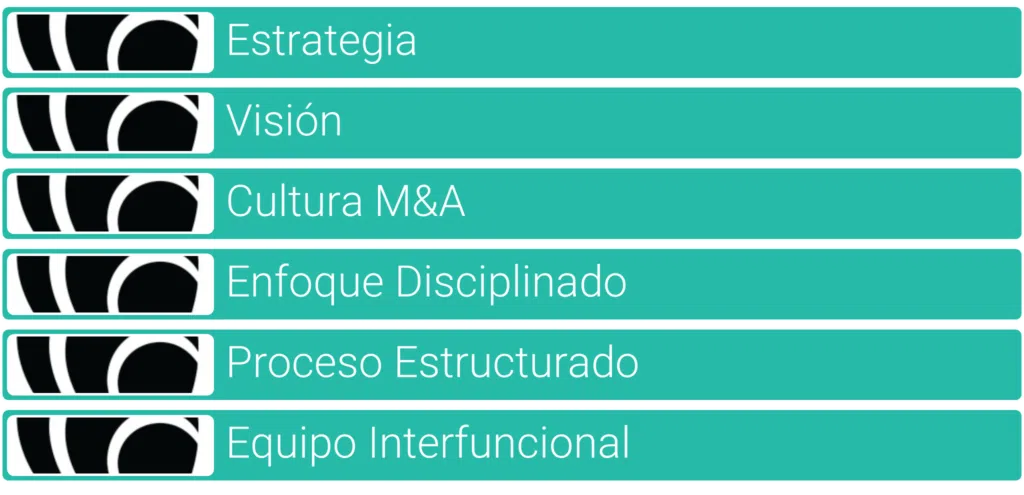

Engage in conversations with seasoned M&A strategy professionals used to work alongside highly acquisitive corporate entities, and you're bound to encounter a consensus on six pivotal attributes essential for triumph in this domain. These include a well-defined M&A strategy, a vision of how mergers and acquisitions supports that strategy, an organizational culture that embraces M&A, a disciplined approach to deal-making, a structured process for executing deals, and the involvement and alignment of teams responsible for operating the business in the future.

In this how to, we will delve into these aspects, exploring each one in depth to understand their significance and how they contribute to the success of M&A strategy.

Table of Contents

Every successful organization needs clear goals and a well-articulated strategy to achieve them. It's these defined objectives and strategic plans that serve as the guiding light, directing the organization towards its desired outcomes. Goals and strategies not only provide a sense of direction but also help in making crucial decisions regarding the allocation of resources.

resources are utilized efficiently and effectively. Without clear goals and strategies, organizations risk losing focus, becoming uncertain about their objectives, and ultimately squandering their resources on endeavors that may not align with their overarching mission. Therefore, the importance of crafting and communicating a coherent strategycannot be overstated, as it serves as the foundation upon which successful organizational endeavors are built.

Strategic growth and expansion are paramount for organizational success, but building a business from scratch poses significant challenges and costs. Mergers and acquisitions (M&A) offer invaluable solutions. Acquiring an established business can often be a wiser choice than starting from scratch, saving time and resources. M&A serve as strategic accelerators, facilitating market entry, product diversification, and operational efficiency. A well-defined strategy coupled with a disciplined approach to deals ensures alignment with organizational goals.

Cultural fit and impact assessment further enhance decision-making, supported by structured processes and cross-functional teams. Thus, M&A play a pivotal role in realizing strategic objectives and fostering organizational growth.

Fostering culture that fully embraces M&A necessitates a comprehensive approach that spans across various facets of organizational development. This endeavor demands dedicated effort over time, starting with top-tier leadership commitment. It involves not only recognizing the intrinsic value of M&A for driving growth and evolution but also investing in building the necessary capabilities within the organization. This may include providing specialized training, establishing dedicated M&A teams, and cultivating a collaborative environment where cross-functional expertise can flourish.

Moreover, incentivizing behaviors that align with M&A objectives can further reinforce the desired cultural shift. Ultimately, the goal is to engrain M&A principles deeply into the fabric of the organization, ensuring that they become integral to strategic decision-making processes and driving sustained growth and success.

nvolves structured evaluation of potential acquisitions, considering strategic fit, cultural alignment, impact, and feasibility. This ensures resources are allocated wisely and deals align with long-term objectives.

assessing opportunities, organizations prioritize those offering the greatest strategic value while mitigating risks associated with M&A transactions. This methodical approach enables informed decision-making and enhances the likelihood of successful deal execution. It also facilitates effective allocation of resources towards opportunities that align with the organization's growth trajectory.

Corporate buyers skilled in M&A rely on structured processes to navigate the complexities of deal execution. These processes facilitate effective coordination between diverse teams and enable timely decision-making.

By following a systematic approach, organizations can streamline due diligence, negotiation, and integration phases, minimizing risks and maximizing value creation. Structured processes also promote transparency and accountability, ensuring that key stakeholders are informed and involved throughout the deal lifecycle. Leveraging structured processes enhances the efficiency and success of M&A endeavors, enabling companies to achieve their strategic objectives effectively.

Buying a business demands a diverse range of skills and expertise. A cross-functional team, consisting of functional experts and business leaders, is essential to conduct thorough due diligence and maximize deal value. By bringing together individuals with varied backgrounds and perspectives, organizations can assess different aspects of the target company comprehensively, including financial, legal, operational, and strategic considerations.

This collaborative approach enhances decision-making and mitigates risks associated with the acquisition process. Furthermore, a cross-functional team ensures that all relevant stakeholders are represented, fostering buy-in and alignment throughout the deal lifecycle.

A structured playbook guides the orchestration of the M&A process, ensuring seamless coordination between stakeholders. With a well-defined playbook, corporate buyers can navigate the complexities of M&A with confidence, maximizing value creation and achieving strategic objectives.

In summary, to succeed in the realm of mergers and acquisitions, several key principles are essential. Firstly, a clearly defined strategy is crucial, as it guides all M&A activities towards general organizational goals. M&A not only supports strategic growth but also accelerates it by providing efficient avenues for expansion and market entry.

However, for M&A to thrive, it must be ingrained within the organizational culture, with leadership commitment and collaboration driving its adoption and integration. A disciplined approach to deal-making, supported by structured processes and the involvement of cross-functional teams, ensures that resources are allocated wisely and opportunities are pursued with strategic precision.

Ultimately, a well-defined playbook serves as the blueprint for orchestrating successful M&A endeavors, enabling corporate buyers to navigate complexities and achieve desired outcomes. In essence, the synergy between strategy, culture, discipline and collaboration forms the playbook for success in the dynamic landscape of mergers and acquisitions.