than 280 investors.

The first half of 2014 confirms the reactivation of venture capital in Spain

The first half of 2014 confirms the reactivation of venture capital in Spain

The government wants to improve access to direct financing for SMEs. To this end, this Friday it approved the draft law regulating venture capital entities and closed-end collective investment entities, which includes the creation of the figure of Capital-Riego pyme and a series of reforms in venture capital entities that establishes the harmonised framework of conditions for authorisation, marketing, conduct and organisation of the managers of these investment funds at European level.

Venture capital has reached SMEs

Venture capital has reached SMEs

The government wants to improve access to direct financing for SMEs. To this end, this Friday it approved the draft law regulating venture capital entities and closed-end collective investment entities, which includes the creation of the figure of Capital-Riego pyme and a series of reforms in venture capital entities that establishes the harmonised framework of conditions for authorisation, marketing, conduct and organisation of the managers of these investment funds at European level.

Social Security rebates for research staff

Social Security rebates for research staff

After two years, the rebates on social security contributions for research personnel are back, with the aim of encouraging the recruitment of research personnel.

The Help Desk sector: growth in the amount invested

The Help Desk sector: growth in the amount invested

The Helpdesk encompasses numerous tasks that are indispensable for companies to make the most of the introduction of new technologies. These tasks range from providing technical support for computer programmes, software updates, to personalised attention to customers for any problems they may have in this field. In recent years investors have bet more strongly on the sector, 2013 has raised a total of 94M, a 56% more than in 2009 which raised 60M, although the number of operations have been lower, from 13 operations in 2009 to 9 in 2013.

Investors in biomarker development companies

Investors in biomarker development companies

The use of genetically-derived biomarkers is becoming a fundamental practice in hospitals because of their cost-effectiveness. Since 2005, 95 investors have invested in companies developing biomarkers, raising a total of $1,911M. The average amount invested by each investor is $22M, although there are large differences between investors. Some investors have invested more than $100M, while others have invested less than $150,000.

In the US, new technologies in the oil industry are boosting financial operations in the sector.

In the US, new technologies in the oil industry are boosting financial operations in the sector.

In recent years, the entry of new technology in the oil and gas sector and the recovery of the US as the leading oil and gas producer has encouraged venture capital to invest in the sector, which in the last half of 2013 reached its highest investment figure, with a total of $149M in 10 deals. In addition, thanks to foreign buyers, and the use of new technologies to extract shale gas, the shale gas market has become more attractive to foreign investors. M&A activities reached its highest volume in the last decade in the first quarter of 2014.

Funding rounds in the mobile payments industry

Funding rounds in the mobile payments industry

Companies offering mobile payments have grown in popularity in recent years, with a study in the US claiming that 48% of the population is interested in this form of payment, up from 27% last year. This is one of the reasons why this sector is very active in terms of investment and corporate transactions. In the last few years, 290 investors have completed 172 rounds worth 739M$.

Mergers and acquisitions in Latin America May 2014

Mergers and acquisitions in Latin America May 2014

May has seen an increase in the volume of investment in the M&A activitiesThe number of new registrations in all countries, with the exception of Mexico, which has maintained the same number as in May 2013, continued to fall.

Venture capital recovery in Spain 2014

Venture capital recovery in Spain 2014

Venture capital is picking up again in 2014, with a total of 76 deals so far this year, amounting to €12,207M, which is more than the €9,423M raised in the 138 deals made in the whole of 2013.

How is the Venture Capital model evolving?

How is the Venture Capital model evolving?

May has seen 26 operations of Venture capitalThis is the highest figure so far this year according to data provided by TTR. Despite this, the total amount invested was €31m, almost half of what it was in April 2014.

How is the Venture Capital model evolving?

How is the Venture Capital model evolving?

May has seen 26 operations of Venture capitalThis is the highest figure so far this year according to data provided by TTR. Despite this, the total amount invested was €31m, almost half of what it was in April 2014.

Gauzatu industry 2014

Gauzatu industry 2014

On 10 June, the deadline for applications for SPRI's Gauzatu - Industry investment support grants opened. The aim of these grants is to promote the creation and development of technology-based and/or innovative SMEs. Beneficiaries will be able to submit their applications until 11 July.

Call for projects related to the Dependency 2014 is open

Call for projects related to the Dependency 2014 is open

The application period for the 2014 programme, a fund charged to the Ministry of Health Budget, which aims to provide financial support to business initiatives that promote and develop infrastructure projects and / or services of the System for Autonomy and Care for the Elderly, was opened on 12 June 2014.

