In the dynamic world of digital services acquisitions strategic acquisitions play a key role in driving innovation and growth in a variety of technology industries. Throughout this article, we will explore how these digital services transactions are reshaping the global landscape, from key infrastructure purchases to strategic moves in cybersecurity and hybrid cloud. Each deal not only strengthens connectivity and paves the way for a more digitized and efficient future, but also promotes competitiveness and the continued evolution of companies in an increasingly interconnected environment.

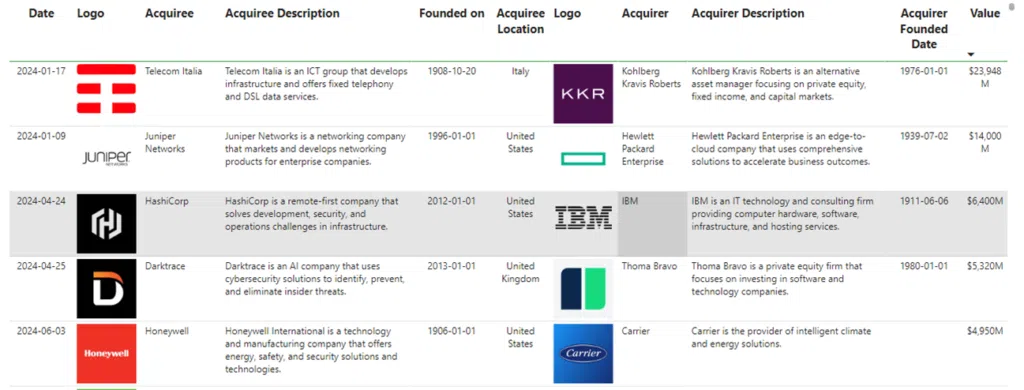

The European Commission has given the green light to the acquisition of Telecom Italia's (TIM) fixed-line network by private equity firm KKR, assuring that the deal does not raise competition concerns in the market for wholesale broadband access services in Italy.

KKR (Kohlberg Kravis Roberts & Co.) is a global investment firm with more than four decades of experience in managing investments across a broad range of sectors. Recognized for its strategic approach and ability to drive growth, KKR has a strong track record of improving the operations of the companies in which it invests.

TIM (Telecom Italia Mobile) is one of the leading telecommunications companies in Italy, offering a wide range of communication and data services. The company, known for its leadership in the Italian market, is constantly seeking to improve its infrastructure and services in order to remain competitive.

The EU approval facilitates NetCo, the entity that manages TIM's fixed network, to join FiberCop, a joint venture between TIM and KKR. FiberCop is engaged in providing passive services on TIM's secondary network and is in the process of upgrading copper assets to fiber optics in Italy. With this acquisition, KKR not only supports TIM's infrastructure modernization but also ensures that wholesale fixed access services remain competitive and affordable.

This strategic transaction will allow TIM to focus on upgrading its fiber infrastructure, benefiting Italian consumers with faster and more reliable connectivity. In addition, KKR's expertise in asset management and its ability to provide capital and know-how will strengthen TIM's market position and promote a robust competitive environment in the Italian telecommunications sector.

Hewlett Packard Enterprise (HPE) has announced in January 2024 the acquisition of Juniper Networks for $14 billion, a strategic move to strengthen its position in the networking market.

Hewlett Packard Enterprise (HPE) is a global company that provides cloud, data center and networking technology solutions. Headquartered in San Jose, California, HPE is distinguished by its innovation and adaptability in a dynamic technology environment.

Juniper Networks, founded in 1996, is a leading networking equipment company known for competing with Cisco. In 2022, Juniper experienced 12% year-over-year revenue growth. The company earned a profit of $76 million on $1.4 billion in revenue in the latest quarter.

The acquisition of Juniper Networks will enable HPE to double its networking business, improving margins and accelerating growth. This transaction is expected to be accretive to HPE's adjusted earnings per share in the first year. In addition, annual cost savings of $450 million are projected within three years. The integration of Juniper will enable HPE to offer more complete and competitive solutions to its customers.

