How are companies planning to grow and transform their businesses as the world emerges from the Covid-19 health crisis? Are they pursuing new routes or taking counter-intuitive approaches to achieving these targets?

These are the questions underpinning our research in this report, the third in our Global Dealmakers 2021 series on global M&A and deal trends, as we uncover how corporate management teams are positioning their organisations for rapid expansion.

To provide answers and insights, we focused on developments and strategies at fast-growing private companies, specifically those with private equity backing. These funds predominantly invest in fast-growing companies and on average aim for 40% annual growth in revenue, although almost a quarter of respondents say they try to achieve growth of 50% or more.

Respondents are confident the pandemic will prove to be a short pause for breath in their search for growth, rather than an enduring setback.

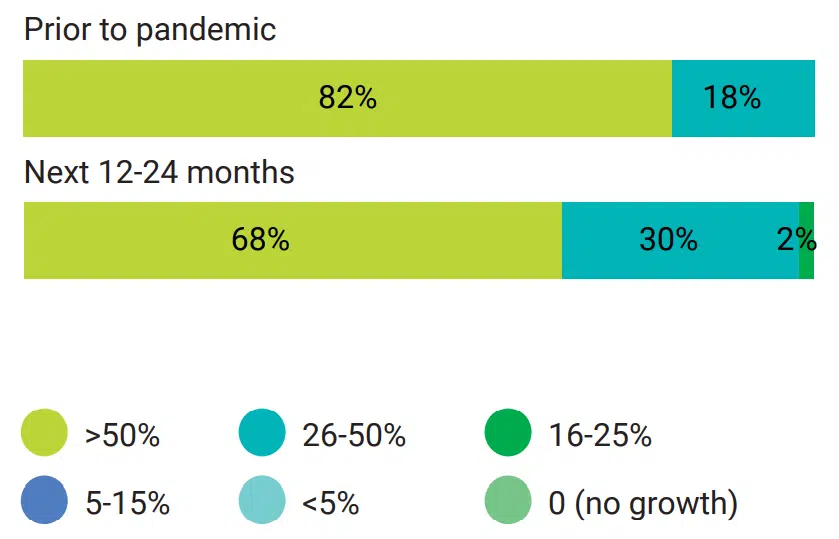

Respondents expect fast-growing companies to bounce back with renewed strength from the pandemic, with projected growth rates down only modestly from pre-Covid-19 figures. Impressively, more than two-thirds of respondents (68%) believe these companies will deliver a growth rate of more than 50% over the next one to two years. A further 30% anticipate achieving rates of between 26% and 50%.

For many, this confidence comes from moves and investments made during the depths of the pandemic,

when it was apparent that staying the course would prove detrimental to bottom lines — or even survivability. As the partner at one Indian PE firm says, “During the pandemic, we targeted many operational improvements, and our management teams took decisions to move along the growth. In the next 12 to 24 months, we will be targeting a 55-60% growth rate, and we know that the company has the potential to enhance performance.”

Technology and M&A feature among the leading strategies private companies will deploy to expand and achieve higher growth rates.

Even before the pandemic, digital transformation was a key priority for most businesses as many scrambled to prepare for and compete in the digital age. Now, the crisis is accelerating the rapid shift to digitalisation - from the rise of ecommerce to the need to support more flexible working - and this trend shows no sign of slowing.

Indeed, in many industries, digital transformation is underpinning new business models: manufacturers are moving from just selling products to delivering services as well, while new entrants to financial services are disrupting incumbent providers in areas such as payments. In this context, 92% of respondents say digital transformation is paramount to growth.

Despite the advantages it creates for businesses, digital transformation is no panacea for growth and

competitiveness. Other levers must also be considered and many respondents (87%) say alliances and JVs are necessary to respond to change.

Almost as many (82%) are focused on addressing internal aspects of the business, such as ensuring staff have the

skills they need to prosper in this new world. Almost three-quarters (73%) cite the need for operational improvements

while more than two-thirds (68%) are focused on effective capital allocation.

