Negotiating a Letter of Intent (LOI) in a merger and acquisition (M&A) transaction is a critical step that can greatly determine the final outcome of the deal. In this step, sellers must consider a series of key considerations to protect their interests and maximize the value of their business.In this article, we will explore the fundamental role of the LOI, its nuances of negotiation, and strategies for exerting influence to achieve optimal outcomes in M&A transactions.

Table of Contents

In a LOI negotiation, while strategies may vary, understanding your points of strategic influence is essential for steering negotiations in your favor. Let's begin by exploring the typical strategies employed by buyers during LOI negotiations.

Buyers strategically craft LOIs after assessing the suitability of a target, including critical elements such as purchase price, asset/liability inclusions, exclusivity clauses, and closing conditions. Conversely, sellers often overlook the gravity of LOI negotiations, falling prey to buyer tactics aimed at exploiting impatience and lack of foresight:

The potency of buyer strategies emanates from poorly delineated or ambiguous LOIs, underscoring the imperative to clearly define key terms within them. Failing to do so risks conceding negotiation advantages to buyers, amplifying vulnerabilities during subsequent contract purchase negotiations.

Not defining certain terms in the letter of intent can be devastating for you. If a term is not defined in the LOI, the purchase agreement will be drafted in favor of the buyer in the first draft and it can take a significant amount of negotiation rounds to undo a term that you did not define in the LOI. Here are some terms that could, but shouldn't, remain undefined in the LOI:

As observed, the LOI is a comprehensive document for any merger and acquisition transaction, even if non-binding. Here's a list of the value a well-drafted letter of intent adds to the transaction:

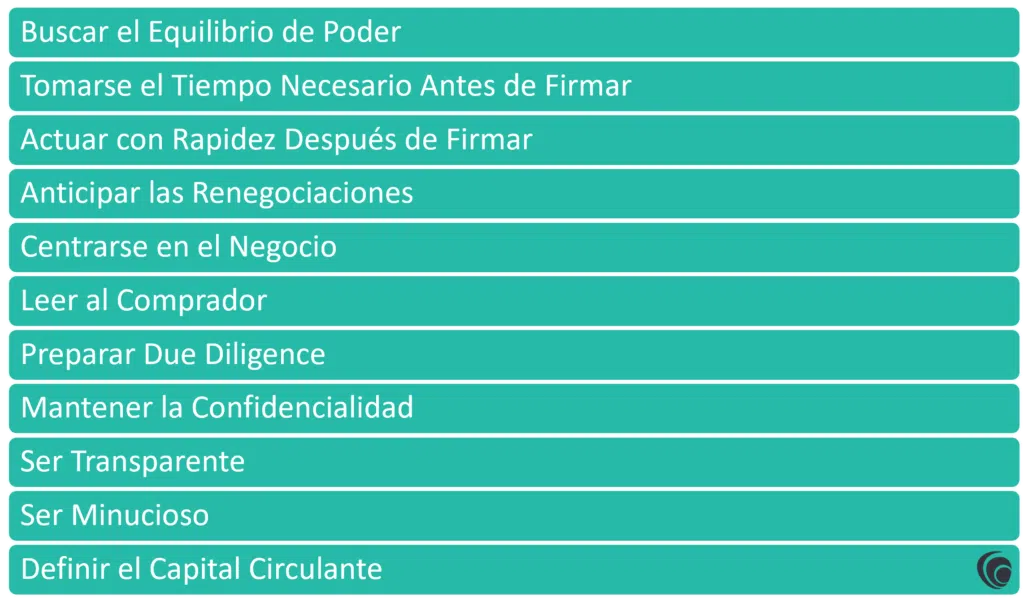

Once the importance of the LOI is understood, let's delve into some of the most important considerations in a LOI negotiation, from establishing power balance to exhaustively defining key terms. These guidelines are essential for protecting the seller's interests and facilitating a smooth and effective negotiation process.

Signing an LOI marks the beginning of formal negotiations between the seller and the buyer. However, it's important to recognize that this stage can also tilt the power balance in favor of the buyer. Exclusivity clauses in the LOI can limit the seller's options by committing them to exclusively negotiate with a single buyer for a specific period. Therefore, sellers must be aware of this shift in the balance of power and seek to detail critical terms in the LOI to avoid exploitation of ambiguities by the buyer.

Although tempting offers in an LOI may seem attractive, sellers must resist the temptation to rush into signing. It's crucial to take the necessary time to carefully review and negotiate the proposed terms. Rushing to sign an LOI can expose sellers to unfair strategies by the buyer, who may retract or propose less favorable terms once the seller has committed.

Once the LOI is signed, sellers should maintain a steady momentum towards closing the deal. Delay can expose the business to additional risks and decrease the perceived value by the buyer. Maintaining momentum during this period is crucial to maximize the sale price and minimize opportunities for renegotiation by the buyer.

One of the major concerns for sellers after accepting an LOI is the possibility of the buyer seeking to renegotiate key terms during due diligence.To avoid this, sellers should take proactive measures, such as thorough preparation for Due Diligence early disclosure of potential issues. This helps set clear expectations from the outset and minimizes unpleasant surprises during the sales process.

While negotiating the LOI is crucial, sellers must not neglect the day-to-day management of their business. Maintaining profitability and sales flow during this period is essential to avoid renegotiations based on changes in business performance. It's important to strike a balance between LOI negotiations and effective business operation.

LOIs are not standard and can vary significantly depending on the buyer and the nature of the transaction. Sellers should anticipate the buyer's specific concerns when negotiating terms and proactively address them. Experience and proper guidance can help sellers identify and effectively address buyer concerns.

The Due Diligence is an integral part of the sales process and can influence the buyer's perception of the value and viability of the business. Sellers should prepare in advance for Due Diligence , having key documents available and organized beforehand.This not only speeds up the sales process but also reduces the chances of due diligence negatively affecting business performance.

Confidentiality is paramount throughout the sales process to protect the seller's interests and prevent misuse of information by the buyer. Sellers should exercise caution when sharing sensitive information and seek controlled disclosure of confidential information to minimize risks associated with data disclosure.

Disclosing potential issues in the business in advance allows sellers to control the narrative and avoid unpleasant surprises during the sales process. Being transparent from the outset can help build trust with the buyer and avoid renegotiations based on later discoveries during due diligence.

eticulous attention to detail. It's crucial that the LOI covers all critical terms of the transaction from the outset. Avoiding leaving important provisions for later negotiations ensures a smoother process and protects the seller's interests. Clarity and thoroughness in drafting the LOI are essential to avoid misunderstandings and unfavorable renegotiations. Each term must be precisely defined, and any ambiguity that may arise during the execution of the agreement should be eliminated.

Working capital can be a source of dispute if not clearly defined in the LOI. It is crucial to establish specific criteria for its calculation, including which assets and liabilities are included in the formula. Detailing how each component of working capital, such as inventory and accounts receivable, is determined helps avoid conflicts during the final balance sheet audit. A precise definition of working capital in the LOI provides certainty and reduces the risk of disagreements in later stages of the sales process.

It is evident that both sellers and buyers must be aware of the importance of the LOI as a starting point for the transaction, morally committing and laying the groundwork for future purchase agreement negotiations. Clarity in defining terms, seeking power balance, preparing for due diligence, and transparency are fundamental aspects that can influence the final outcome of the LOI negotiation. Ultimately, a well-negotiated and drafted LOI provides certainty, clarity, and protection for both parties, reducing uncertainty and risks associated with the transaction.