The Catalan startup Keonn Technologies has recently received a €1.32 million round of funding. The company is dedicated to the development of radio frequency identification products, commonly known as RFID.

Our expert analysts in corporate finance have wanted to investigate more about this sector by analysing the sale of companies most prominent and recent at the international level.

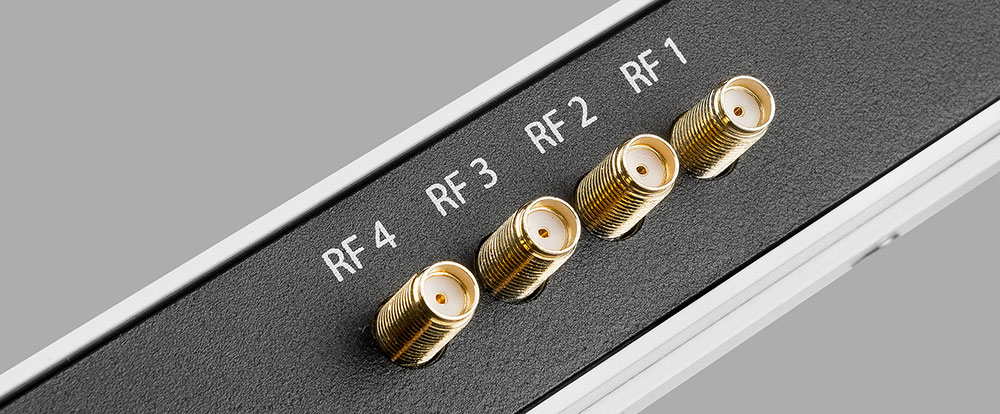

Keonn Technologiesbased in Barcelona, is a startup specialising in the development of RFID software and hardware products radio frequency identification. It works for different sectors such as retail, healthcare, libraries, industry, logistics and others. It also provides UHF RFID components such as antennas, multiplexers and readers for any industry.

In terms of its financial data, in the last year it has obtained revenues of 2.14 million euros, making up an EBITDA of 130,000 euros.

On January 31, 2019 Keonn closed down a financing round of approximately 1.32 million eurosThe company was backed by Spanish firms Inderhabs Investments, Investgut, and other unidentified investors. Its last round was in 2015, when it received an injection of €1 million to accelerate its international expansion, strengthen product development and expand its patent portfolio.

These are the most prominent sales transactions between international companies:

BioStore (Newcastle) is a identity management solutions provider. It provides integrated authentication for a variety of applications, including electronic registration, print and copy, password management, computer login, cashless catering, visitor management, access control, library management or locker systems.

With more than 3 million daily users, BioStore is recognised as the most important leading UK identity management providerwhich offers secure authentication using RFID, Mifare, iClass HID, magnetic stripe cards, PIN, barcode and more.

On 7 January 2019 the Iris Software Groupthe UK enterprise software provider, announced the purchase of BioStore for an undisclosed sum.

"BioStore has been a leading provider of innovative identity management and cashless catering solutions for schools and businesses for many years. We are delighted to be part of IRIS Software Group, where we can create even tighter integrations between our respective award-winning portfolios and innovate even further," said Nigel Walker, managing director of BioStore, following the deal.

Paragon Medical designs, validates and manufactures cases and trays, reusable or single-use surgical instruments, and implantable components for the medical device market. It also offers design and development services for orthopaedic instruments; logistics, prototyping, RFID, sterilisation validation, testing, inventory management, warehousing and kitting services, among many others.

The company was sold to NN, a manufacturer of metal components for plastics, rubber and precision. The transaction was closed on 7 May 2018 for USD 375 million.

Paragon recorded sales growth of 11.9% to $141 million last year, according to NN's post-deal statement. Paragon expects the deal to deliver 33 million in synergies for three years.

Verifonefounded in 1981 and headquartered in San Jose, California, is a company that designs, markets and provides electronic payment solutions services for consumers, traders and financial institutions.

Verifone's devices and systems process a variety of payments, including PIN and signature-based debit cards, credit cards, radio or contactless ID cards, smart cards, electronic bill payments and more.

Verifone announced on August 20, 2018 the news of the acquisition by a group of investors led by Francisco Partners, a leading technology-focused private equity firm. The sale proceeds amounted to USD 3.4 billion.

Under the terms of the sale, Verifone shareholders received USD 23.04 per share in cash. As a result of the completion of the transaction, Verifone's common stock ceased trading on the New York Stock Exchange (NYSE).

Elatecbased in Puchheim (Munich), is specialising in the development and global sales of contactless (RFID, NFC, Bluetooth) and contact (SmartCard) readers/writers. Elatec modules enable clear identification of individual users on end devices and are used in a wide range of numerous applications and solutions, such as secure printing, lift systems, fitness devices, industrial production and more.

The readers developed by Elatec are compatible with all common RFID standards around the world, which allows the the highest possible degree of flexibility in the integration of new peripheral devices.

On 14 February 2018 we learned of the sale of the company to the US firm Summit Partners. The amount of the transaction was not disclosed.

"Elatec's multi-protocol solutions uniquely address a market need. They support more than 60 different transmission standards and enable the use of RFID applications in countless end markets," said Dr. Matthias Allgaier, Managing Director of Summit Partners who joined the Elatec Board of Directors.