In the world of entrepreneurship, pivotal decisions often serve as crossroads, determining the trajectory of one's professional journey. One such juncture that entrepreneurs frequently encounter is deciding to sell your business, capitalizing on its current value, or to double down, reinvesting and steering it towards further growth. This decision, akin to navigating uncharted waters, holds profound implications for the future. This article aims to provide a comprehensive framework to guide entrepreneurs through this crucial decision-making process, emphasizing introspection and industry analysis.

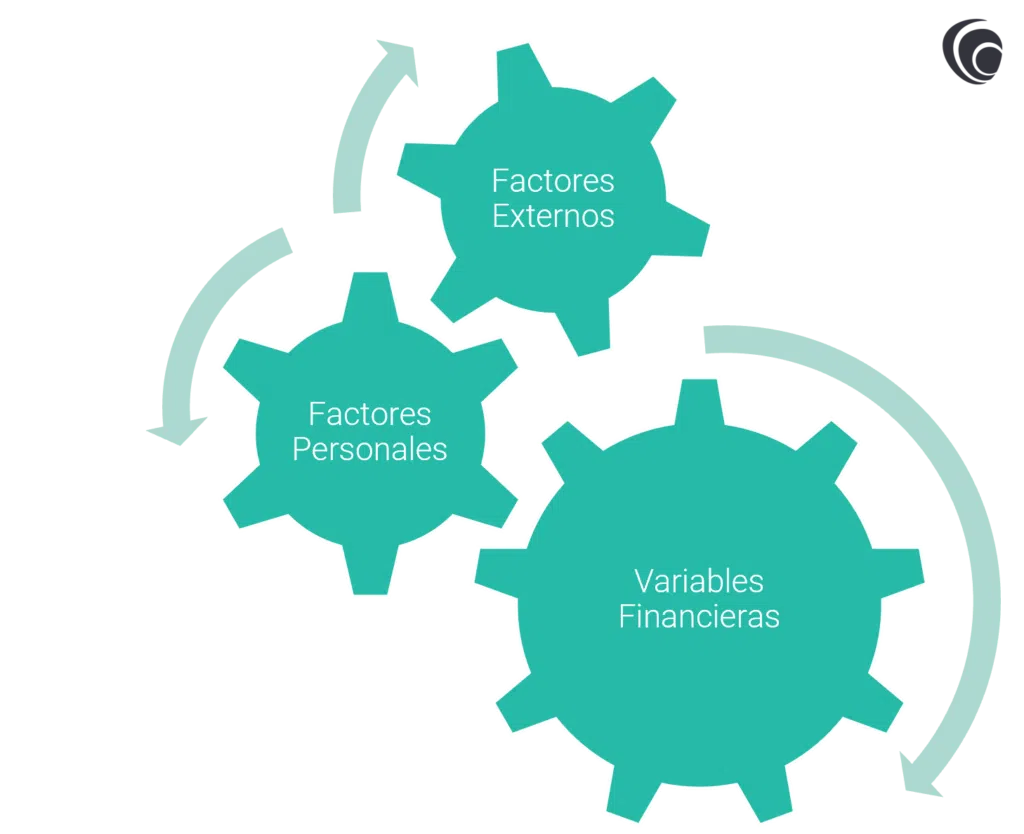

When facing the pivotal decision of whether to sell or double down on your business, adopting a strategic approach becomes paramount. This critical juncture necessitates a thorough analysis of internal and external factors, establishing the groundwork for a well-informed decision-making process.

Table of Contents

Commence this strategic journey with a systematic approach to gather external information, emphasizing the importance of objective data collection.This initial step acts as the cornerstone for the decision-making process. Pose essential questions regarding the stability of your business, delve into prevailing industry trends, and meticulously examine the dynamics of your competitive landscape.

Probe the stability of key financial indicators such as revenues, gross margins, and net profit. Conduct a rigorous evaluation of the continued relevance of your value proposition, critically assessing whether you are gaining or losing ground in the fiercely competitive arena. This external scrutiny offers a comprehensive perspective on your business's current standing within the broader market.

Once information is gathered, the next step is to simplify and synthesize it, providing a panoramic view of industry dynamics.Investigate industry growth patterns, identify consolidation trends, and dissect competitive threats to unveil the trajectory of your business within the broader market context. This synthesis is pivotal as it transforms raw knowledge into actionable wisdom, fostering a clearer understanding of your business's position in the competitive landscape.

Acknowledging the impact of personal attributes on decision-making, it is imperative to shift the focus inward. This introspective phase delves into an assessment of your skills, motivation, and alignment with personal dreams.

Evaluate the relevance of your skills considering the industry's demands. Are your capabilities aligned with the evolving requirements of your business landscape? Delve into motivational factors, particularly in the crucible of competitive environments. Explore the depth of your personal dreams and scrutinize their alignment with overarching business goals, introducing an emotional intelligence dimension to the decision-making process.

This dual-pronged exploration, both outward and inward, forms an intricate dance between objective industry analysis and subjective self-reflection. The convergence of external and internal factors provides a holistic understanding, empowering you to make an informed decision that resonates with both market dynamics and personal aspirations.

Now that you've delved into both your industry and personal considerations, it's the pivotal moment to make a decision. Indications favoring the doubling-down option include a pragmatic evaluation revealing your business's sustained competitiveness and growth. Your optimism about the industry's prospects, coupled with a relatively weak competitive landscape and the absence of imminent threats from new entrants or highly attractive value propositions, further supports this choice.

These insights serve as essential markers to guide your decision-making process, help you deciding to commit to further investment in it or deciding to sell your business

Apart from your business, industry, and competitive landscape, there are various other indicators that suggest you should increase your commitment:

On the contrary, indicators suggesting selling as a strategic choiceare examined next. The identification of certain elements, namely the decline in revenues, the confronting of industry challenges, and the prevalence of robust competition, distinctly signals the imperative to carefully craft and implement an exit strategy deciding to sell your business. As revenue streams diminish, industry-specific hurdles emerge, and formidable competition becomes a prevailing factor, the call for strategic planning to navigate a successful exit becomes increasingly evident.

Financial constraints, along with a lack of motivation and the misalignment of personal and business objectives, also underscore the need to adopt selling as a prudent and necessary measure

Given the dynamic nature of business environments, it is advisable to embrace flexibility. Market cycles and industry shifts may require adjustments to the strategy.An adaptable mindset allows business owners to pivot plans based on emerging information or changing economic conditions.

Deciding to sell your business or doubling down on its growth represents a critical juncture for entrepreneurs, one that demands a strategic and introspective approach. By carefully assessing both external market conditions and internal personal factors, entrepreneurs can gain a holistic understanding of their business's position and potential trajectory. Clear signals indicating whether to double down or deciding to sell your business emerge from factors such as financial stability, industry prospects, competitive landscape, personal skills, motivation, and alignment with long-term aspirations.

However, it's crucial to remain flexible and open to adjusting strategies based on changing industry dynamics or economic conditions.

Ultimately, by combining objective analysis with subjective reflection, entrepreneurs can make informed decisions that align with both market realities and personal goals, charting a course for success in the ever-evolving landscape of entrepreneurship.