In the process of Selling a company one of the significant steps is finding and qualifying the right buyers – essential to ensure you get the best price and most favorable terms for your business.

In this process, meticulous preparation, thorough research and rigorous screening of potential buyers play a crucial role. A mergers and acquisitions (M&A) advisor will contact these potential buyers directly and send them a profile of your company to capture their interest. It is crucial to maintain the confidentiality of your business throughout the process, which is achieved by using a profile that does not reveal your company's identity.

Table of Contents

g the buyer list is fundamental to maximizing the value of your company. When creating this list, it's important to consider the size and suitability of potential buyers, as well as what they would value most in your company. Initially, you can provide your advisor with a preliminary list of companies you believe may be suitable candidates to acquire your business. This may include direct and indirect competitors, as well as companies in related industries. Your advisor will then expand this list and seek contact information for any companies you have provided, or they have discovered.

A private auction is a commonly employed strategy to maximize the value of a company during its sale. To conduct a successful private auction, it's necessary to have a broad list of qualified buyers. The more qualified buyers compete to acquire your company, the greater the chances of obtaining the best price and most favorable terms for your business. Creating a competitive environment among potential buyers is essential to drive your company's value to its maximum.

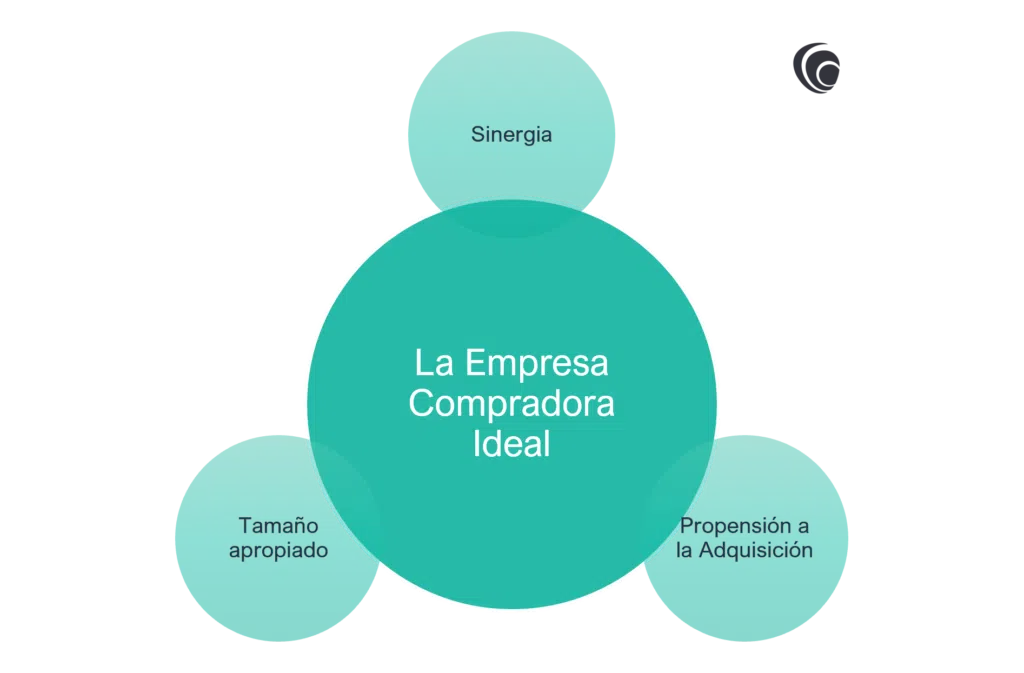

A la hora de buscar compradores, es decisivo identificar al comprador corporativo ideal. Este comprador adecuado para la venta de tu empresa debe ofrecer productos o servicios complementarios, tener experiencia en acquisitions y estar motivado para completar la transacción, entre otras características:

There should be a balance regarding the buyer's size. If it's too similar in size to your company, it may be too cautious to take on the risk of the transaction. On the other hand, a buyer that is too large may not see enough strategic value in your company and be less likely to close the deal.

Once you have identified potential buyers for your company, it's crucial to obtain the correct contact information to communicate with them effectively. Ideally, potential buyers should have a corporate development department that oversees acquisitions and can provide information about their acquisition preferences. Additionally, it's important to identify key individuals within the buying companies who have the power to make decisions and who can personally benefit from the acquisition of your company.

One of the most common mistakes made in the early stages of a transaction is engaging with buyers who are not qualified. This error can be costly in both time and resources, as evaluating an offer without first obtaining background information about the buyer can be a considerable waste of time.

Before investing time and energy in negotiating with potential buyers, it's essential to ensure that they are sufficiently motivated financially capable of acquiring your business. This will ensure that you are negotiating with a qualified buyer and will motivate you to invest more time and effort in the selling process.

Most buyers who are not seriously interested will not bother to complete a detailed buyer profile. Therefore, the filtering process alone will help weed out those who are not committed to the transaction. Once a potential buyer submits an offer, they should provide supporting documents to verify their financial capability, allowing you to evaluate them with greater confidence and accuracy.

dition to assessing the buyer's financial capability, it's also important to consider their level of motivation. How quickly do they respond to your calls and emails? Are they eager to progress in the process or do they display excessive critical attitude?

Truly motivated buyers will not hesitate to go the extra mile to advance the transaction. They will be eager to communicate and will demonstrate genuine interest in the business. Conversely, buyers who are overly critical or show a lack of commitment are likely not genuinely interested in buying your company.

Potential buyers may disappear for various reasons. Perhaps their priorities suddenly changed. In the case of a corporate buyer, there may have been an internal restructuring, and the person you were in contact with is no longer with the company. Or perhaps, due to an economic downturn in their sector, they chose to freeze spending or adopt a more cautious stance towards the future. It is also possible that they found a more attractive offer elsewhere.

The solution is simple: avoid becoming emotionally invested in a specific buyer. This does not mean giving up being assertive when selling your business. You must be proactive but maintain composure and focus on managing your business during the process, maintaining emotional distance regarding any particular buyer.

Identifying the ideal buyer, ensuring their suitability, and maintaining confidentiality are essential steps. It's crucial to evaluate the buyer's motivation and financial capability, avoiding emotional involvement. Buyers may disappear for various reasons, but maintaining composure and focusing on running the business during the sale will maximize value and favorable conditions.Ultimately, focusing on qualified buyers and remaining objective increases the chances of a successful and beneficial sale for all parties involved.