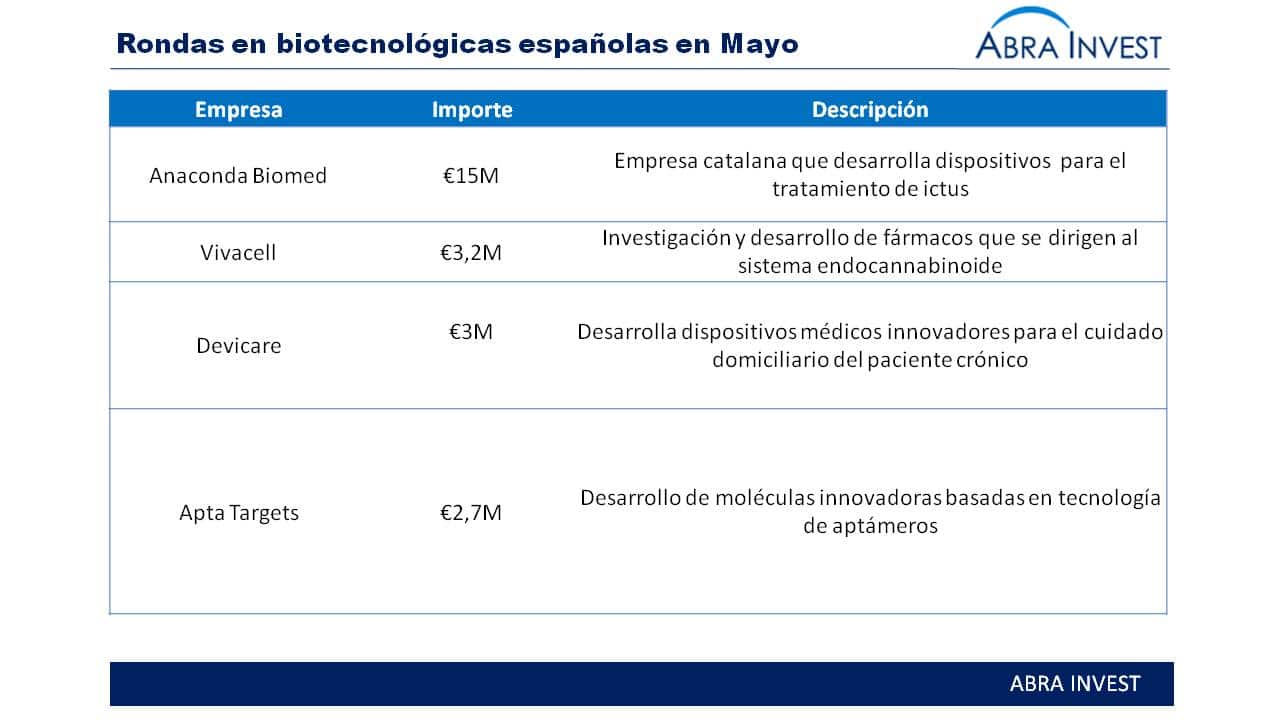

Anaconda Biomed, a Catalan company that develops devices for the treatment of stroke, has received a €15M round.

With this round, the company aims to develop Anaconda Biomed's ANCD Brain device, obtain regulatory approval in Europe and introduce the product to the European market. The funds will also allow the company to initiate FDA approval procedures in the US.

The round was led by Ysios Capital, one of the most active biotech investors in Spain. Other investors include Banco Sabadell, as the first operation in the biomedical sector, as well as the specialised international funds Innogest Capital and Omega Funds.

Anaconda Biomed, which was founded in 2015, had already received a small round in 2016, but the round it has just closed will be the final one to bring its devices to market.

Vivacell is a company located in the Cordova Science Park. The company is a world pioneer in research and development of drugs that target the endocannabinoid system and holds six international patents on new chemical entities designed to act on the endocannabinoid system.

The company has recently received €3.2 million from the Canadian company Emerald Health, which had previously invested in the company.

The proceeds will be used to support VivaCell's ongoing research and development programmes for cannabis-derived medicines.

Devicare, as we mentioned in a previous post, develops innovative medical devices for the home care of chronic patients. The company has just closed a €3M round to consolidate the launch and clinical studies of the first two product lines in the Spanish market: Lit-Control® for the prevention and self-management of recurrent urinary diseases and Tao-Control® for the self-management of patients taking oral anticoagulants (Sintrom®, Aldocumar®, etc.).

"La Caixa, through its venture capital firm Caixa Capital Risc, and Inveready have invested €2.7M in biopharmaceutical company AptaTargets to complete the pre-clinical phase and enter Phase I and II clinical trials of its first drug candidate (ApTOLL) for the acute phase treatment of ischaemic stroke.

AptaTargets is a biopharmaceutical company that started its activity in 2016 and is dedicated to the development of innovative molecules based on aptamer technology. The molecules it develops are neuroprotectants and immunomodulators, from preclinical phases to complete proof of concept in the clinic.

If you are looking for investors, you want to buy or selling a companyplease contact us. Abra-Invest has a team of experts in each area at your disposal. Call +34 946424142 or fill in the contact form.