In April this year IBM has announced the acquisition of HashiCorp for $6.4 billion, strengthening its portfolio in hybrid cloud, multicloud and artificial intelligence (AI)The transaction, which is expected to close by the end of 2024, is a significant strategic move for IBM.

IBM stands out for its innovation capabilities and leadership in hybrid cloud. Its focus is on delivering solutions that address the growing complexity of infrastructure and applications in hybrid and multicloud environments.

San Francisco-based HashiCorp is known for its HashiCorp Cloud Platform, which includes lifecycle management and security, compatible with Google and AWS. In 2024, HashiCorp reported revenue of $583.1 million and is recognized for Terraform, the industry standard for infrastructure provisioning in hybrid and multicloud environments.

The acquisition of HashiCorp is a key strategy for IBM, expanding its capabilities in hybrid cloud and multicloud management. The combined portfolios will enable IBM to offer a comprehensive platform designed for the AI era. HashiCorp brings critical automation tools for dynamic and complex infrastructures, helping IBM manage the increasing complexity of cloud environments as more organizations implement generative AI.

This acquisition will benefit both companies, offering technology buyers new options for managing their cloud environments and applications, backed by IBM's robust infrastructure and HashiCorp's innovation.

US private equity firm Thoma Bravo has agreed in April 2024 to acquire UK cybersecurity firm Darktrace for £4.3bn. The move underlines Thoma Bravo's strategy to strengthen its presence in the global software and cybersecurity market by driving growth in its technology investments.

Founded over 40 years ago, Thoma Bravo manages nearly $140bn in assets and is recognized as one of the world's leading software investment firms. Its focus on acquiring and optimizing technology companies has enabled Thoma Bravo to build a robust portfolio of businesses in critical sectors such as cybersecurity.

Darktrace, founded in 2013 and based in Cambridge, provides artificial intelligence-based cybersecurity services. The company experienced a significant increase in value after going public in April 2021, although it subsequently faced market challenges and controversy over its valuation.

Thoma Bravo's decision to acquire Darktrace is based on several strategic reasons:

With this acquisition, Thoma Bravo solidifies its position in the cybersecurity sector, underscoring its commitment to strategic expansion and technological development.

Honeywell has announced in June 2024 the acquisition of Carrier's Global Access Solutions unit. This acquisition promises to strengthen its capabilities in e-commerce and HVAC, positioning it as a leader in building automation.

Carrier, while relatively new to certain aspects of e-commerce, has demonstrated impressive growth in its digital initiatives. With operations in 500 distribution centers, Carrier launched its first ecommerce system, CarrieratHome.com, in 2021 and a B2B marketplace initiative with Amazon Web Services (AWS) in 2022. These platforms have significantly improved its efficiency and sales, decreasing order fulfillment times and increasing sales by 40% annually.

On the other hand, Honeywell, with sales of $6 billion in 2022 , is a giant in building automation products and services. The acquisition of Carrier's Global Access unit in a $4.95 billion deal will allow Honeywell to absorb a crucial part of its competition. This move not only expands its base in HVAC ecommerce but also integrates well-known brands such as LenelS2, Onity and Supra.

The strategic acquisition seeks to leverage the combined expertise of both companies in advanced safety and efficiency systems. According to Honeywell CEO Vimal Kapul, this will create a leading security platform with projected annual revenues in excess of $1 billion. The integration of Carrier's digital capabilities with Honeywell's robust infrastructure promises to maximize performance, efficiency and profitability for customers, generating long-term sustainable value.

Digital services transactions are reshaping the technology landscape. In the dynamic world of digital services transactions, strategic asset purchases have become crucial to driving innovation and growth.

In conclusion, digital services transactions are redefining the global technology landscape. These strategic transactions range from infrastructure investments to significant advances in cybersecurity and hybrid cloud solutions. By facilitating the modernization and expansion of digital capabilities, digital services sector transactions strengthen the competitive position of companies and foster an environment of continuous innovation. In an increasingly interconnected world, these initiatives play a crucial role in ensuring that organisations evolve and deliver advanced and effective solutions to their customers and users.