The dynamic Industrial Technology M&A sector is undergoing a transformational phase, highlighted by strategic moves that redefine the global business landscape. These transactions in the Industrial Technology sector not only reflect adjustments in portfolio strategies and operational optimization, but also underscore a commitment to innovation and growth in key markets.

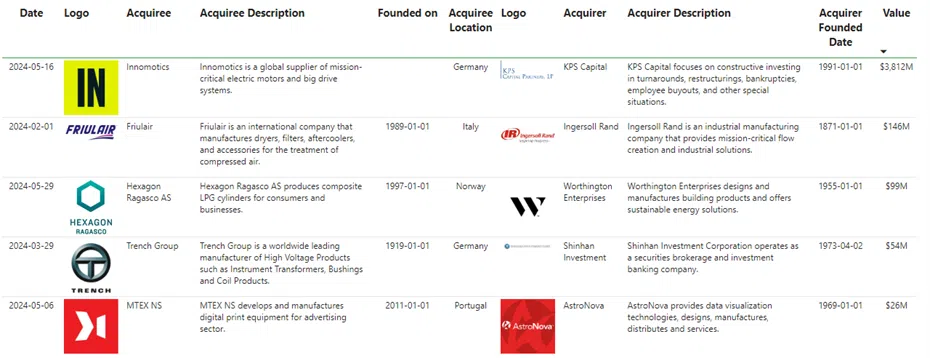

Siemens AG has made a strategic move by selling Innomotics, a global leader in electric motors and large drives, to KPS Capital Partners for €3.5 billion. This sale announced in mayo 2024 marks a crucial step in Siemens portfolio optimisation strategyThe company is concentrating on its core operations and positioning Innomotics for future growth under new ownership.

KPS Capital Partners, experts in business transformation, specialize in revitalizing industrial manufacturing companies. With a proven track record of operational excellence and strategic guidance, KPS is poised to capitalize on Innomotics' market leadership and accelerate its growth trajectory in the global electrification sector.

Innomotics, with revenues of €3.3 billion and approximately 15,000 employees worldwide, is known for its innovation in large electric drives and motors. The company serves a diverse customer base across multiple industries with advanced solutions for energy-efficient electrification.

Siemens' decision to divest Innomotics aligns with its strategy to optimize operations and enhance shareholder value. The sale provides Innomotics with a dedicated partner in KPS, enabling focused investments and operational synergies to accelerate innovation and market expansion. This strategic move ensures that Innomotics is well positioned to capitalize on the growing global demand for sustainable industrial solutions.

By entrusting Innomotics to KPS, Siemens reinforces its commitment to drive sustainable growth and technological advancement in its portfolio, thereby consolidating its leadership in the digital and physical convergence of industries.

Ingersoll Rand Inc. (NYSE: IR) has acquired in february 2024 Friulair S.r.l. to grow its air dryer business and add new chiller and heat pump technologies. The acquisition will improve penetration in the food and beverage and pharmaceutical markets, and the resulting synergy is expected to significantly reduce the adjusted EBITDA multiple.

Ingersoll Rand Inc. is a global provider of critical flow creation and industrial solutions. The company, known for its technological excellence, offers products and services that operate in complex and demanding conditions, backed by more than 40 respected brands.

Based in Italy, Friulair is recognized worldwide for the design and production of dryers, filters, aftercoolers and accessories for compressed air treatment, in addition to a line of chiller products. Friulair operates factories in Cervignano del Friuli (Italy) and Si Racha Chon Buri (Thailand), and employs approximately 215 people, generating revenues of around $65 million.

Ingersoll Rand's acquisition of Friulair seeks to significantly expand the scale of its air dryer business by increasing access to the OEM channel and adding chiller production capabilities. In addition, this transaction will enable Ingersoll Rand to increase its presence in the food and beverage and pharmaceutical end markets. The resulting synergies and the implementation of Ingersoll Rand's Execution Excellence (IRX) program are expected to reduce the adjusted EBITDA multiple to mid-single digits within three years, substantially improving operating margins.

Worthington Enterprises has successfully completed the acquisition of Hexagon Ragasco in may 2024, a world leader in lightweight, customizable composite LPG cylinders used in leisure, domestic and industrial applications.

Worthington Enterprises, founded in 1955 by John H. McConnell, operates in two main segments - Building Products and Consumer Products - focused on innovation, transformation and leadership. The company is distinguished by its renowned brands such as Balloon Time®, Coleman® and HALO™, and its commitment to a philosophy of putting people first while generating shareholder value.

Hexagon Ragasco stands out in the global market for its composite LPG cylinders, which facilitate the use of clean fuels, especially in developing countries with limited infrastructure.

This strategic acquisition allows Worthington Enterprises to strengthen its position in the global propane market and advance the global energy transition. Andy Rose, president and CEO of Worthington Enterprises, stated, "We believe Hexagon Ragasco complements our existing cylinder business and accelerates our position in the global propane market. Their advanced composite cylinder technology is key to promoting the use of clean fuels.”

Shinhan Securities has spearheaded a major acquisition by leading the purchase of Trench Group, a leading global manufacturer of components for high-voltage transmission networks based in Germany. In a significant move to strengthen its global presence in the financial sector, Shinhan Securities acted as the sole South Korean underwriter, securing €50 million ($53.9 million) to fund the acquisition.

Shinhan Securities, known for its expertise in complex international transactions, directly managed negotiations and financing in major financial centers such as New York and London. This strategy highlights its ability to execute major corporate finance transactions globally.

Trench Group is recognized for its advanced technology in the energy sector, which makes this acquisition a strategic opportunity for Shinhan Securities. This transaction not only diversifies its portfolio, but also strengthens its position as a key player in the global corporate finance arena.

By expanding its influence beyond national borders, Shinhan Securities consolidates its commitment to the global expansion of its corporate finance operations, initiated last year. This move underscores its determination to strengthen its international presence and its ability to manage high-level financial operations in global markets.

AstroNova, Inc. has announced in may 2024 the strategic acquisition of MTEX NS, S.A., a prominent Portuguese leader in label, packaging and direct-to-film printing solutions. This transaction, valued at €24.3 million plus a potential earnout of up to €4 million, positions AstroNova to significantly expand its presence in the global digital printing market.

Recognized for its leadership in data visualization technologies, AstroNova strengthens its Product Identification portfolio with this strategic acquisition.

MTEX NS, based near Porto, stands out for its advanced capabilities in manufacturing and technological development of high speed and high quality digital printers, ideal for applications in flexible packaging, color labels and textile solutions.

This transaction allows AstroNova to diversify its offering and accelerate its growth by integrating MTEX NS' innovation and expertise in digital printing technologies. It also strengthens its position in key markets and reinforces its commitment to sustainability and quality.

With these major transactions in the industrial technology sector, it is clear how the strategies of the mergers and acquisitions are significantly reshaping the global Industrial Technology transaction landscape. Each strategic move not only seeks to drive growth and innovation in their respective markets, but also to strengthen leadership positions in an increasingly competitive Industrial Technology transaction environment. These Industrial Technology transactions reflect an unwavering focus on portfolio optimisation and strategic expansion, ensuring a robust and sustainable future in the digital and physical convergence of industries.