When buying a company, one of the most critical stages is determining a company's fair price to pay. This process, involving a thorough evaluation of the company's value, requires a holistic approach that encompasses understanding valuation methods to considering the risks and opportunities associated with the transaction.

In this how-to guide, we will explore how buyers can make informed decisions about the price of a company in an M&A transaction.

To determine a company's fair price, it is essential to understand the different available valuation methods. These include the transaction and publicly traded comparables approach, and the discounted cash flow (DCF) method. Each method has its own advantages and limitations, and it is important to consider them together to obtain a comprehensive evaluation of the company's value.

sing valuation multiples to determine the fair price of the target company. On the other hand, the publicly traded comparables approach involves comparing the target company to other companies listed on the stock exchange and operating in the same sector or industry, while the DCF evaluates the present value of the company's future cash flows.

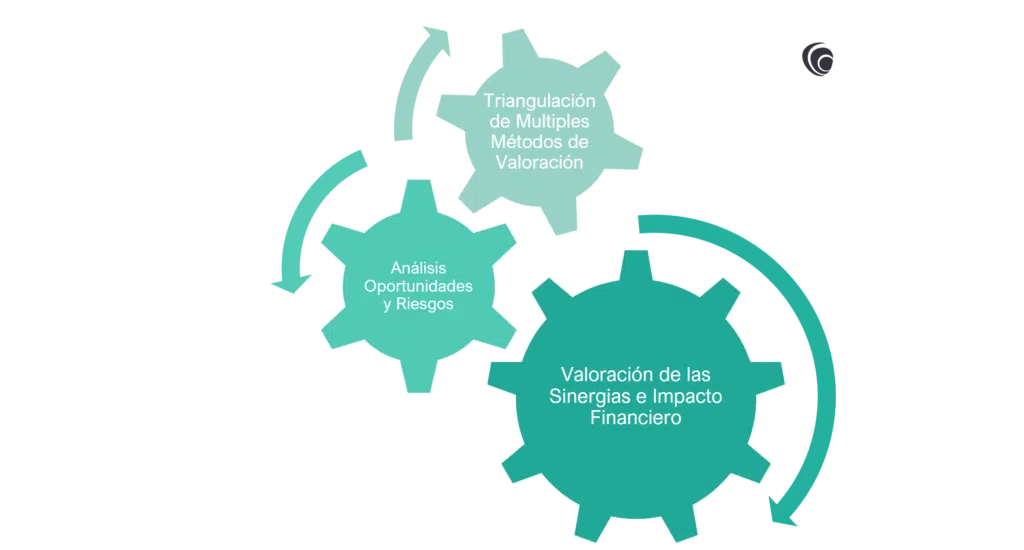

To achieve a more precise and comprehensive evaluation of the target company's value, triangulating valuation methods is a fundamental practice. This approach involves the utilization and comparison of various valuation methods, each offering unique perspectives on the business's value.

By integrating these different valuation methods, buyers can obtain a more robust and complete understanding of the target company's value. Comparing the results of different methods allows for the identification of potential discrepancies and a better understanding of the factors influencing valuation. Moreover, triangulation helps mitigate the risk of biases inherent in a single valuation method, providing a more balanced and well-founded assessment of a company's fair price.

In any transaction, buyers must also consider the risks and opportunities associated with the deal. This involves conducting a comprehensive due diligence analysis to identify potential legal, financial, or operational issues that could affect the company's value. It is crucial to involve multidisciplinary teams in this process, including business and functional teams, as well as team leaders and the investment committee. This collaboration ensures that all relevant perspectives are considered when evaluating a company's fair price and mitigating the risks associated with the transaction.

In addition to considering the aforementioned aspects, valuing synergies and their financial impact is a crucial aspect in the process of determining the price of a target company during a transaction. Synergies, derived from the strategic combination of operations, technologies, or resources between the buyer and the target company, have the potential to generate significant operational efficiencies and consequently increase the value of the transaction.

When two companies merge or are acquired, the integration of their operations can lead to synergies in different areas. For example, consolidating teams, optimizing supply chains, or sharing technology and knowledge can generate cost savings and increase productivity. Furthermore, synergies can open up new market opportunities, increase combined market share, or enhance the innovation capacity of the resulting company.

However, it is essential to recognize that synergies do not always materialize as anticipated. Various factors can hinder their realization, such as cultural differences between companies, challenges in integrating systems and processes, or resistance from employees. Therefore, buyers must be cautious when incorporating the value of synergies into their valuation analysis.

price of the target company, buyers must conduct a thorough and detailed assessment. This involves identifying and quantifying potential synergies in key areas, such as operational costs, additional revenue, or efficiency improvements. Additionally, it is important to consider different scenarios and sensitivities to assess the impact of synergies on profitability and the future value of the company. When conducting this evaluation, buyers must consider both the potential benefits and the risks associated with realizing synergies

ermining a company's fair price is a critical task that requires a holistic and exhaustive approach. To achieve this, it is essential to understand and employ various valuation methods, such as the transaction and publicly traded comparables approach, as well as discounted cash flow (DCF) analysis, triangulating these methods to obtain a more accurate and balanced evaluation of the business's value.

Additionally, buyers must analyze the risks and opportunities associated with the transaction, conducting thorough due diligence, and considering the impact of synergies on the final priceBy integrating all these aspects into their valuation process, buyers can make informed and well-founded decisions that maximize the value of the transaction and mitigate potential risks.