Thundersoft, founded in 2009, is a global leader in smart device and mobile operating system solutions. The company provides solutions and services to smartphone, tablet, IoT, automotive and enterprise markets with full-stack engineering resources spanning software and hardware.

To date, Thundersoft had seven R&D centres in China and was present in Japan, South Korea and the United States. The automotive market is one of the fastest growing segments for Thundersoft.

"This rapid growth in such a short period of time has been possible thanks to the support the company has received from renowned investors such as Qualcom Ventures, which led its first round in 2011 and has accompanied it both financially and strategically since then," says Diego Gutierrez, corporate finance expert at Abra-Invest.

Rightware , founded in 2009 is the market leader in user interface technology, serving the mobile communications integration, automotive and related industries with its Kanzi solution, and develops industry-leading tools for system performance analysis. The company, headquartered in Espoo, Finland, has offices in Saratoga, CA, Shanghai and Munich.

It is on Deloitte's Fast 50 list of fastest growing technology companies in 2015, and its year-end sales are expected to reach €7M.

Rightware has received a total of $9.49M in two investment rounds.

Strengthening its position on the automotive market

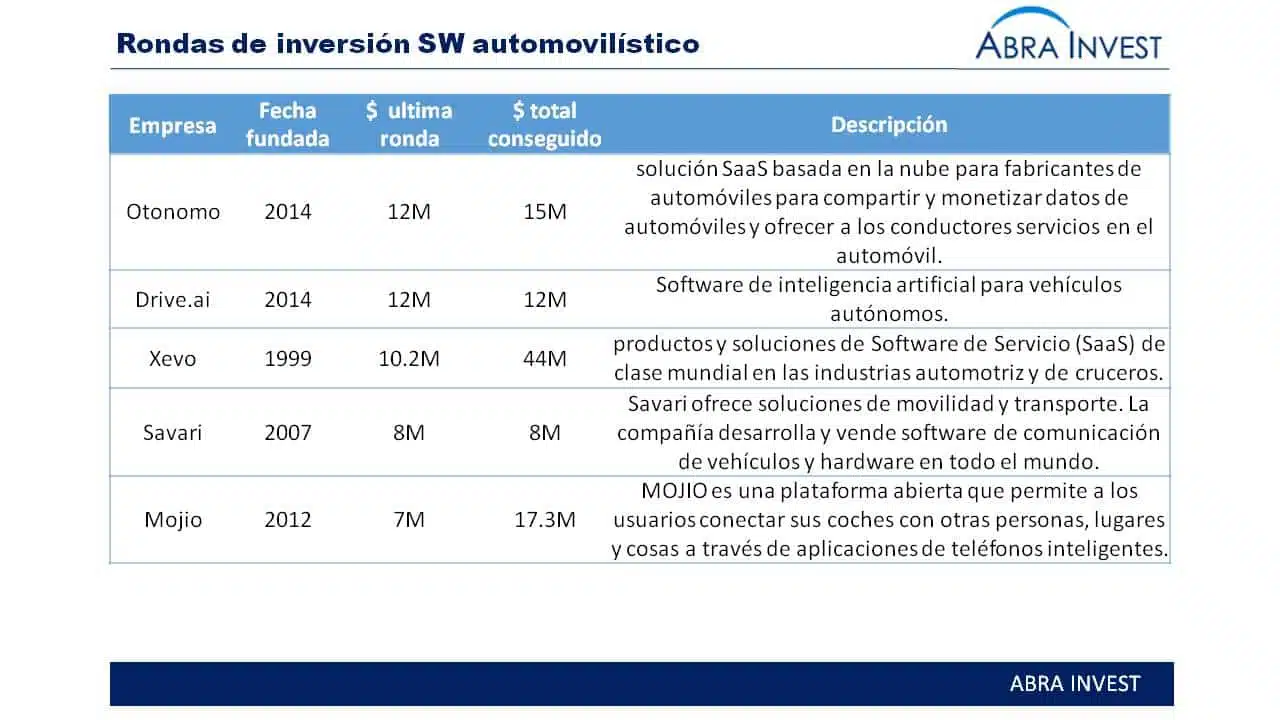

The automotive market is the fastest growing sub-segment for Thundersoft. By acquiring the leading provider of automotive user interface software, Thundersoft ensures that it maintains its strong position in the sector. In recent years, we have noticed that companies offering software solutions for the automotive industry are being created and supported by investors in order to grow, innovate and gain a foothold in the market. By joining forces, these two companies will be able to offer better and more complete solutions to their customers and differentiate themselves.

Entering new geographic markets

The acquisition of Rightware is Thundersoft's first acquisition in Europe. In addition to strengthening its position in the Asian market, where Rightware has offices, it allows Thundersoft to enter the European and American markets.

Offering more complete solutions in a sector where innovation is taking place

In recent years, numerous companies offering software solutions to the automotive industry have been created and these companies are growing rapidly thanks to the support of investors. In 2016, we have detected 28 investment rounds in the sector and of these companies, the majority were created after 2012. The arrival of new competitors and the new innovations they are bringing to the market, makes it necessary to join forces to be stronger, to be able to offer better solutions, in more markets and to differentiate themselves.