In the world of mergers and acquisitions, one theme stands out above all others: reaching an agreement on price through an objective valuation. Without this crucial step, a deal cannot materialize. However, reaching a consensus on the value of a business is not always straightforward.

The Valuation is a subjective process, especially when it comes to privately held companies. Although there are various methods for valuing a business, each with its own limitations and dependent on certain assumptions, none offers an absolute solution. Ultimately, it is the methodologies employed and the assumptions made by individuals that determine the perceived value of a business. This subjectivity underscores the absence of an exact science in business valuation, turning it into an estimate rather than a precise calculation.

In this "how to" guide, we will address the role of human judgment in the objective valuation process and advocate for a disciplined approach among buyers.

As mentioned earlier, valuing a business is an inherently subjective and complex process, where the determination of value is not governed by objective rules, but rather heavily relies on individual perceptions and interpretations of those involved in the process. This subjectivity, though inevitable, opens the door to a range of biases and emotional influences that can significantly impact the integrity of the decision-making process.

mong the most concerning biases is confirmation bias, a psychological phenomenon in which decision-makers actively seek information that confirms their preexisting beliefs, while ignoring or dismissing any evidence that contradicts their views. This bias, although often unconscious, distorts the objectivity of the valuation process and can lead to erroneous conclusions about the true value of the business in question.

In addition to cognitive biases, emotions also play a crucial role in the valuation process. Pressure to close a deal, anxiety about not missing out on an opportunity, or overconfidence in one's own abilities can influence individual perceptions of the business's value and, ultimately, the decisions made. These emotions can lead decision-makers to overlook critical aspects of the objective valuation process or underestimate the associated risks with the transaction, compromising the integrity of the process and leading to suboptimal decisions.

To counteract these risks and ensure a more objective and well-founded valuation, it is crucial for buyers to adopt a disciplined and rigorous approach in the valuation process. This involves cultivating an analytical and objective mindset, as well as implementing structured and transparent processes that guide decision-making in a grounded manner. Recognizing the inherent subjectivity in the valuation process and actively addressing cognitive biases and emotional influences allows buyers to improve the accuracy and reliability of their assessments, thereby promoting more informed and successful decisions in the transactional context.

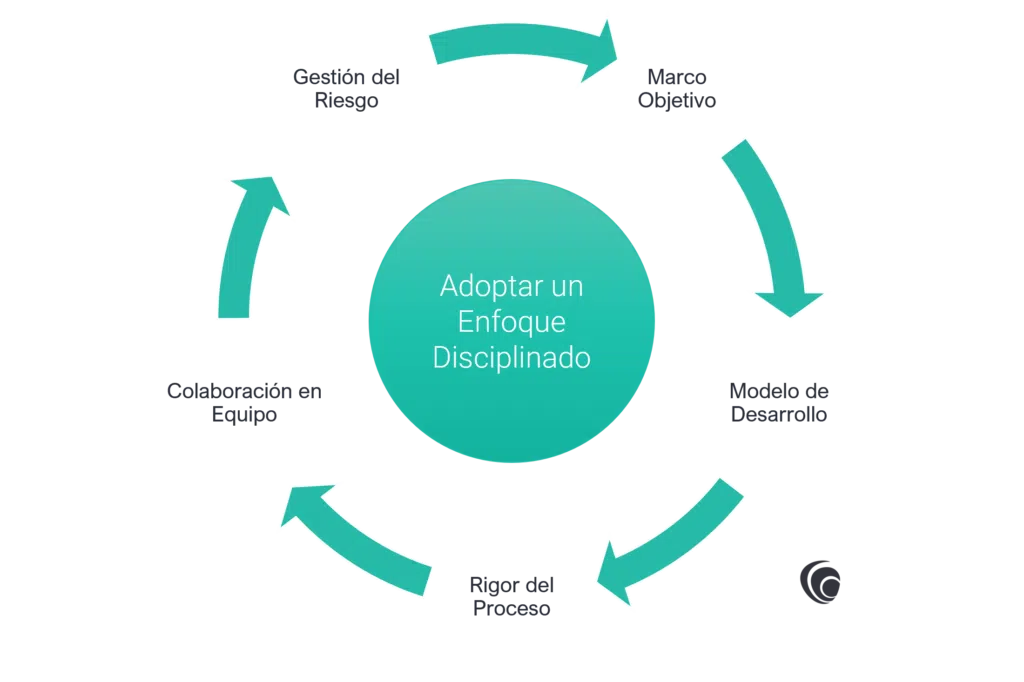

ensure sound investment decisions and mitigate inherent biases and emotional influences. By adhering to a structured framework and rigorous process, buyers can minimize the risk of overpricing and make prudent investment decisions. This disciplined approach encompasses several key principles:

in the valuation process is crucial to ensuring sound investment decisions and mitigating inherent biases and emotional influences. By developing an objective framework, establishing robust valuation models, maintaining rigorous due diligence processes, fostering team collaboration, and effectively managing risks, buyers can improve the accuracy and reliability of their valuation assessments. This disciplined approach not only promotes informed decision-making but also contributes to the mitigation of risks associated with mergers and acquisitions transactions, thereby ensuring the long-term success of business investments.