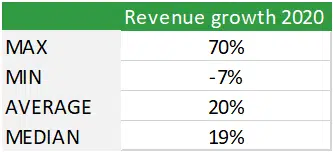

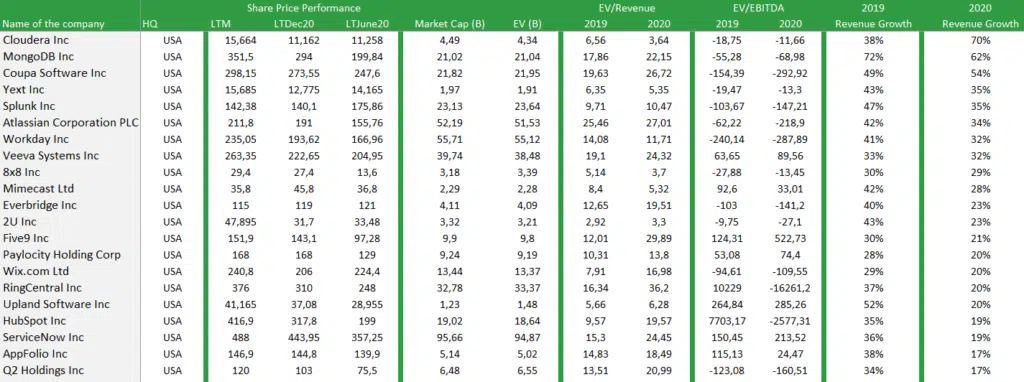

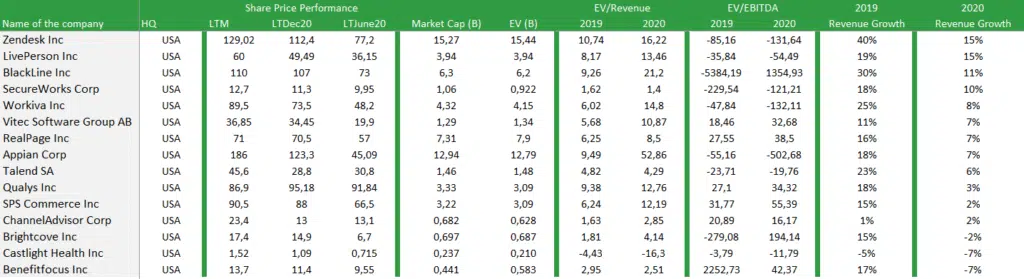

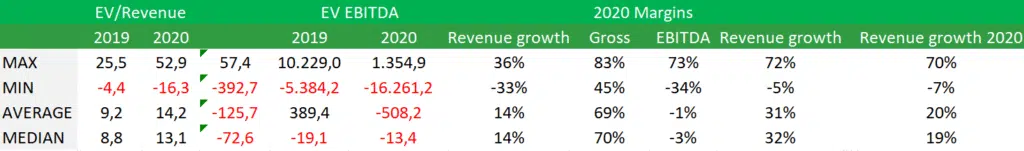

Despite the current Covid-19 situation, most listed companies have continued with double-digit growth. For example, the average has reached 20% and the median 19%. In addition, more than 60% have grown above 15%.

According to the Top Revenue Growth, Cloudera is the one showing the highest increase, by 70%. Cloudera, is a software company based in the US that provides a software platform for data engineering and warehousing, machine learning and analytics that runs in the cloud or on-premises.

