Interested in understanding the fundamental financial aspects of the advertising world? The Advertising Valuation Report 2023, by Baker Tilly, provides a comprehensive view of the sector. This report thoroughly examines 91 companies within the advertising realm, providing a complete analysis of financial statements, characteristics, and industry multiples.

In a digitally evolving world, comprehending market valuation and the financial health of advertising companies becomes a vital aspect. This report not only serves as a roadmap for investors, business leaders, and industry experts but also offers an in-depth analysis of the financial and valuation factors influencing the dynamics of the advertising sector.

The advertising landscape is constantly evolving, driven by a set of trends that shape its dynamics and demand a strategic vision for success. These emerging forces not only reflect technological advancements and changing consumer preferences but also present unprecedented challenges and opportunities for brands and marketing professionals.

Trends shaping the landscape:

The report conducts a comprehensive analysis of the financial statements of companies, addressing aspects such as revenues, cash flows, and leverage. This detailed examination provides valuable insights into the financial stability, profitability, and operational efficiency of companies within the advertising industry.

A thorough analysis of debt levels within companies in the sector provides a clear insight into leverage and financial stability in this industry. By studying companies and their level of indebtedness, the report highlights the implications of debt on company valuations and shareholder confidence.

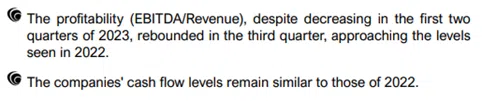

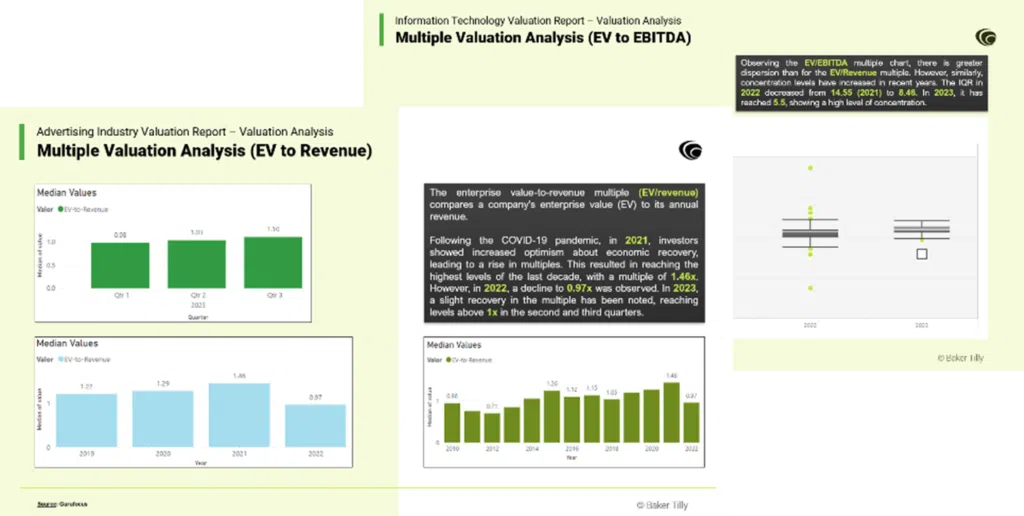

The Advertising Valuation Report 2023 presents a comprehensive analysis of market valuation. The report provides a detailed and exhaustive evaluation of market multiples for publicly traded companies in the sector. This analysis offers a comprehensive view of the relative value of companies in the sector, aiding investors and business leaders in better understanding market dynamics and making informed decisions.

Various key multiples have been evaluated, including:

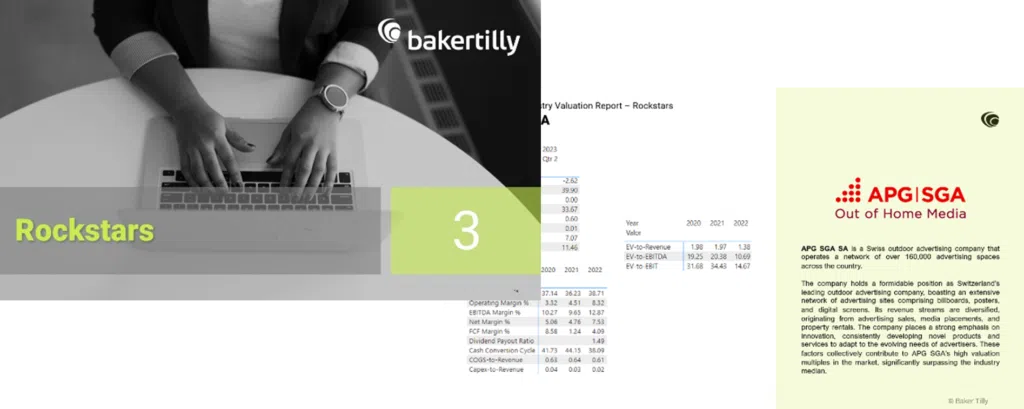

The advertising valuation report 2023 not only examines general trends within the sector but also identifies certain companies as prominent leaders, recognized for their outstanding valuation in terms of financial multiples. These companies are distinguished by their continuous innovation, a solid track record of growth, and an exceptional ability to create value for their shareholders. Among these prominent leaders is APG SGA SA.

The analysis of these companies underscores their ability to achieve superior financial multiples, such as the enterprise value to revenue ratio (EV/Revenue), the enterprise value to EBITDA ratio (EV/EBITDA), and the enterprise value to EBIT ratio (EV/EBIT), compared to the industry average. This distinction highlights their prominent position and significant impact on the landscape of the advertising industry.

The final section of the report on the advertising industry addresses the most recent Initial Public Offerings (IPOs). Within the context of the industry, it is crucial to consider these latest IPOs as they provide a unique perspective on the current valuations and growth prospects of emerging companies in this dynamic sector.

Some of these notable IPOs involve companies that have experienced rapid growth and have sparked significant interest in the advertising market. These new additions are contributing to shaping the evolution and innovation in the industry, and their performance in the market is essential for understanding the future trajectory of the sector.

This report provides valuable insights into industry multiples, financial statements, debt evolution, and market valuations , all of which are fundamental elements for understanding the complexities of the advertising sector.

To access the full report and gain a detailed understanding of the 2023 advertising industry valuation landscape, please leave your details below and we will contact you.