Mergers and acquisitions May 2014

Mergers and acquisitions May 2014

The key M&A activities in the month of May, continue the positive trend of which this market is the protagonist. According to TTR data, comparing the number of operations carried out this month with the same period last year, we see that the number of operations has increased by 40%, from 59 to 83.

Acció 10: Boosting innovation and internationalisation of Catalan companies

Acció 10: Boosting innovation and internationalisation of Catalan companies

ACCIÓ10 is the agency attached to the Department of Enterprise and Employment of the Government of Catalonia, which supports Catalan companies, promoting innovation, internalisation and growth, with the aim of making them competitive.

BASQUE FONDO promotes Basque SMEs.

BASQUE FONDO promotes Basque SMEs.

New Basque government fund with €5M to promote new Basque companies that have gone through the Ekintzaile programme. The programme is divided into two parts, to meet the needs of the companies according to their characteristics, Basque fund section I and Basque fund section II.

SMEs, how does the government's growth plan affect you?

SMEs, how does the government's growth plan affect you?

On 6 June, the Spanish government published the plan of measures for growth, competitiveness and efficiency. This communiqué was published in the same week that the government announced future reductions in both corporate and income taxes and an early repayment of the loan received for the FROB. This all sounds like good news for the Spanish economy, but what is the expected effect on SMEs?

Talde's new fund towards internalisation

Talde's new fund towards internalisation

The Basque venture capital company Talde is opening a new fund to support investments from Europe to Latin America and vice versa.

In which sectors does crowdfunding invest?

In which sectors does crowdfunding invest?

Crowdfunding has grown a lot in recent years, according to a study by the agency Massolution, in 2012 this type of funding grew by 81% compared to the previous year, raising a total of $2,700M worldwide and in 2013 the figure doubled to more than $5,000M.

Spain crowdfunding: draft bill boosts crowdfunding activity

Spain crowdfunding: draft bill boosts crowdfunding activity

The limitation on the amount of investment, the main fear of all platforms in the first draft of the bill, has been overcome. Although the draft bill states that by default all investors will have a limit on their investments (maximum €3,000/transaction and €6,000/year), the door is left open for professional investors who are used to analysing the risks of investments to invest without limits per project or per year.

CDTI produces a quick guide to H2020

CDTI produces a quick guide to H2020

Horizon 2020 (H2020) is the Programme for Research and Innovation in the European Union for the period 2014-2020. The Cdti has prepared a quick guide with its main features that we detail below.

Venture capital recovery in Spain in the first quarter of 2014

Venture capital recovery in Spain in the first quarter of 2014

Venture capital once again placed its trust in Spain in the first half of 2014, doubling investments from €310M in the first quarter of 2013 to €618M. This increase in investments has been due to the average increase in the amount of each deal, as the number of deals has remained practically the same, at around 100.

ICF loans to boost the growth of Catalan SMEs

ICF loans to boost the growth of Catalan SMEs

The ICF's main objective is to promote and facilitate access to financing for businesses based in Catalonia, mainly SMEs, acting as a complement to the private financial sector. That is why it provides a large number of loans suitable for each state and characteristics of the company.

Investments in the IT manufacturing sector

Investments in the IT manufacturing sector

Of the total 40 rounds of financing in the manufacturing sector, 9 (25%) have gone to companies involved in the production of IT-related devices, raising a total of 61.3$M. These operations have been mainly in US companies, but also emerging markets, such as China and India, are gaining the backing of the venture capital is.

Entertainment investments that bridge reality and the virtual world

Entertainment investments that bridge reality and the virtual world

In recent years, the entertainment industry has evolved a lot, users are no longer satisfied with controlling characters with a controller, now they themselves want to get into that reality. Large technology companies are investing millions of dollars to make technology "almost real worlds".

For an interesting Innovation and Development project in the investment sector we are looking for a developer. The project is mainly built on Java, MySQL and SolR (Lucene).

Investments in B2B lead generating companies

Investments in B2B lead generating companies

Companies working in B2B have several challenges to face in order to reach their audience, getting leads is more difficult than in B2C due to the lower volume of customers and the complexity of reaching the target. More and more companies are taking advantage of these difficulties to offer services aimed at increasing leads. Some of them have received funding from the venture capital is in 2013.

Venture capital in "prediction companies".

Venture capital in "prediction companies".

Today, companies not only need to know what happened in the past to understand the present, but also to anticipate the needs of their customers. The "Predictive Enterprise" involves the use of advanced technological tools that make it possible to move from product-focused to customer-focused companies. These types of companies, which are currently growing considerably, have applications in numerous sectors of activity and have received great support from the venture capital isIn 2013 and so far in 2014 alone, this sector has achieved $531M.

Investors in mobile marketing to access consumers

Investors in mobile marketing to access consumers

New technologies are changing the consumer's behaviour when it comes to making a purchase decision, the mobile phone, for example, is one of the tools that have been incorporated into the decision making process. The customer at the point of sale can compare prices, ask for opinions, look for offers. That is why in recent years companies have been created that provide mobile marketing services for large brands that see the mobile phone as an opportunity to interact with their customers. It seems that the trend for this type of company is on the rise as their effectiveness becomes clearer and investors do not hesitate to bet on them.

Venture capital drives digital marketing tools

Venture capital drives digital marketing tools

The elimination of geographical barriers, as well as new technologies applied to production processes and increased competition, are creating an increasingly demanding customer. Companies face two challenges: to know what their customers' real needs are and to reach them. In order to help them in this task, numerous online marketing companies have appeared, many of them driven by the venture capital is.

Venture capital in the health IT world

Venture capital in the health IT world

The venture capital is in the world of health-focused information technologies. The concern for fitness and new technologies have led to the emergence of numerous applications and software that help people lead a healthier life. Venture capital has seen the potential of such companies and has decided to invest in them. Of the 95 A and B rounds raised in 2013 and 2014 in the health sector, 23 were in this niche market (ICT-wellness).

Venture capital specialising in the energy sector

Venture capital specialising in the energy sector

In recent years, concern for the environment and the use of alternative energies have led to the emergence of investors specialising in this sector, and these investors have been increasing their portfolios as new start-ups focused on this sector appear. In addition, other Venture capital not focused solely on this sector are increasing their operations in the sector.

ICTs applied to the Cleantech with the approval of investors

ICTs applied to the Cleantech with the approval of investors

The introduction of new technologies in the Cleantech sector, such as home automation, the internet of things and big data, has made it possible for investors and companies that were reluctant to invest in this type of sector to invest recently, such as Google, which has acquired Nets for $3,200M. Nets is a manufacturer of home devices such as thermostats and smoke alarms.

Cabiedes and Partners' investment activity in 2013

Cabiedes and Partners' investment activity in 2013

Cabiedes, which started out as a pioneering business angel in the Spanish internet market, has grown and evolved to become one of the leading firms in the sector. venture capital is for the most recognised technology startups in our country. The three key issues in its investment policy are: Internet startups, consumer-focused startups and [...]

Investors in software that connects doctors with patients

Investors in software that connects doctors with patients

New technologies applied to connect with professional experts present a wide range of opportunities, even in sectors where it seemed impossible, as in the case of medical care. In recent years, numerous companies have emerged that use new technologies to carry out patient follow-up, thus saving time and costs and providing a more personalised service. The venture capital is did not want to be left behind and have decided to invest in the sector.

Strong growth in the e-health sector

Strong growth in the e-health sector

Numerous companies have taken advantage of the concern for health and wellbeing and the increased use of new technologies to create innovative companies in this field. Investors have not been left behind and are betting heavily on the sector. Proof of this is that the number of Series A and B rounds in the health sector has increased by 179% from 2010 to 2013, from 24 deals in 2011 to 67 in 2013.

Latest investments in HR technology

Latest investments in HR technology

The use of new technologies for hr management is a great source of opportunities such as task efficiency, cost reduction, increased productivity or improved internal communication and coordination, which have not gone unnoticed by investors. This is why in recent years we have witnessed a large number of operations, first at international level, and little by little at national level.

Growing investment in the Fintech sector

Growing investment in the Fintech sector

In the last 5 years, investment in the Fintech sector worldwide has tripled, reaching an investment of $3B in 2013. In Europe, the UK tops the list of major investors.

New Enisa lines 2014

New Enisa lines 2014

Funding from the Ministry of Industry, Energy and Tourism, for companies that have invested in innovative business projects or growth.

ICF 2014: providing guarantees for startups to get bank financing

ICF 2014: providing guarantees for startups to get bank financing

Obtaining bank financing for a start-up is often linked to guarantees that are difficult for entrepreneurs to obtain. The ICF helps SMEs operating in Catalonia to solve this problem by granting guarantees of up to 70% for the formalisation of bank loans. The guarantees can be used both to finance working capital and to finance investments.

Venture capital takes advantage of the opportunity that natural language provides.

Venture capital takes advantage of the opportunity that natural language provides.

In recent years, a number of natural language processing companies have been set up that offer advantages for day-to-day business. The venture capital is and large corporations have wanted to take advantage of this opportunity, as Inversur Capital has just invested in Inbenta.