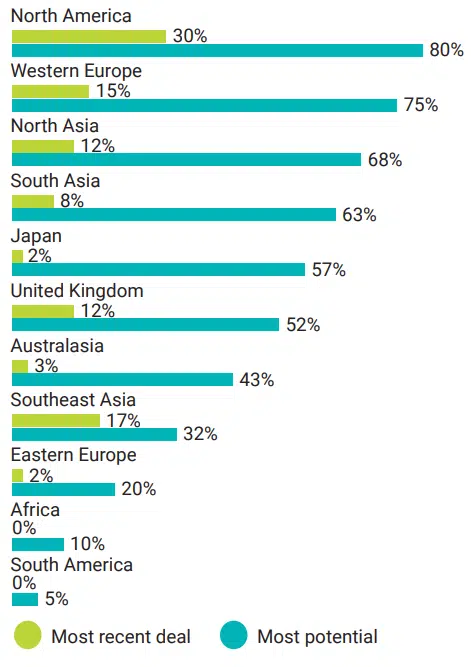

While developing economies are often regarded as offering particularly attractive prospects for high growth companies, respondents currently view advanced economies as offering the greatest potential for these businesses.

In particular, 80% pick out North America as the most promising market, while 75% cite Western Europe. By contrast, areas such as Southeast Asia, where firms had previously done significant numbers of deals, are now less in focus.

This is not to suggest emerging markets are dropping out of the reckoning. Many respondents still see opportunities in these regions - North Asia, for example, is a potential target market for acquisitions for 68%, likely driven by the desire for increased exposure to China.

Still, the more rapid progress made by many Western countries on Covid-19 vaccination programmes may be prompting focus on these markets, at least for the time being and as countries in Asia-Pacific make progress.

Despite broad optimism that fast-growing companies can deliver over the next one to two years, respondents cite a number of challenges that could threaten their growth trajectories. In particular, the prospects of economic volatility (a concern for 92% of respondents), regulatory challenges (90%) and further uncertainty and disruption related to Covid-19 (87%) all loom large.

Such fears are not unfounded. In its most recent World Economic Outlook, the IMF forecast that global economic growth would recover to 6% in 2021 and 4.4% in 2022, an upgrade on its January projections. The IMF also warned that “Global prospects remain highly uncertain… the outlook depends not just on the outcome of the battle between the virus and vaccines - it also hinges on how effectively economic policies deployed under high uncertainty can limit lasting damage from this unprecedented crisis.”

Moreover, perceptions of an increased focus on regulation are not misplaced. In industries such as financial services and technology, policymakers continue to pursue regulatory reforms. Data regulation is increasing on a global scale. The US-led initiative on minimum corporate tax rates is also focusing minds.

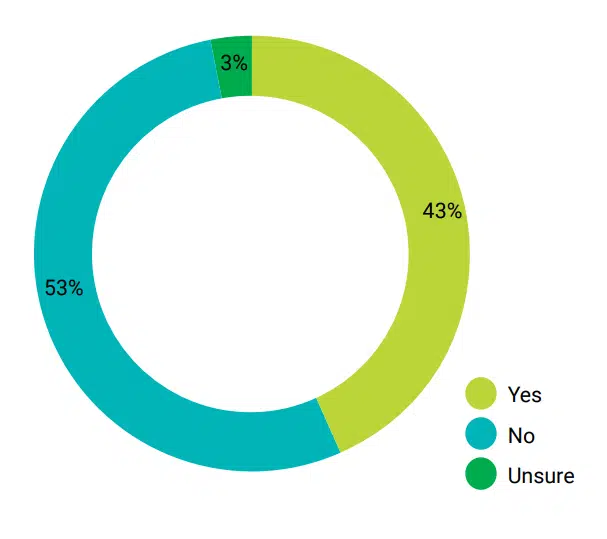

One consequence of the Covid-19 crisis appears to be that close to half (43%) of PE firms are holding on to investee businesses for longer than originally planned. The majority (53%), however, are sticking with the exit plans they had all along.

One reason many are extending their holding periods is that the disruption of the pandemic has checked the rapid growth of many businesses, leaving investors short of their target returns. Another driver is nervousness about pursuing a sale given current market conditions, where volatility is continuing and visibility is limited even in the short term.