If you don't know what Kuaderno is, it was Founded in 2015. It is a leading Spanish independent digital platform for learning English for students from 5 to 15 years old.. The objective of the round is to finance the main avenues of growth; Improve products and strengthen the intelligent algorithm for content generation. In addition to boosting its international growth.

Cabiedes & Partners and Fides Capital have been the investors that have backed kuaderno in this €450,000 financing round.

The company intends to launch an international expansion, marketing in at least six countries: Spain, France, Italy, Poland, Russia and Mexico. In addition, the company also wants to develop and improve the product by expanding the educational subjects covered; strengthen the educational materials with the introduction of curricular content and new tools for teachers and students; and strengthen the intelligent algorithm for content generation.

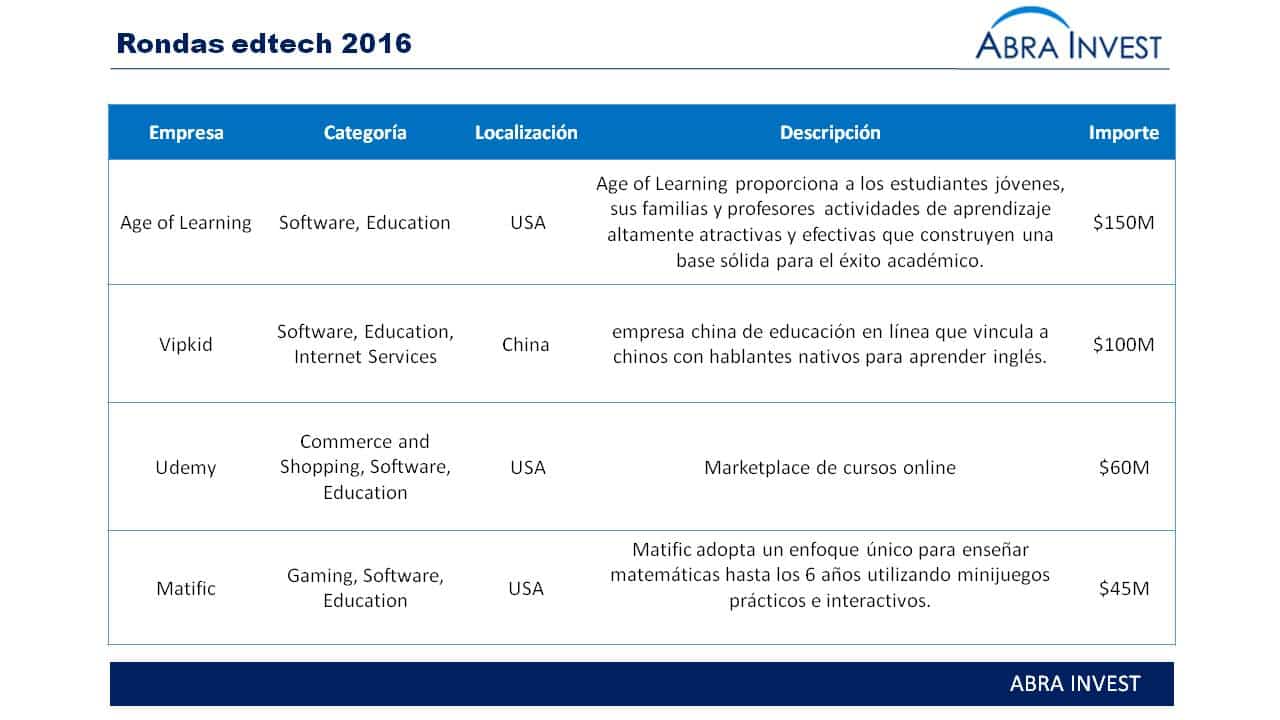

In Spain, Edtech investors are still not as active as in other countries, although in the last year we have detected several rounds in the sector, such as the one closed by OpenWebinars online programming course and Bluebottlebiz, but with the exception of Abba English, all rounds have been for less than €1M. The international market is ahead of the curve and in 2016 we have detected rounds of more than €$45M in the sector.

If you are looking for investors, you want to buy or selling a company or, Call +34 946 42 41 42 or fill in the contact form. Baker Tilly GDA has an expert team at your disposal.