The mergers and acquisitions (M&A) are often perceived as high-risk ventures with uncertain outcomes. Studies suggest that a significant proportion of M&A deals fail to deliver the anticipated value, raising questions about their effectiveness as strategic tools. However, these statistics may not fully capture the complexity of the M&A landscape, particularly in the realm of private deals.

In this how to, we will go into the reasons behind M&A failures and explore some rules for success in M&A. By examining common pitfalls and best practices, we aim to equip readers with the knowledge and tools necessary to navigate the complex process of M&A.

Table of Contents

What could go wrong? When a company acquires another with high expectations of synergies, all shrouded in secrecy, the stage is set for potential obstacles. Following the announcement, shareholders of the acquiring company worry about possible overvaluation, while employees brace for imminent layoffs. Unfortunately, the anticipated synergies do not materialize, leaving the merged entity vulnerable to aggressive responses from competitors in the market. The ensuing layoffs affect both morale and productivity within the organization.

Eventually, the buyer finds itself grappling with substantial losses as stock prices plummet, serving as a vivid reminder of avoidable missteps taken along the way. Despite its hypothetical nature, this scenario underscores a series of unfortunate decisions laden with real-world repercussions.

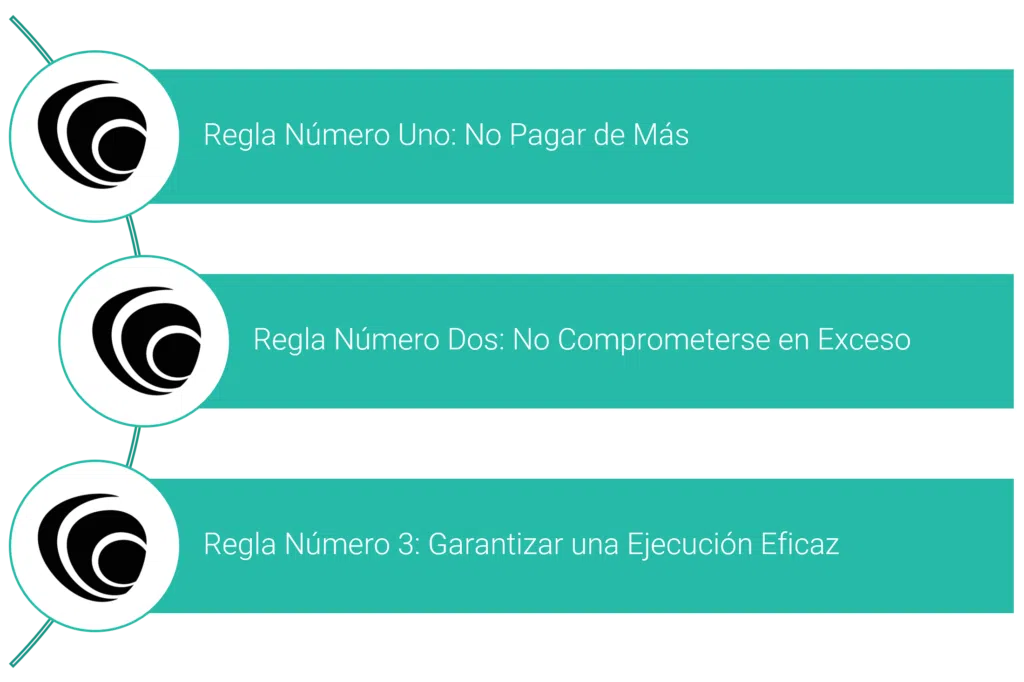

The failure of M&A deals can typically be attributed to three main factors: overpayment, overcommitment, and poor execution. Overpayment occurs when the price paid for an acquisition exceeds its justified value, leading to diminished returns for the acquiring company. Overcommitment involves setting unrealistic expectations or goals for the post-acquisition integration, resulting in unmet targets and disappointments. Poor execution encompasses a range of challenges, from inadequate due diligence to ineffective post-acquisition management, ultimately hindering the realization of synergies and value creation.

While strategic misalignment can also contribute to M&A failure, the focus in this how to is primarily on the execution-related aspects of deals. By addressing these rules for success in M&A, companies can mitigate the risks associated with Mergers and Acquisitions and enhance their chances of success.

The first of the 3 rules for succcess in M&A is related to valuation. Effective valuation lies at the heart of successful M&A transactions. To avoid overpayment, companies must conduct comprehensive financial analysis and due diligence, leveraging sophisticated financial modeling techniques to assess the true value of the target business. This involves not only scrutinizing historical financial data but also projecting future performance and identifying potential synergies.

er, it is essential for buyers to critically evaluate the strategic rationale behind the acquisition and assess whether the proposed price aligns with the anticipated benefits. By integrating both quantitative and qualitative factors into the valuation process, companies can ensure that they are not paying more than the intrinsic value of the target.

Furthermore, buyers should remain vigilant during negotiations, resisting the temptation to succumb to competitive pressures or inflated expectations. A disciplined approach to pricing, informed by rigorous analysis and strategic alignment, is crucial in preserving shareholder value and mitigating the risks of overpayment.

Setting realistic expectations and commitments is paramount for the success of M&A transactions. To avoid overcommitment, buyers must engage in thorough due diligence to assess the feasibility of integration plans and synergy targets. This involves soliciting input from operational experts and business leaders to gain a comprehensive understanding of the challenges and opportunities associated with the acquisition.

Furthermore, buyers should align commitments with operational capabilities and market realities, ensuring that they do not promise more than they can deliver. This requires a nuanced understanding of the target business and its industry dynamics, as well as a willingness to adjust expectations based on new information and changing circumstances.

Additionally, buyers should establish clear criteria for success and develop contingency plans to mitigate risks and address unforeseen challenges.. By adopting a flexible and adaptive approach to integration planning, companies can navigate the complexities of post-acquisition execution and maximize the value of their investments.

Successful execution of M&A deals requires coordinated effort across various functional areas, from deal negotiation to post-acquisition integration. Building cross-functional teams comprising both dealmakers and operational leaders is essential in bridging the gap between strategic vision and operational reality.

companies should establish clear communication channels, foster a culture of accountability, and align objectives across the organization. This involves engaging stakeholders at every stage of the M&A process, from due diligence to integration, and empowering them to contribute their expertise and insights.

Moreover, companies should invest in robust project management capabilities and leverage technology to streamline workflows and facilitate collaboration. By adopting best practices in project management and harnessing the power of data analytics, companies can optimize their M&A processes and drive sustainable value creation.

In conclusion, mergers and acquisitions (M&A) present both opportunities and challenges for companies seeking to grow and create value. While these transactions are often viewed as high-risk ventures with uncertain outcomes, they can be successful if executed with careful planning, diligence, and effective execution.

In this how to we have explored the reasons behind M&A failures, emphasizing three main factors: overpayment, overcommitment, and poor execution. Overcoming these challenges requires a multifaceted approach, starting with effective valuation to avoid overpayment and setting realistic expectations to prevent overcommitment.

Furthermore, successful execution demands coordinated efforts across functional areas, with clear communication, accountability, and alignment of objectives. By adhering to these rules for success in M&A, companies can mitigate the inherent risks associated with M&A and enhance their chances of achieving value creation.