Interested in understanding the financial statements of the software applications 2023 sector? The Software Application Industry Valuation Report 2023, developed by Baker Tilly, provides a comprehensive exploration of this constantly evolving sector. In this analysis, 429 companies operating in the realm of software applications are meticulously examined, providing a detailed insight into their financial states, characteristics, and industry multiples.

In a constantly changing digital environment, understanding the market valuation and financial health of software application companies becomes essential. This report not only serves as a guide for investors, business leaders, and industry experts but also delves into the financial and valuation aspects that impact the dynamics of the software applications 2023 sector.

The software application industry is at a turning point, driven by technological evolution, new market needs, and global competition. New technologies, changing market needs, and global competition are redefining the landscape and creating new opportunities for companies that are able to adapt and develop a solid strategic vision.

In this context, it is crucial to understand the trends shaping the market and the key factors that will determine success in the future:

Thorough analysis of the financial statements of companies constitutes a fundamental part of this report. Key aspects such as revenue, cash flows, and leverage are addressed, offering a comprehensive view of the financial stability, profitability, and operational efficiency of companies within the sector. This detailed examination provides valuable insights that aid in better understanding the financial and operational landscape of these companies in a dynamic and ever-evolving market.

A detailed exploration of debt in companies within the software applications 2023 sector provides a profound understanding of leverage and financial stability in this particular industry. This analysis helps identify financial risks and evaluate the overall health of software application companies, offering a key perspective for investors and business leaders.

The report presents a comprehensive analysis of market valuation, focusing on key multiples used to assess companies within the sector.

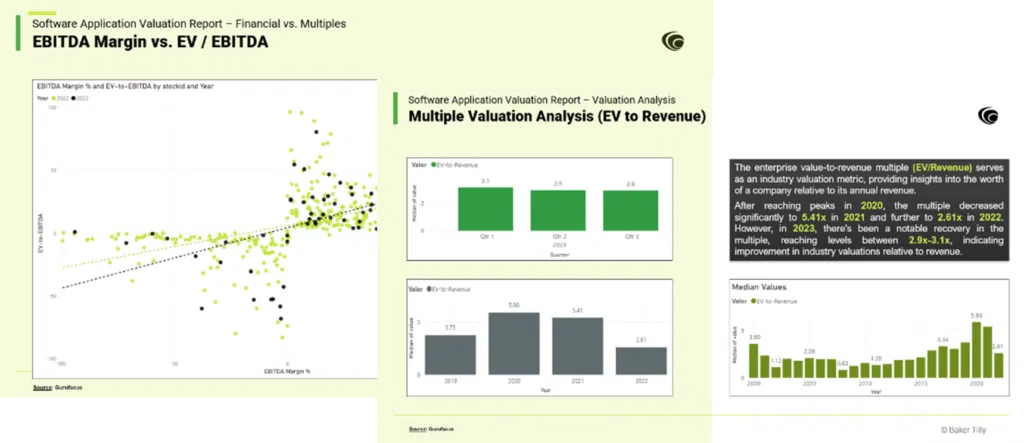

One of the primary multiples examined is Enterprise Value/Revenue (EV/Revenue). This multiple compares the total value of the company, including both its debt and market value, to its total revenue. It is a fundamental measure for evaluating a company's valuation based on its ability to generate revenue.

In addition to EV/Revenue, the report also analyzes other important multiples, such as EV/EBITDA. This multiple compares the total value of the company with its earnings before interest, taxes, depreciation, and amortization (EBITDA). In the report, the relationship between this multiple and the EBITDA margin of the sector is analyzed.

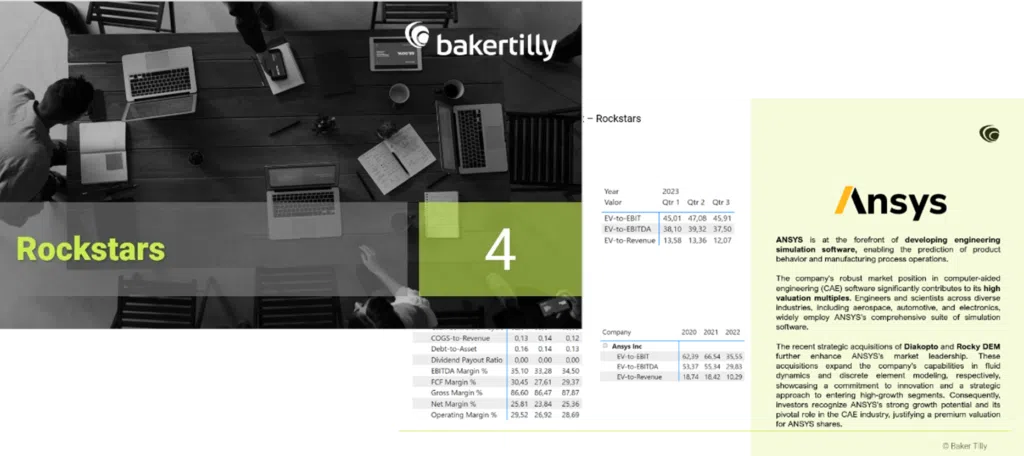

The prominent leaders in the software application industry are identified in the industry valuation report. These companies stand out for their outstanding valuation in terms of financial multiples, as well as their continuous innovation, solid track record of growth, and exceptional ability to create value for shareholders. Among these leading companies are names such as ANSYS and and Hitit Bilgisayar Hizmetleri.

The analysis of these companies highlights their ability to achieve superior financial multiples, such as the Enterprise Value/Revenue (EV/Revenue) ratio, the Enterprise Value/EBITDA (EV/EBITDA) ratio, and the Enterprise Value/EBIT (EV/EBIT) ratio, compared to the industry average. This distinction underscores their prominent position and significant impact on the landscape of the software applications 2023 industry.

The most recent Initial Public Offerings (IPOs) are addressed in the final section of the report on the software applications 2023 industry. Within this context, it is crucial to consider these recent IPOs as they offer a unique perspective on the current valuations and growth prospects of emerging companies in this dynamic sector.

Some of these notable IPOs involve companies that have experienced rapid growth and have sparked significant market interest in the software application market. These new additions are contributing to shaping the evolution and innovation in the industry, and their performance in the market is essential for understanding the future trajectory of the sector.

This report provides valuable insights into industry multiples, financial statements, debt evolution, and market valuations, all of which are fundamental elements for understanding the complexities of the software applications 2023 sector.

To access the full report and gain a detailed understanding of the application software industry valuation landscape, please leave your details below and we will email it to you.