Si no sabes qué es Kuaderno, fue Fundada en 2015. Es una plataforma digital independiente española líder en aprendizaje de inglés para alumnos de 5 a 15 años. El objetivo de la ronda pasa por financiar las principales vías de crecimiento; Mejorar los productos y reforzar el algoritmo inteligente de generación de contenidos. Además de impulsar su crecimiento internacional.

Cabiedes & Partners y Fides Capital han sido los inversores que ha apoyado a kuaderno en esta ronda de financiación de 450.000€.

La empresa pretende lanzarse a la expansión internacional, comercializando en al menos seis países: España, Francia, Italia, Polonia, Rusia y México. Además la empresa también quiere desarrollar y mejorar el producto con ampliación de las materias educativas cubiertas; reforzar los materiales educativos con introducción de contenidos curriculares y nuevas herramientas para profesores y alumnos; y reforzar el algoritmo inteligente de generación de contenidos.

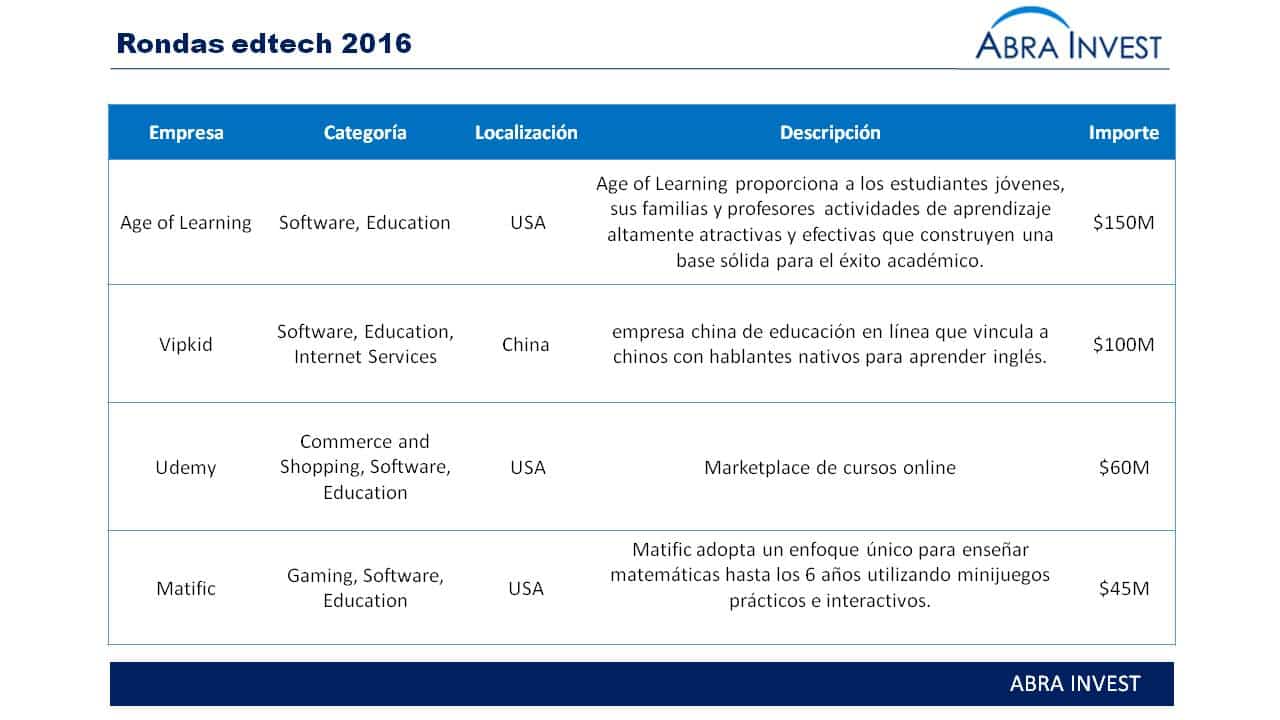

En España los inversores Edtech todavía no están tan activos como en otros países, aunque en el último año hemos detectado varias rondas en el sector, como la cerrada por OpenWebinars de curso online de programación y Bluebottlebiz, pero salvo la de Abba English, todas las rondas han sido por importes menores a €1M. El mercado internacional va por delante y en este 2016 hemos detectado rondas de importes que superan los $45M en el sector.

Si estas buscando inversores, quieres comprar o vender una empresa o, Llama al +34 946 42 41 42 o rellena el formulario de contacto. Baker Tilly GDA cuenta con un equipo experto a tu disposición.

Las empresas del Mab amplían capital: Agile y Secuoya

Ezentis compra la Chilena Tecnet para crecer en el mercado de la energía