As we have seen in the article "EdTech and Covid-19"2020 has been no different for the EdTech sector, where the pandemic has caused radical changes in the sector. This post will focus on identifying and analysing the "anomaly" produced, as far as movements are concerned, in funding rounds in the EdTech sector, where this past year 2020 has raised three times more than in 2019.

But what is the EdTech sector? Education technology, or Edtech for short, is a concept that refers to the process of designing, analysing, developing, implementing and evaluating learning in all its forms with the aim of improving the educational process by making it more attractive, inclusive and individualised.

Technology has fully entered education through various tools that use virtual reality or artificial intelligence, among others, to achieve innovative teaching methods that improve learning processes.

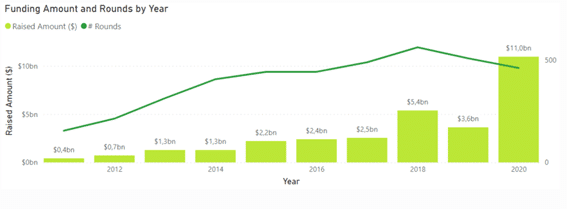

Having defined what this sector encompasses, let us describe what has happened in 2020 with regard to funding in the EdTech sector. In that year, as shown by the dark green line in the graph extracted from the Investment Analysis by Baker Tillyfewer rounds of funding were raised than in the previous year. Despite this, and as the green column for 2020 shows, a total of 11 billion dollars (10,961,805,381$, to be exact) was raised in these rounds. This is an increase of 300% over the previous year, where just over $3.6 billion was raised.

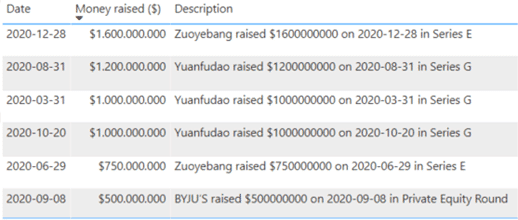

This sharp growth in funding in the EdTech sector is due to giant rounds by industry leaders such as those shown by Baker Tilly in its article "...".EdTech leaders". Examples are Yuanfudao or Zuoyebang, which conducted a total of 6 rounds between the two companies in the same year.

The largest round was announced by Zuoyebang on 28 December 2020 and raised no less than $1.6 billion in a single Series E round. This is claimed to be the largest round ever raised in the Education Technology sector. Zuoyebang, founded in 2014, is a Chinese online education platform offering quality educational products and services to primary school students.

Another funding milestone in the EdTech sector was the round conducted by YuanfudaoYuanfuadao, also a Chinese company, raised $1.2 billion in a Series G round on 31 August this year. Yuanfuadao, founded in 2012, is a company that offers live courses and tutoring via an online platform.

In turn, the third and fourth largest EdTech funding rounds in 2020 were also raised by Yuanfudao, raising $1 billion in two Series G rounds on 31 March and 20 October.

On the other hand, the following rounds raised less than a billion with Zuoyebang being the next (raising 750M$) or BYJU'S, an Indian company developing personalised learning programmes for primary school students, which received USD 500 million.

To give the reader an idea of how unique 2020 has been, in the previous year the highest round raised by a single round was only $350 million, conducted by Zhangmen, a Chinese online tutoring platform. In other words, the top 6 rounds raised in 2020 are larger than Zhangmen's round in 2019.

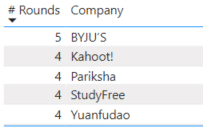

In terms of the number of rounds conducted in that year, the number of rounds was BYJU'S the aforementioned Indian company, which takes the first place, thanks to the execution of 5 rounds. In second place are Kahoot!, a Norwegian game-based learning platform founded in 2012 and IPO'd in 2019, tied with Pariksha, an Indian company founded in 2015 that helps prepare for specific exams, StudyFree, a recent 2019 platform based in Delaware, USA, that aims to connect students with international opportunities, and, finally, the aforementioned Yuanfudao. These four companies raised a total of 4 rounds in 2020.

The following tables show a summary by company of the above; the first table in terms of the number of rounds conducted and the second table in terms of the amount raised: