The current global pandemic has given a sudden boost to the Educational Technology or EdTech sector, as explained in the article "The EdTech sector is a global pandemic.Edtech and Covid-19"The data on the largest and most important acquisitions in 2020 and the most active companies in the sector. Educational Technology could be defined as the use of resources, processes and technological systems for the improvement or management of the learning process, from design to implementation.

The movement in the sector, as described in the Investment Analysis by Baker TillyThe number of acquisitions has increased in almost all areas of the business, such as in terms of financing and acquisitions, in short, investments. As can be seen in the following graph, the number of acquisitions increased in 2019 and remained more or less constant in 2020 (represented by the columns). On the other hand, the dark line shows the variation in the median number of transactions in each year. As we can see, it has increased compared to last year.

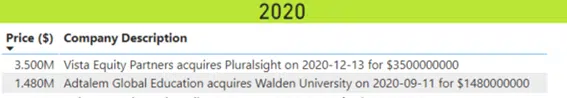

In this article we will focus on two major transactions in the past year 2020. The acquisition of Pluralsight by Vista Equity Partners and the one carried out by Adtalem Global Education who bought Walden Univesity.

On 13 December 2020, one of the biggest acquisitions in 2020 was announced, the massive buyout by Vista Equity Partners. This investment firm, focused on software, data and technology companies, has made more than 70 acquisitions in its history and 35 investments, being the lead investor in 29 of them (information taken from Crunchbase). Although the company made three more acquisitions in 2020, it was one of the least active years for the company in terms of acquisitions.

For its part, Plurasight, a company already defined in the article "...", is a company that has already been in operation for several years.EdTech Sector Leaders and Global Presence"is an Educational Technology platform for teaching software developers, IT administrators and content generation professionals. The company, in turn, has a total of eleven acquisitions all of which have been made with technology education or enterprise software.

The deal closed at a total value of USD 3.5 billion, making it the largest ever purchase in the EdTech sector.

This purchase was announced on 11 September 2020, making it the second largest acquisition in 2020. Adtalem Global Education, an education services provider, acquired Waldem University, an online university in Minnesota, USA, for $1.48 billion.

This university founded in 1970 has always aimed to make higher education more accessible so that people can make the world, as they describe on their website, a better place. They want to adapt better and better to new technologies, to new learning options and to create new forms of social change.

In turn, Adtalem Global Education seeks to empower students and members to achieve their goals, find success and make inspiring contributions to the global community. The latter makes clear the common goal of both companies and the reason for this acquisition.

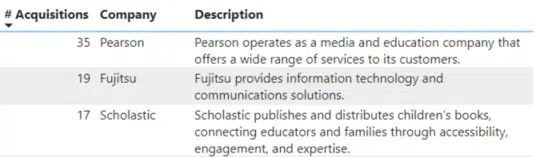

Among the most active companies in the sector in terms of number of acquisitions were Pearson, Fujitsu and Scholastic.

The first of these has a total of 35 acquisitions and consolidates its position as the EdTech company with the highest number of acquisitions. Nine of the acquisitions are of EdTech companies, with the majority of these acquisitions being of companies in the education sector in general.

On the other hand, there is Fujitu. This company, which is present in several sectors, including educational technology, has made 19 acquisitions throughout its history, most of them of software companies. Fujitsu is a company that mainly offers communication solutions.

Finally, in this top 3 is Sholastic, a leading publisher of children's books that also connects educators and families through a platform. Scholastic has made 17 acquisitions, with most of the acquired companies being from the education and publishing sector.