Negotiations in mergers and acquisitions often hinge on the valuation of a target business. However, when buyers and sellers can't quite align on the current value, a pricing mechanism known as an earn-out comes into play. Earn-outs in M&A serve as contingent purchase prices, where the buyer agrees to pay additional amounts if the business achieves predetermined milestones within a specified timeframe post-deal closure.

In this how to we examine the details of earn-outs, exploring their mechanics, advantages, challenges, and implications for both buyers and sellers.

Table of Contents

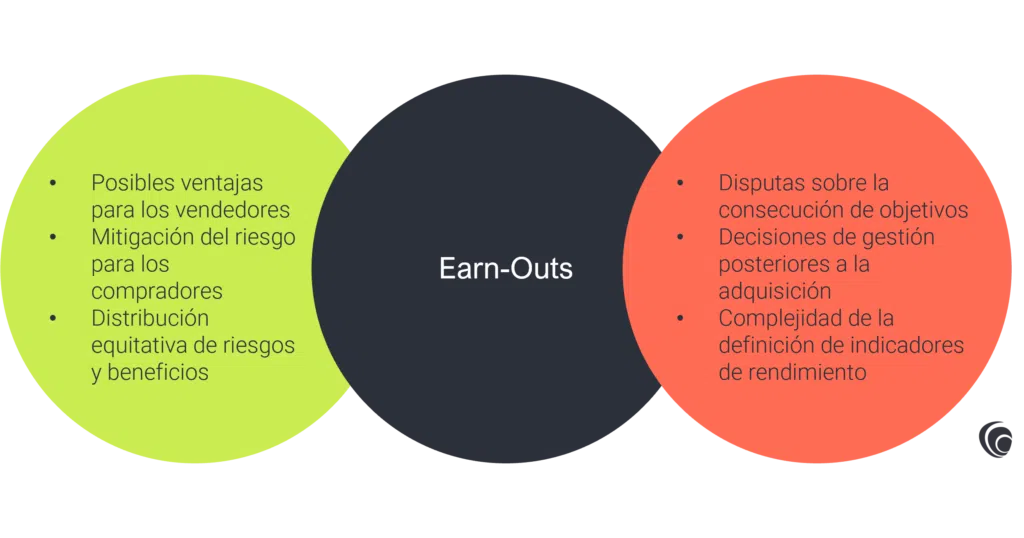

Earn-outs in M&A serve as multifaceted instruments within M&A transactions, fulfilling various objectives beyond mere valuation alignment. Beyond bridging valuation disparities, earn-outs also serve to mitigate a buyer's risk by tethering a portion of the purchase price to the target business's future performance.

For instance, a buyer may consent to an earn-out arrangement contingent upon the target business obtaining regulatory approvals, securing patents, or achieving specific profitability benchmarks post-acquisition. In essence, earn-outs in M&A furnish sellers with the prospect of reaping enhanced returns should their optimistic projections materialize, thus fostering an alignment of incentives between both parties involved in the transaction.

Earn-outs offer both opportunities and challenges, serving as a mechanism for additional value realization and risk mitigation, yet introducing complexities and potential disputes:

The structuring of earn-outs in M&A is subject to the influence of several factors, each exerting a significant impact on the negotiation process and ultimate arrangement outcome. Key considerations include the initial valuation of the target business, projected performance metrics, risk assessment, strategic imperatives, and pertinent legal and regulatory considerations. Both buyers and sellers must engage in meticulous planning and negotiation to delineate earn-out targets, establish precise timeframes, and devise payment mechanisms that foster alignment and mitigate potential conflicts or misunderstandings.

Effective communication and comprehensive agreement documentation are imperative for managing expectations surrounding earn-outs in M&A transactions. Parties must anticipate and address potential changes in the target business's operational landscape post-acquisition, ensuring that earn-out metrics remain relevant and attainable under evolving circumstances.

Disputes frequently arise when parties fail to foresee or adequately address operational changes or when there is ambiguity surrounding the definition and measurement of performance metrics. As such, upfront clarity, transparency, and mutual understanding are indispensable for fostering trust and minimizing the likelihood of post-transaction conflicts.

Earn-out targets may assume two primary forms: event-based or performance-based, each presenting unique challenges and complexities. Event-based earn-outs, such as securing regulatory approvals or patents, typically offer straightforward criteria for target achievement.

Conversely, performance-based earn-outs, predicated on metrics like revenue or profitability, demand meticulous definition and measurement due to their inherent subjectivity and susceptibility to interpretation. Both sellers and buyers often seek audit rights to verify the accuracy and fairness of earn-out calculations, safeguarding their interests and ensuring adherence to mutually agreed-upon terms.

While earn-outs serve as valuable instruments for bridging valuation disparities and aligning buyer-seller interests, equity rollovers represent an alternative mechanism with distinct advantages and challenges. Equity rollovers enable sellers to retain ownership stakes in the target business, thereby fostering continued participation in its growth and success over the long term. While this arrangement aligns buyer and seller interests and facilitates smoother post-acquisition integration, it also introduces complexities related to governance, decision-making, and exit strategies.

Ultimately, the choice between earn-outs and equity rollovers hinges on the parties' long-term objectives, risk tolerance, and strategic vision for the target business.

Earn-out arrangements may be structured with various features, including cliff payments, tiered payments, and caps, designed to manage risk and incentivize performance effectively. Cliff payments offer binary outcomes, wherein the earn-out is triggered only upon the achievement of a specific target, with no payment otherwise.

In contrast, tiered payments provide graduated rewards for incremental target achievements, allowing sellers to receive partial payments earn-out is triggered only upon the achievement of a specific target, with no payment otherwise. In contrast, tiered payments provide graduated rewards for incremental target achievements, allowing sellers to receive partial payments even if the full earn-out is not realized. Caps impose an upper limit on the total earn-out payable, thereby limiting the buyer's potential liability while still offering sellers the opportunity to reap rewards commensurate with the target's performance.

In conclusion, earn-outs in M&A represent a versatile and valuable tool within the M&A toolkit, offering a means to bridge valuation disparities, manage risk, and align buyer and seller interests effectively.

However, successful earn-out arrangements hinge on clear communication, meticulous planning, and mutual understanding between parties. By carefully defining earn-out targets setting realistic expectations, and structuring agreements with transparency and fairness, buyers can effectively manage the complexities of M&A transactions, ensuring optimal results for all stakeholders involved.