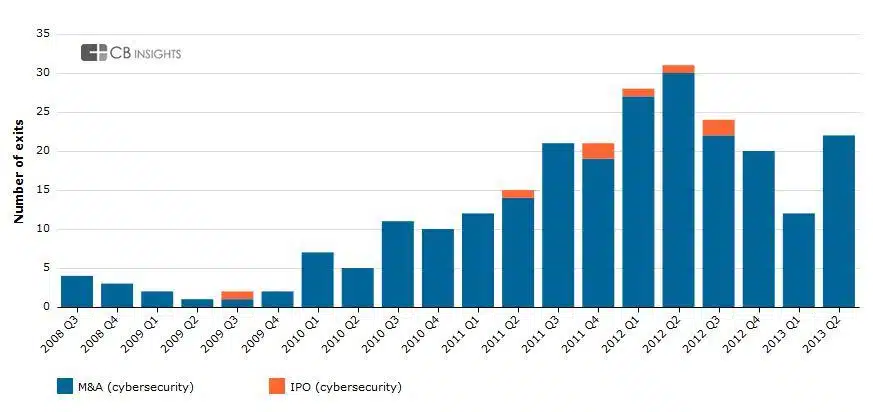

In the past year the firms of venture capital is invested $1.4MM in 239 American companies from cybersecurity . 80% of which ended in acquisitions or IPOs, with an average return on investment of 10 times.

In the past year the firms of venture capital is invested $1.4MM in 239 American companies from cybersecurity . 80% of which ended in acquisitions or IPOs, with an average return on investment of 10 times.

Successful operations in the security sector

Fire Eye went public in September last year (it now has a market capitalisation of $7 MM ) and subsequently acquired by Mandiant for $ 1 MM.

Cisco bought for $2.7 MM the security company Sourcefire e IBM acquired Trusteer by $1 MM.

"In Spain there have also been successful operations in this sector, Alien Vault, 18 million round of financing last September, with the participation of the following investors Trident Capital, Kleiner Perkins Caufield & Byers, Sigma West and Adara Venture Partners and Top Tier Capital and Correlation Ventures, as new investors. A year earlier, it closed its second round for 6.5 million euros," says Diego Gutierrez, corporate finance expert at Abra-Invest.

Cybersecurity industry forecasts

In recent years, the problems caused by the lack of security in the cyber world have increased the belief that cyber security is a necessary investment.

On the other hand, the increased use of new technologies opens up many fields within the world of security in areas such as mobility, social media or the cloud.

It seems that the success of investing in the world of cybersecurity can be quite positive, although it is true that it must be borne in mind that setting up a cybersecurity company requires a large amount of financial and technical resources.

If you need financing or are looking for investment opportunities, do not hesitate to contact us for a no-obligation consultation.