Impact of the amendment to the law on debt refinancing and debt restructuring

Impact of the amendment to the law on debt refinancing and debt restructuring

On 7 March, a series of measures were approved in relation to debt refinancing and restructuring. Among the measures introduced, we would like to analyse those that may have an effect on investment strategies and the sale of mortgage debt assets.

Mergers in the tourism sector

Mergers in the tourism sector

In recent years, the tourism sector has undergone several changes, one of which has been the use of new technologies by customers to find out about the wide variety of offers and organise their trips. This has revolutionised the tourism offer, which has wanted to take advantage of this great opportunity, carrying out numerous purchasing operations to adapt to the technological market or to take advantage of the opportunity that the Internet gives to open up to new geographical markets.

Caixa Capital Risc launches a new fund in the Biotech sector

Caixa Capital Risc launches a new fund in the Biotech sector

Caixa Capital Risc, the "la Caixa" group's venture capital manager for early-stage innovative companies, which had 4 investment vehicles specialising in Biotechnology, Industry and ICT, has launched a new Biotech fund together with the CDTI.

Strong activity in the E-learning sector.

Strong activity in the E-learning sector.

Due to the rise of new technologies, learning has become much easier and more fun. Investors have realised that e-learning presents an opportunity for their portfolios and have been very active in this sector, especially in the last 3 years.

Artificial intelligence presents an opportunity for investors

Artificial intelligence presents an opportunity for investors

Funding to AI-related companies has tripled in the last 5 years, and this trend seems to be growing. In 2013 alone, $581M was invested in 142 deals.

Healthcare does not feel the impact of the crisis

Healthcare does not feel the impact of the crisis

Healthcare is one of the few sectors that has not been affected by the crisis. Venture Capital in this sector has grown considerably, from 28 operations in 2009 to 37 in 2013.

Advertising Agencies Invest over 500M$ in Startups

Advertising Agencies Invest over 500M$ in Startups

The boom in advertising and new technologies is increasing investor interest in this sector. Since 2010, 4 advertising agencies, through their funds, have been involved in 52 investment rounds, totalling $500M.

Media Sector USA: VCs Invest $331M in 60 Startups

Media Sector USA: VCs Invest $331M in 60 Startups

Media startups raise $33M in 60 deals in 2013, an increase of 117% in funding over the previous year and 30% in the number of deals.

Venture Capital and Venture Capital in Ireland

Venture Capital and Venture Capital in Ireland

2014 looks like a promising year for the venture capital is and Venture Capital in Ireland, Enterprise Ireland, the government agency responsible for supporting Irish businesses, has done 11 deals in the last 6 months.

H2020 - SME instrument

H2020 - SME instrument

In Horizon 2020 there is a dedicated SME instrument targeting all types of innovative SMEs showing a strong ambition to develop, grow and internationalise. This instrument will apply to all types of innovation, including non-technological and service innovations.

Axon Partners €10M Fund for Andalusian Startups

Axon Partners €10M Fund for Andalusian Startups

Axon Partners Group, an international investment firm, has launched a new fund to invest in early stage Spanish companies in the digital economy sector in Andalusia. The ICT II Fund has approximately €10 million in assets from private investors and the JEREMIE (European Investment Fund) initiative in Andalusia managed by the Innovation and Development Agency of Andalusia (IDEA), a body attached to the Regional Ministry of Economy, Innovation, Science and Employment.

SPRI - Publicly Sponsored Financing

SPRI - Publicly Sponsored Financing

As in other autonomous communities, the Basque Country has been offering a guarantee by the administrations so that SMEs can access financing from financial institutions, thus improving their chances of success. The presentation is not simple and requires a good dialogue with the bank and experience in the specific line.

Corporate moves 2013 in the ICT sector in Spain

Corporate moves 2013 in the ICT sector in Spain

According to Capital&corporate data, during 2013 a total of 90 corporate transactions were carried out in the Spanish ICT sector with a total of €406M invested. The purchase of Arsys' 79% by 1&1 for €140M and the purchase of softonic International's 30% by Partners group stand out for their size.

Wearable technology, driven by venture capital in 2013

Wearable technology, driven by venture capital in 2013

Wearable technology, has secured funding in 2013 in the amount of $248M of venture capital isin a total of 49 deals. The number of rounds for wearable technology startups has increased by 150% and the volume of investment by 80%.

Venture capital drives language learning apps

Venture capital drives language learning apps

Among the companies for learning languages through apps, 5 stand out as having received several rounds of funding and topping the app store charts.

