If you are considering the possibility of selling your company, or if you are looking for information to sell it properly, you should know that what you need is a global and multidisciplinary process to find a buyer that guarantees you the best conditions.

The objective of having a growth consultancy is to provide a strategic and structured approach aimed at increasing the value of your company. In short, the service includes 3 different stages:

One of the most cost-effective investments you can make in your business is to dedicate time to increase its future valueSpending time to properly prepare your business for sale. Laying the groundwork to showcase your business in the most attractive way possible will pay dividends even if the time of its intended sale comes later.

After so many years of effort and uncertainty, I don't need to remind you that your business is one of your most valuable assets. And if you invest time now to prepare your business for sale, whether next month or in two or more years' time, it will increase the value of that asset.

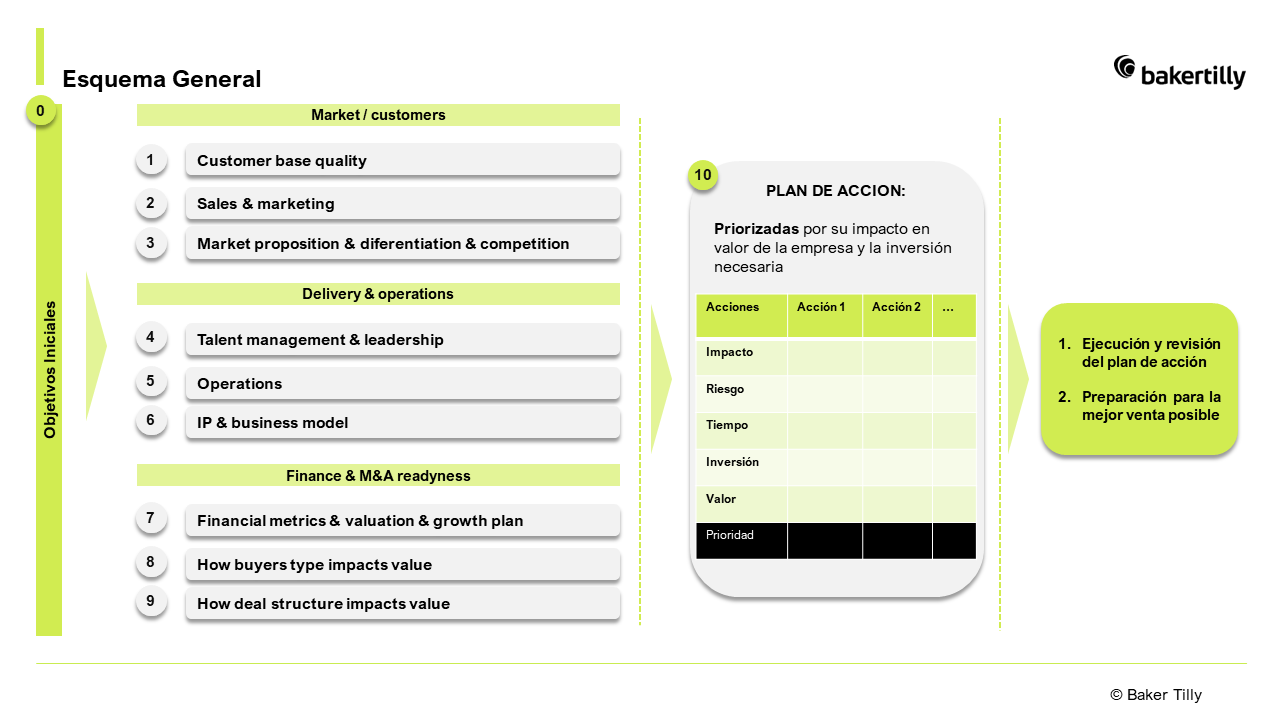

As a growth consultancy, our first recommendation is to make sure that all shareholders are aligned around a common vision at least on the most relevant aspects such as when, for how much and to whom. Once the personal circumstances and motivations of the shareholders are clear, we carry out a diagnosis of the company following the outline shown in the table below:

In our methodology, we analyse a multitude of aspects that we group into the following areas for ease of understanding:

We analyse variables such as customer concentration, registrations and deregistrations, upselling/downselling, etc. It is essential to reinforce those variables that improve predictability and guarantee future income and show strength in growth capacities.

Implementing effective strategies at these key points will enable the company to attract new customers and create a steady stream of high quality prospects along with the development of a strong strategic brand to attract future employees and potential buyers.

For buyers, a clear proposition will allow them to understand where your business will fit into their portfolio, and strong intellectual property (IP) will give them confidence that they can scale the business and that you can establish barriers to entry to protect your market position and encourage continued innovation.

Knowledge-based companies have their main asset in the people who make up their organisation. A good team helps the investor to perceive a greater capacity to overcome the challenges presented by the market:

The efficient delivery of high quality services, backed by intellectual property (IP) and expertise, and enabled by appropriate technology, is crucial to maximise profitability and drive business growth.

The implementation of specialised IP management systems strengthens the company's market position by creating barriers to entry for new competitors, improves customer loyalty and consequently increases the attractiveness for investors.

Understanding the quantitative and qualitative variables that have the greatest impact on the valuation of a company is essential to develop a growth plan that will achieve the expected value in a reasonable timeframe.

By learning about the different types of investors, you can identify who may be most interested in acquiring your company and what their reasons are. This is essential to find out how much your company is likely to be worth, increase the likelihood of a sale, and develop a successful market position strategy.

When valuing an offer, you should consider more than just the price. There is a multitude of terms and conditions in a Transaction that can drastically impact the final liquid amount. Remember a key aspect of any negotiation: "You name the price. I'll set the terms". Follow this advice, and you are sure to walk away with a slightly fuller pocket.