Venture capital in the data recovery niche

Insight Venture capital buy Dell Spanning cloud

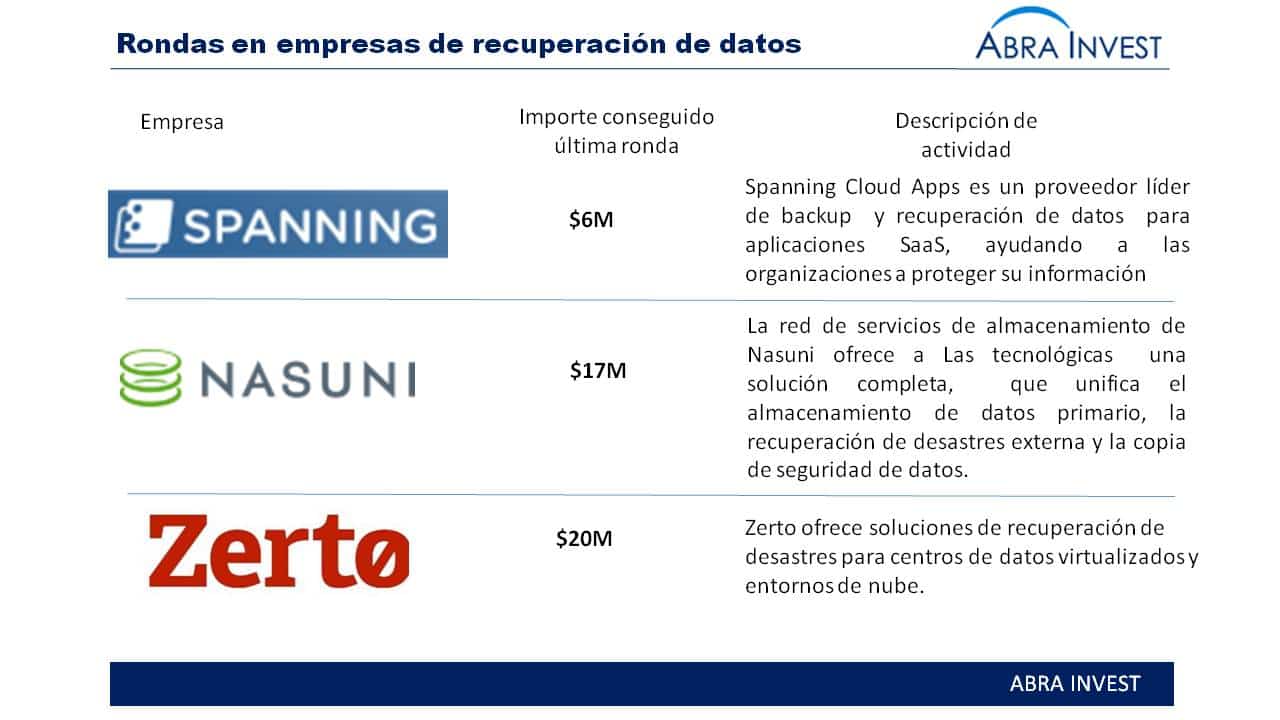

Spanning Cloud Apps is a leading provider of data backup and recovery for SaaS applications, helping organisations protect their information. The company offers powerful data protection for G Suite, Salesforce and Microsoft Office 365.

Until now, the company was owned by Dell, which bought the company in 2014. Despite the sale, Dell will remain a strategic partner of Spanning and will continue to sell Spanning Backup worldwide as part of its leading portfolio of data protection products.

Insight's support provides financial muscle to continue to grow, offering better SaaS data protection solutions.

The acquisition comes at a time when Spanning is experiencing a momentum of more than 70 % of year-over-year revenue growth.

The network of storage services of Nasuni provides IT with a complete solution, unifying primary data storage, offsite disaster recovery and data backup.

The round, which closed in December 2016, was led by a new investor for the company, Sigma Prime Ventures. The round also saw the participation of former investors such as, Flybridge Capital PartnersNorth Bridge Venture Partners.

This investment was the company's 6th since its founding in 2009, raising a total of $70M.

Zerto provides disaster recovery solutions for virtualised data centres and cloud environments.

In June 2016 Zerto received a $20M round, adding to the $50M it had raised in January 2016.

The round was led by CRV, which appreciated the huge growth expected in the cloud environment in the coming years, and the need to protect that data.

In the first quarter of 2016, Zerto expanded its presence in healthcare and financial services. The company experienced its fourth consecutive year of more than 100 percent sales growth in 2015.

European cybersecurity attracts investors: Darktrace and Silent Circle

If you are looking for investors, you want to buy or selling a companyplease contact us. Abra-Invest has a team of experts in each area at your disposal. Call +34 946424142 or fill in the contact form.