Constellation Software is one of the few companies that has been able to grow faster than Amazon over the past decade. The Canadian company has managed to grow from CAD 18.63 in 2006 to CAD 1,154 in 2019 over this period.

In this post business valuation We will present this company, analyse what it does and where the basis for this growth lies.

Constellation Software is a holding company dedicated to the proportion of specialised software for both the public and private sector. Its company policy is based on having the latest technologies, acquiring both solutions and companies inorganically and developing them internally with large investments.

The company has more than 125,000 customers worldwide, operating in over 100 countries. It follows a model of purchase of companies inorganic operating independently with both financial and logistical support from the parent company, sharing technology and collaborating to improve cross-selling between businesses.

In the following tables we have summarised the most relevant data of Constellation Software in terms of its valuation. In them we can see how the sales have grown significantly in 2018 by 23%, maintaining the company's efficiency by achieving the EBITDA to grow in the same proportion. The company is being able to sustain this growth due to the continued acquisition of medium-sized companies.

Breaking down the company's revenues, we can see that professional services and maintenance are the factors that have grown the most, well above the rest. This, thanks to long-term contracts and recurring customers, makes it the most important factor in terms of revenue. a fairly stable business.

In addition, the company's operating working capital has been reduced thanks to the improvement in the average collection period and a lengthening of the average payment period significant.

Net debt remains negative in 2018, due to the company's high liquidity as it maintains the policy of inorganic growth through acquisitions and due to investments in wholly owned or investee subsidiaries to help them grow in their business niches.

It is quite significant low indebtedness This leaves plenty of room for large acquisitions that could sustain this growth spiral in the long term.

Constellation Software's share price in 2006 was just 18.49 CAD. In 2019, however, it has managed to break through the 1,100 barrier, reaching CAD 1,154.

This dizzying growth started in 2012-2013, when an ambitious plan for inorganic growth began with the fruits of the acquisition of the Covarity companySince then, this growth has not stopped.

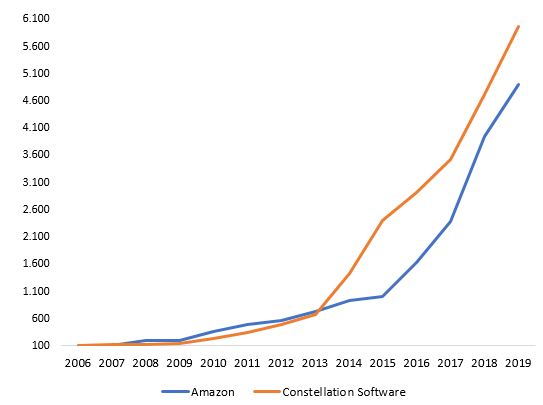

In the graph below we can see what the effect would have been if we had invested $100 in 2006 in both Amazon and Constellation Software.

While it is clear that Amazon's growth spikes from 2015 onwards, when it had 70,000 subscribers, it can be observed how the total return on investment would have been significantly higher. at Constellation Software.

Even if we were to remove the effect of the depreciation of the CAD against the dollar, which during this period was 13%, the investment in Constellation Software would have yielded a $400 higher return, i.e. we would have had to invest an additional 10% in Amazon at the outset to have obtained the same results with both investments.

Constellation Software's strategy of acquiring companies while retaining their management body, giving them freedom and offering them both technological, logistical and financial support to undertake major growth, rather than acquiring the companies to integrate them, is a strategy that has helped it to maintain 12 years of strong growth both in terms of holding companies and share prices.

This is something that more and more listed companies are turning to in order to foster innovation, maintain the growth of profitable businesses and try to have different sources of income, under a broad umbrella of different brands, without renouncing the synergies of holding companies.