The Covid-19 pandemic radically changed our way of life, severely crippling the global economy. Many sectors were crippled and forced to reinvent themselves in order not to suffer major losses. Education is a case in point. Thanks to technology, the education sector has been able not only to sustain itself and not make losses, but to achieve more than enviable growth, as demonstrated in Baker Tilly's analysis of the sector..

his has been achieved, in large part, thanks to the so-called Educational Technology, or edtech sector for short. The term EdTech is defined as the use of technological resources, processes and systems to enhance or manage the learning process. It is this application of technology in education that has really made education possible during the pandemic.

The growth of the EdTech sector was to be expected, since technology, as in everything else, was increasingly penetrating something as traditional as education, resulting in a more hybrid education (so-called b-learning), which manages to bring together the best of traditional and technological education. But what was not expected was that this growth would be so sudden. Covid-19 has accelerated this process, as many people have been forced to carry out their different types of learning through digital platforms, causing a more than remarkable development in this sector.

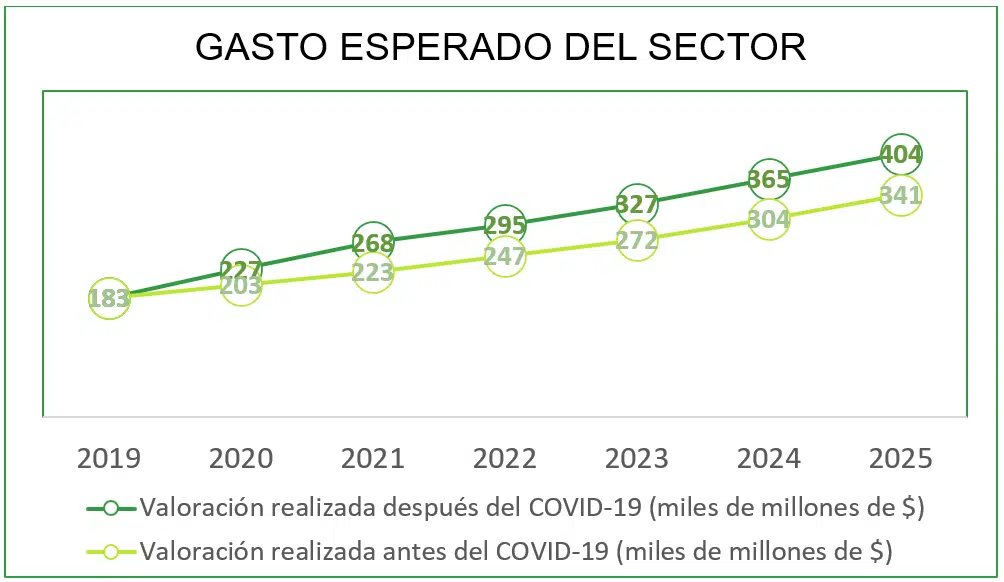

Indeed, as HolonIQ (global education intelligence source) assessment argues, due to COVID-19, expected spending in the EdTech sector by 2025 has increased by 3%, from a compound annual growth rate of 13.1% (pre-CovID-19 assessment) to 16.3% (post-CovID-19 assessment). The latter figure in absolute numbers translates into an expected total sector expenditure of $404 billion. The following graph clearly shows the difference between the two valuations, pre- and post-Covid-19, finally achieving a difference of 64 billion dollars by 2025.

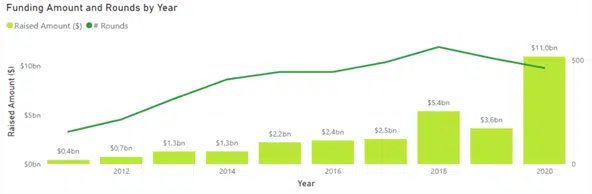

Another very clear indication of growth is seen in the number of funding rounds conducted in the sector. In this case, fewer rounds were held in 2020 than in the previous year, but much more money was raised. To be precise, in 2020, $11 billion was raised compared to $3.6 billion in 2019. This is a 3-fold increase in value, which is a considerable increase and proof, as mentioned above, of the sector's clear development.

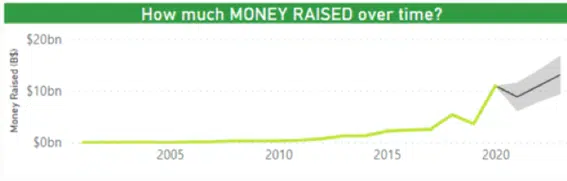

Moreover, according to the data obtained from Crunchbase, it is possible to make future projections for the sector. With regard to funding rounds, it is expected that, in the next 3 years, the number will increase compared to 2020. And in terms of the money raised, the graph shows a drop for this year 2021, but by 2023 it recovers and exceeds the amount of 2020, as shown in the graph below, reaching about 13 billion dollars raised.

On the other hand, this rapid development of the sector due to the pandemic has led to the emergence of some sceptics who argue that such a large and sudden change will have a negative effect on society, as, according to these experts, it leads to an increase in the so-called digital divide, which increases the achievement gap and widens inequalities.

Apart from this, we can clearly say that we have realised thanks to Covid-19 that it is perfectly possible, and even necessary, to combine face-to-face (more traditional) and online learning, with edTech companies being the main key to its realisation.