In order to value a company properly, certain technical knowledge is required, for example, methods of Business Valuation, and sufficient experience in transactions involving the sale and purchase of companies. It is very important to achieve a good result and always keep in mind the objectives of the exercise, i.e., why and for whom the valuation is being made.

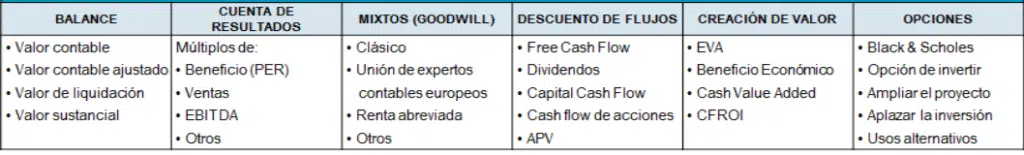

According to Pablo FernándezIESE professor, in his book "Company Valuation"The main valuation methods are diverse, but can be classified as follows":

According to the IESE professor, the only conceptually correct method is the DFC. It is a valuation method based on projecting all future cash flows generated by the company's operations and discounting them by the return demanded by investors.

This method is the most widely used method in valuation practice because it is able to take into account all the variables that affect the value of the enterprise. From its investment policy, to its efficiency in sales and production processes, to the competitive intensity of its sector, etc. The DFC is a dynamic method, as it takes into account future expectations. Therefore, it will be necessary to make projections of the financial statements.

Although, according to Pablo Fernández, the rest of the methods are not conceptually correct, the reality is that they are widely used in practice. The main reason is that they are easier to apply. For example, in shareholder agreements regulating the entry or exit of shareholders, it is common to find references to valuation multiples because they reduce uncertainty for all parties and make it easier to avoid future disagreements.

In the case of the method of multiples, The new system is widely used because of its ease of application and comparability between companies. major limitations. Firstly, it is difficult to find companies similar to the target company and secondly, the result presents a very wide and dispersed range of values.

The DFC is the most appropriate in the case of continuity of the company's activity, which is the usual and desirable situation. But in those circumstances where the end of the company's operations is envisaged, the most appropriate method is the liquidation value which results from the difference of the sale of assets minus the cancellation of debts including staff severance payments and liquidation expenses.

Another circumstance in which the DFC does not apply is in the case of start-ups. The main reasons are the high uncertainty in the projection of future flows and the different risk rate in each round. For this reason, the so called "Cash Flow Method" is more commonly used. Venture Capital. This method is based on agreeing a return for the investor rather than a price and establishing ownership transfer mechanisms based on compliance with the business plan.

Download here the complete guide on company valuations: