The Advertising 2023 sector witnessed a dynamic transformation, marked by strategic investments that redefined the market's competitiveness and shaped its future. These investments introduced innovative solutions and creative approaches that sculpted the business landscape. We highlight key transactions that drove the growth and evolution of the industry, from start-up investments to strategic acquisitions acquisitions , each bringing unique benefits to the advertising ecosystem. We explore in detail the most notable investments that left a lasting mark on this ever-changing landscape.

Table of Contents

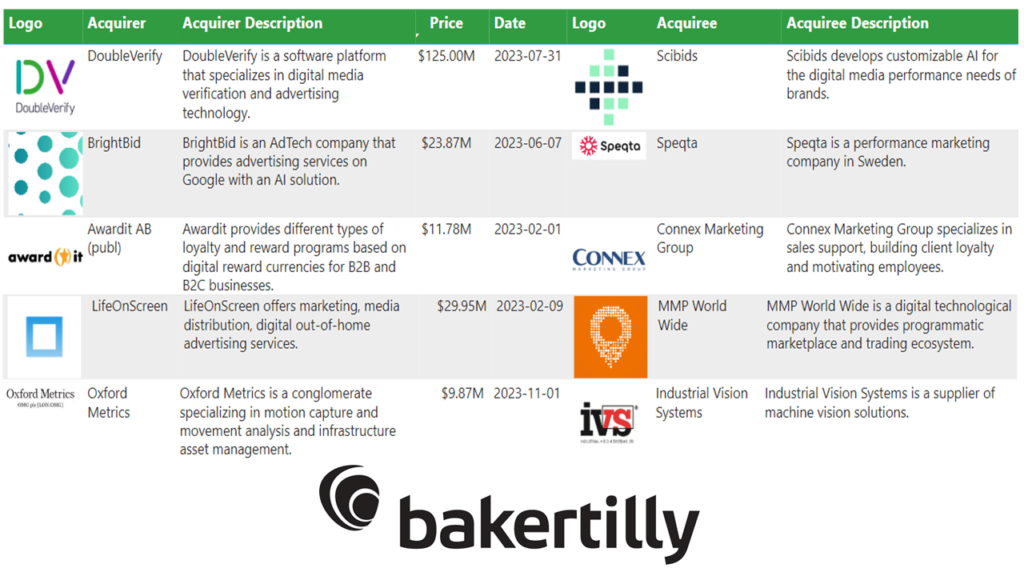

The acquisition of Scibids on July 31, 2023, for $125 million was a strategic move for both companies.

DoubleVerify acquires Scibids to expand its campaign optimization offering, leveraging Scibids' leadership in AI for optimizing digital advertising campaigns, which complements DoubleVerify's measurement platform. The acquisition aims to enhance campaign efficiency and performance by automating optimization with Scibids' technology. Additionally, it seeks to provide customers with comprehensive solutions by combining measurement and optimization capabilities for more effective management of digital advertising campaigns. Ultimately, the acquisition strengthens DoubleVerify's position as a leader in advertising measurement and optimization solutions in the market.

BrightBid acquired Speqta on June 7, 2023, for $23.87 million.

BrightBid expands its offering with the acquisition of Speqta, gaining complementary products and access to new markets. Additionally, it adds talent and expertise by integrating Speqta's team, enhancing its technology and intellectual property. For Speqta, being acquired by BrightBid means additional resources, access to a new customer base, and growth opportunities with the support of a larger company.

Awardit AB has several reasons for the acquisition of Connex Marketing Group. Firstly, it seeks to complement its service offering with Connex's unique capabilities, allowing for a more comprehensive offering to its clients. Additionally, the acquisition could open up new market opportunities by accessing Connex's different customer base.

Another key reason is the acquisition of talent and expertise, thus strengthening Awardit's capabilities. Furthermore, integrating Connex's technology and infrastructure could enhance Awardit's operational efficiency. For Connex, being acquired by Awardit represents an opportunity to gain additional resources, access a new customer base, and benefit from Awardit's expertise to enhance its products and services.

