The education sector has been forced to adapt as much as anyone due to the Covid-19 pandemic, as explained in the article EdTech and Covid-19. Thanks to technology and thus the emergence of the so-called Educational Technology, the education sector has been able to cope with the pandemic, giving rise to 3 main leaders in the EdTech sector. The term EdTech refers to a broad concept that refers to the process of design, analysis, development, implementation and evaluation of learning in all its forms, in order to improve the educational process and adapt to the changing times.

There are many companies working to improve this process; both dedicated to the development of tools for the virtual classroom, as well as for face-to-face education. In this article we will focus on well-known companies focused on different areas of the sector.

Zuoyebang is a Beijing, China-based company founded in January 2014 and dedicated to providing quality educational products and services to primarily primary school students. According to Crunchbase, the company is valued at 10 billion and thus becomes the third highest-valued company among the leaders in the EdTech sector.

In second place, there is BYJU'S. This is an Indian company, based in Bangalore, which was founded in November 2011. It is primarily engaged in developing customised educational programmes for primary school students, just like Zuoyebang. The company is valued at just over 11 billion of dollars.

Finally, at the top of this top 3 leading EdTech companies by valuation is Yuanfudao. This Beijing-based Chinese company was founded in March 2012 and has a valuation as a company of 17 billion USD. This Asian company is dedicated to providing live tutorials and courses through an online platform.

It is worth noting that these three companies are private companies, making them also the top of the so called unicorn companies. This concept refers to private companies with a valuation of more than one billion dollars. To identify the top public company in the sector, one would have to look at the number 5 position where it is located Pluralsightwhich according to Crunchbase is valued at $1 billion. Prualsight, a US company, provides a technology learning platform for software developers, IT managers and creative professionals. It went public in May 2018.

As described in Baker Tilly's sector analysis, the EdTech sector is differentiated into several segments. We will now describe companies recognised in three areas of the sector: companies dedicated to online training, virtual and face-to-face classroom tools.

ABA English, a Spanish company recognised in the sector

First of all, one of the leading companies in the field of online training is ABA English. This Spanish company, based in Barcelona, is one of the most recognised online English language schools in the sector.

Blackboard, ideal for online learning

On the other hand, in terms of companies that provide online teaching through different tools, there is the well-known American brand Blackboard. This technology company presents innovative solutions that enhance online teaching and learning methods.

Wuloah, paid notes

Finally, another recognised company that provides tools and motivates students, in this case, in their face-to-face teaching, is Wuolah. This American platform offers university students the opportunity to upload notes to their website and get paid for it.

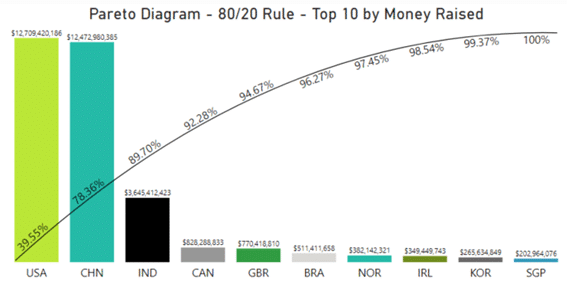

US and China, the 80% of EdTech funding

To conclude this article, to situate the EdTech market globally in terms of funding received. As also explained in the aforementioned article ("...").EdTech and Covid-19"), funding in the sector has skyrocketed in the last year (2020). Broadly speaking, funding has been distributed between the United States and China, accounting for almost 80% of the sector's total in terms of money raised in the different rounds carried out. This can be clearly seen in the following Pareto diagram, which shows the top 10 countries with the highest fundraising.

This diagram gives us an idea of where the greatest activity of companies in the Educational Technology sector is to be found. As we have seen in the section on the leaders of the sector, the majority are Chinese, Indian or American companies, making clear the global distribution of the sector. It is also worth noting that this is still a growing sector, which will mean an increase in startups across the globe in the coming years.