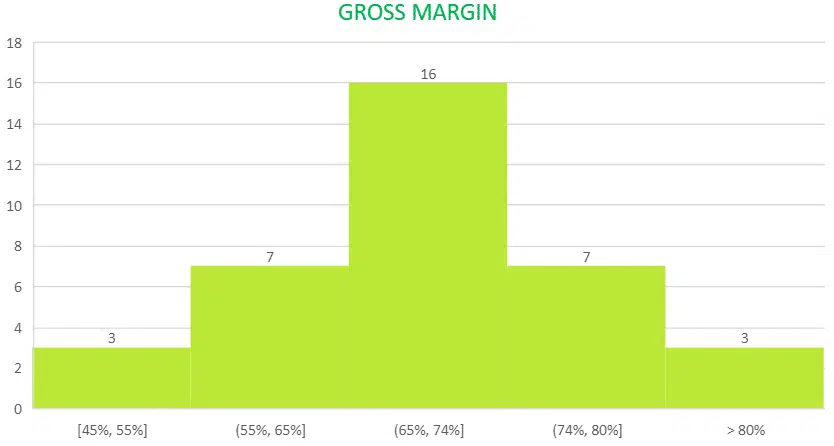

Gross margin shows an overall high level reaching an average of 70%. However, most EBITDA margins (>50% of the companies) are negative, with an average of -1% and a median of -5%.

In terms of EBITDA Margin Top, AppFolio shows the largest increase, up 73%. AppFolio offers web-based property management software for residential property managers to market, manage and grow their businesses.

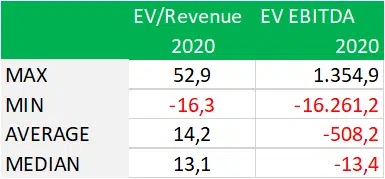

In general, the EV/EBITDA multiple is usually more meaningful than the EV/revenue multiple because it shows less dispersion. In this case, EV/EBITDA cannot be used as a benchmark, as more than 50% of companies have negative EBITDA. The EV/revenue multiple is extremely high, with a mean of 14 times and a median of 13 times.

According to the Top EV/Rev Multiple, Appian Appian is a low-code automation platform for building enterprise software applications faster. With Appian, you get the speed of low-code development with the power of intelligent automation in a unified and trusted cloud platform.

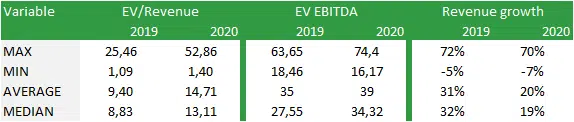

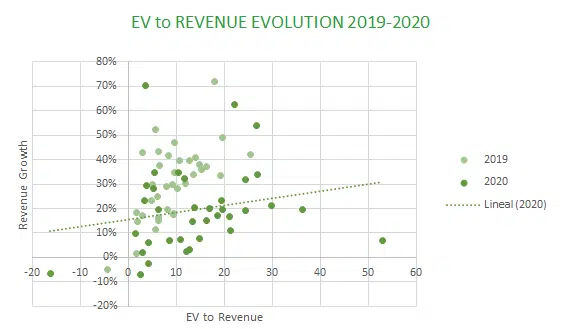

As we can see in the graph, valuation multiples have increased over the last year at an incredible rate, the average has increased by 56% while the maximum has reached a difference of 116%. There are no major differences between the lower values.

As for the median, it has increased by more than 48% and income growth has stabilised at its highest and lowest values. However, the median and average growth have declined markedly.

REVENUE GROWTHThe average growth has declined significantly year-on-year possibly (31% ->19% on average) due to the current market situation, although companies continue to grow at very healthy rates.

BENEFITMost of the companies show a high gross margin (69%) but EBITDA margins show negative values in more than 50% of the companies analysed, which leads to the hypothesis that these companies are in a race to consolidate their market share by combining high growth with negative margins.

EV/ INCOME vs. EV/ EBITDAEv to Revenue multiples show extremely high values (52x). Ev to EBITDA multiples are not consistent due to widespread negative EBITDA.

EV to EVOLUTION OF REVENUEThe mean of the multiples has increased considerably, from 9.2 to 14.2, as has the median, from 8.8 to 13.1.

ALTHOUGH THE MARKET IS GROWING AT A SLOWER PACE, THE MULTIPLIERS ARE INCREASING

Source: Gurufocus 21/02/23

Note: Valuation multiples below 0.0 and above 75.0 have been considered non-significant and the EV/EBITDA statistics above have not been taken into account, they are indicative only.