The most active investor in the information technology (IT) sector is 3i Group. The IT sector consists of companies that produce software, hardware or semiconductor equipment, or companies that provide Internet or related services.

The three major industry groups in the IT sector are :

These three industrial groups are further divided into industries and sub-sectors.

In recent years, the information technology sector has been the focus of a great deal of investment activity. To give you an idea, in the last 3 years in Europe, there have been 4073 investment rounds and 1,131 acquisitions.

One of the most recent funding rounds in the IT sector, announced on 19 January 2021, has been the one that has received KONUXKonux, a German software platform for the rail sector, uses smart sensors and machine learning for efficient maintenance of track devices. Konux, which has raised €65m in a round led by Sanno Capital.

One of the latest acquisitions announced so far, on 12 January 2021, has been that of Orbus softwarea UK-based IT and business transformation software company, by Silvertree Equity.

The most active private equity investor in the sector in Europe is 3i Group.

London-based 3i Group is currently the most active investor among the top international investment managers focused on private equity and infrastructure.

From an infrastructure point of view, they are focused on sectors adjacent to utilities, transport, communications and energy.

From a Private Equity perspective, sub-sector specialisation is at the core of their investment strategy. They invest in four main industry sectors: business and technology services, consumer, healthcare and industrials.

So far 3i Group has conducted 455 rounds of financing, 95 acquisitions and 175 exits.

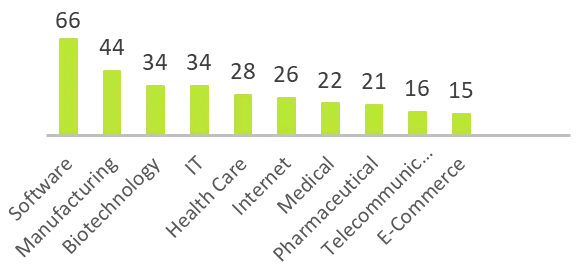

Within the IT sector, they are focused on the following sub-segments:

The image shows the sub-sectors in which 3i Group invests:

They invest in companies with a value-added service offering, backed by intellectual property and sufficiently focused to differentiate themselves from large companies.

The typical holding period for investments is 3 to 5 years, although they may be held for longer depending on the strategy of the company. investment.

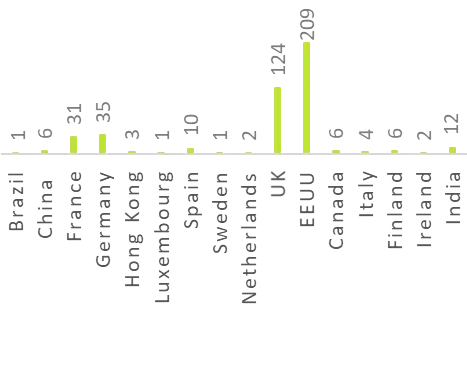

Financially, they invest in companies in Europe and North America with an EV typically in the range of EUR 100 to 500 million and with international growth potential.

Geographical area of interest:

Currently, within the IT sector, they have 6 companies in their portfolio: BVG, Evernex, FormelD, arrives (formally I.EC.), WYD and Magnitude . Among his past investments, there are very interesting companies such as Civic or ERMamong others.

As we have seen throughout the post, the information technology sector is a very interesting sector in which there are private equity firms such as 3i Group, which are very interested in the investment opportunities that exist in the sector.