LifeOnScreen has various reasons for acquiring MMP World Wide. Firstly, it aims to complement its service offering by integrating MMP World Wide's complementary products and services, enabling it to provide more comprehensive solutions to its clients. Additionally, the acquisition could open up new market opportunities by accessing MMP World Wide's diverse customer base. Another significant reason is the acquisition of talent and expertise, thereby strengthening LifeOnScreen's capabilities.

Furthermore, there is consideration for improving LifeOnScreen's technology and infrastructure through the integration of MMP World Wide's tools and intellectual property. On the other hand, for MMP World Wide, being acquired by LifeOnScreen represents an opportunity to gain additional resources, access a new customer base, and benefit from LifeOnScreen's expertise to enhance its products and services.

Oxford Metrics (OM) has several reasons for acquiring Industrial Vision Systems (IVS). Firstly, it seeks to expand its technological portfolio by incorporating IVS's expertise in artificial vision and industrial measurement systems, aspects that would complement its offerings in the field of motion measurement and behavior analysis. Additionally, the acquisition could open up new market opportunities by accessing customers and industrial sectors different from those of OM, thus facilitating expansion into new areas.

Another key reason is to strengthen OM's research and development capabilities by integrating IVS's talented team of engineers and researchers, as well as obtaining valuable intellectual property such as patents related to artificial vision.

On the other hand, for Industrial Vision Systems, being acquired by OM represents an opportunity to gain additional resources, access a broader customer base, and benefit from OM's expertise to enhance its products and services.

The acquisition of Embrace by Bertelsmann Interactive (BI) aims to expand BI's service offerings, especially in digital transformation and business development. Additionally, it strengthens BI's presence in employer branding.

Embrace benefits from access to Bertelsmann's financial resources and global expansion capabilities, as well as the stability and security of being part of a large corporate group. Both companies seek to leverage their mutual expertise to enhance their services and solutions.

Reasons for Entravision's acquisition of BcnMonetize include expanding Entravision's advertising offering, particularly in native and programmatic advertising targeted at Hispanic audiences. The acquisition could increase Entravision's presence in the Spanish advertising market, a key market. BcnMonetize would bring valuable technology and expertise in advertising, enhancing the efficiency and effectiveness of Entravision's advertising campaigns.

For BcnMonetize, benefits would include access to Entravision's resources to accelerate its growth, greater stability and security as part of a larger company, and opportunities for global expansion through Entravision's global network.

Merkle's reasons for acquiring Omega CRM Consulting include expanding its service offerings by leveraging Omega's complementary expertise and skills in areas such as data solutions, technology, marketing, and customer services, enabling it to offer more comprehensive solutions to its clients. The acquisition would provide access to new markets and customers, as Omega could operate in different segments or have a different customer base. Merkle aims to acquire valuable talent and additional expertise through Omega's team, as well as enhancing its technology and infrastructure by incorporating Omega's tools and technology.

For Omega CRM Consulting, benefits would include additional resources to grow as part of a larger company, access to Merkle's extensive client base to expand its reach, and the opportunity to leverage Merkle's expertise and knowledge to enhance its products and services.

The acquisition of Mondo TV Studios by Squirrel Media is motivated by the intention to expand Squirrel Media's content portfolio, leveraging Mondo TV Studios' extensive catalog of acclaimed animated series, thereby strengthening the offering in the animation sector. The acquisition also aims to access new markets, as Mondo TV Studios has a strong presence in key markets such as Italy and Latin America, allowing Squirrel Media to broaden its international reach. Additionally, it seeks to harness the expertise and talent of the Mondo TV Studios team in animation production, considering it a valuable asset for Squirrel Media.

On the other hand, the benefits for Mondo TV Studios include access to Squirrel Media's resources, which boasts a wide infrastructure and financial resources that will drive Mondo TV Studios' growth. The acquisition also represents an opportunity for global expansion by leveraging Squirrel Media's international network of contacts and provides greater long-term stability and security by being part of a larger business group.