Carve-out transactions represent a strategic approach used by companies to restructure their businesses and unlock value for shareholders.

In this how to, we explore the intricacies of carve-out transactions, from their structural considerations to the complexities of transitioning and establishing the carved-out entity in its new environment.

Table of Contents

A carve-out transaction involves the separation and sale of a specific part of a business by the parent company. This part, known as the carved-out business, can be a division, an operating segment, or even a set of products and services within the parent company's broader business portfolio The rationale behind a carve-out transaction can vary, ranging from focusing on core business areas to raising capital for growth or debt reduction.

notable example of a carve-out transaction is the separation of PayPal from eBay in 2015. eBay, a leading e-commerce platform, decided to carve out PayPal, its online payments unit, to allow both companies to focus on their respective growth strategies. The transaction was well-received by shareholders and enabled PayPal to become an independent leader in its industry.

A carve-out transaction can be structured in several ways, with the most common being asset sales and stock sales agreements. This decision hinges on various factors, such as the existing legal framework of the carve-out business and the preferences of both buyer and seller. An asset deal may be preferable if the carve-out operates within a larger corporate entity, allowing for the targeted acquisition of specific assets and liabilities while leaving behind the entity's other businesses.

onversely, a stock deal might be more suitable if the carve-out already exists within its own legal entity. Despite the chosen structure, buyers must adhere to fundamental transaction mechanics, including working capital adjustments, net debt considerations, and indemnities, tailored to fit the unique circumstances of the carve-out.

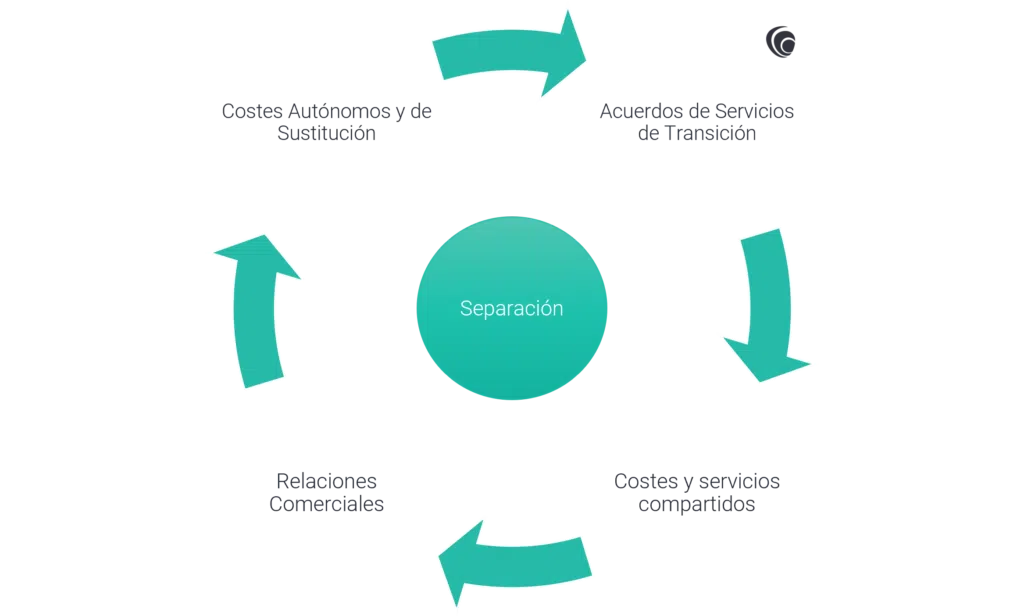

Transitioning a carve-out business from its former parent to a new owner often necessitates a period of transition and support. To ensure a smooth transition of the carved-out business to the new owner, it is common for the parties involved to establish transition services agreements (TSAs). These agreements encompass a range of functions, from IT and accounting to operational support, ensuring continuity and stability for the carve-out as it adapts to its new operational environment. However, the duration and scope of TSAs must be carefully negotiated, balancing the buyer's need for support with the seller's desire to relinquish obligations and costs associated with the carve-out.

Carve-out transactions can pose unique challenges for both parties involved. For the seller, effectively separating the carved-out business from the rest of the parent company can be complex, especially if there are operational or financial interdependencies between the entities. For the buyer, integrating the carved-out business into its existing operation may require careful planning and execution to ensure a smooth transition and realization of the anticipated value.

One of the most significant challenges in carve-out transactions is managing the commercial relationships between the carved-out business and the parent company. These relationships may include supply agreements, licensing contracts, strategic alliances, and more. When the carved-out business is no longer part of the parent company, these relationships may be affected, requiring careful review and, in some cases, renegotiation of contractual terms.

Shared costs and services represent another layer of complexity in carve-out transactions, encompassing a broad spectrum of expenses and resources shared between the carve-out and its parent or affiliates. From insurance premiums and professional services to centralized functions like IT and HR, these shared arrangements necessitate careful scrutiny to ascertain their implications for the carve-out's future operations and financials. .

Buyers must meticulously evaluate the extent of shared costs and services, identifying those that will require replacement or restructuring post-transaction. Whether building out standalone capabilities or leveraging existing resources within the buyer's organization, strategic planning is essential to ensure a seamless transition and sustainable cost structure for the carve-out

Post-transaction planning involves a critical decision: whether to pursue standalone operations or integrate into the buyer's portfolio. Choosing standalone operation necessitates a comprehensive evaluation of costs, covering administrative and operational functions required for autonomy. Conversely, integrating into existing operations requires a careful examination of shared costs and services to ensure a smooth assimilation within the buyer's framework, striking a balance between efficiency and financial sustainability. This decision significantly shapes resource allocation and cost structures post-acquisition, thereby impacting the business's trajectory and success.

A standalone approach demands meticulous scrutiny of all expenses linked with independence, emphasizing a deep understanding of operational needs. Integration, on the other hand, calls for a delicate equilibrium between utilizing existing resources and accommodating carve-out specifics. Transitioning to autonomy may entail investments in infrastructure, technology, and human resources, prioritizing long-term viability. Integration mandates the seamless incorporation of carve-out operations into existing structures, leveraging synergies while minimizing disruptions..

In summary, in carve-out transactions thorough planning is crucial. These deals offer opportunities but also pose unique challenges. From structuring the deal to integrating the acquired business, buyers must address complexities like managing relationships and shared costs .Understanding the operational needs of the carve-out and potential synergies is key. Moreover, transition services agreements play a vital role in ensuring a smooth transition. Overall, success requires meticulous due diligence and clear planning to capitalize on opportunities and drive growth.