Venture capital sees cybersecurity as a source of opportunity

Venture capital sees cybersecurity as a source of opportunity

From 2009 to date the venture capital is $2.9B has been invested in Tics security and 26 rounds have been closed so far this year, raising a total of $150M. The need for security has increased early stage rounds. In the first four months of 2013 16 seed capital companies raised $4.9M.

Mergers and Acquisitions Latin America Market February 2014

Mergers and Acquisitions Latin America Market February 2014

The number of transactions in Latin America has fallen slightly compared to the previous month, however, the volume of investment has increased as a number of large deals have been closed, especially cross-border transactions.

Resounding success of the Barcelona World Congress

Resounding success of the Barcelona World Congress

Last week's Mobile World Congress in Barcelona was attended by more than 85,000 people from 201 different countries and attracted executives from the world's largest telephone operators, software, equipment suppliers, internet companies and industrial sectors such as automotive, finance and health, including Zuckerberg from Facebook, Korum from whatsapp and Rometty from IBM.

The Impact of CDTI Financing on SMEs

The Impact of CDTI Financing on SMEs

The CDTI has recently published a study on the impact of its funding on the evolution of Spanish companies. The results have been very good: these companies have achieved 17% of their sales coming from the new technological developments financed.

MERGERS AND ACQUISITIONS SPAIN JANUARY 2014

MERGERS AND ACQUISITIONS SPAIN JANUARY 2014

January has seen the highest volume of investment in M&A activities The monthly high of July 2013 was surpassed by the last high recorded in July 2013.

Corporate investors launch startup accelerators

Corporate investors launch startup accelerators

In recent years, the number of companies investing in technology-based startups has grown considerably. The main reason for this phenomenon is that companies are moving to an open innovation model, looking for innovation through new acquisitions.

US Venture Capital 2013 at highest levels since 2008

US Venture Capital 2013 at highest levels since 2008

After 3 consecutive years of growth in the number of private equity deals, the number of deals fell by 14% in 2013. Despite this, capital invested has grown to post-crisis highs of $426bn thanks to 13 large deals (>2.5bn$). These include the two largest deals since 2008 by corporate investors: Dell for $24.5Bn and Heinz for $23.2Bn. The pace of investment has grown quarter on quarter, reaching the highest levels since 2008 in the third quarter.

Top 10 Biggest Funding Rounds in the Education ICT Sector

Top 10 Biggest Funding Rounds in the Education ICT Sector

The 10 largest funding rounds in the ICT sector raised a total of $600M in 2013, the majority of which were in early stage companies.

Venture capital participates in mobile BAAS

Venture capital participates in mobile BAAS

The venture capital is has invested $150M since 2010 in Baas, the connection between mobile applications and cloud services. There have not yet been many sales in the sector, limited to smaller acquisitions.

P2P Lending attracts twice as much VC investment as crowdfunding

P2P Lending attracts twice as much VC investment as crowdfunding

In recent years, alternative financing has grown considerably, with P2P Lending in the US attracting large amounts of money through companies such as Lending Club, Prosper Marketplace and Funding Circle.

The Media sector receives investment for "publishing".

The Media sector receives investment for "publishing".

The media sector is in the midst of a profound change brought about by a poor outlook for traditional publishing models such as newspapers and printed books. As a result, we are seeing the emergence of new models financed by the venture capital is.

Content "Curation" receives 18M from venture capital

Content "Curation" receives 18M from venture capital

With the growth of content marketing, the software market has created several tools for what is known as content "curation". According to our research, we have identified more than 30 tools, of which only 8 have received the backing of the venture capital is $18M.

74% of venture capital and private equity deals in 2013 were targeted at SMEs.

74% of venture capital and private equity deals in 2013 were targeted at SMEs.

Private equity invested almost 40% of its investments in the "Other services" and "Other industrial products" sectors. Corporate investors grew by 29% in 2013, with very significant activity in the internet and technology sectors. Spain has one of the best Business Angels network infrastructures.

Cybersecurity: an opportunity for investors

Cybersecurity: an opportunity for investors

In the past year the firms of venture capital is invested $1.4MM in 239 American cybersecurity companies. 80% of which ended in acquisitions or IPOs, with an average return on investment of 10 times.

Digital content managers receive $230M of venture capital

Digital content managers receive $230M of venture capital

Digital content is becoming king in entertainment and leisure as well as in business marketing. As proof of this, the venture capital is has invested 230M in 38 companies since 2012.

Increase in large and Series A funding rounds in the technology sector.

Increase in large and Series A funding rounds in the technology sector.

According to a study by Cb Insight, there has been a significant increase in Series A funding rounds larger than $10M in the technology sector in recent years, while small and medium-sized rounds have remained constant.