Jobandtalentfounded in 2009, is an online job platform that aims to make the job market much more flexible and transparent, helping companies to meet their recruitment demands. It achieves this by being a highly personalised Marketplace. Read our definition of Marketplace in the article Best Marketplaces or in the Investment Analysis by Baker Tilly.

The company is present in Spain, where its headquarters are located (Madrid), but it is also present in the United Kingdom, Germany, Sweden, Mexico, Colombia, France and Portugal. Its mission has as its main objective to reduce unemployment in the world. They argue that the labour market has gone from being characterised by a stable structure to being extremely flexible, which means that companies are demanding this flexibility and that the traditional job search structure is no longer valid. This is why Jobandtalent appears on the market, managing to regenerate this "old-fashioned" process.

At the same time, the flexible state of the labour market means that many workers are in turn in a vulnerable and unprotected employment situation. In an attempt to solve this problem, Jobandtalent has created the Workforce as a Service (WaaS) platform to benefit both companies and employees. This platform offers advantages such as, for example, carrying out everyday processes from an app, such as signing contracts or payroll management, while providing the company with complete information about its employees.

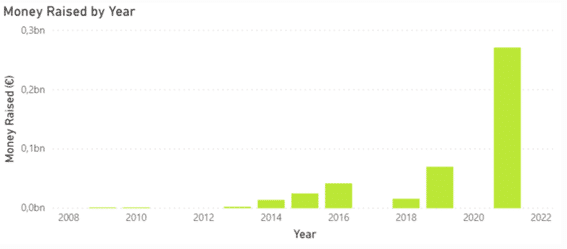

JobandTalent has raised more than €430M since its inception in 2009 as part of ongoing funding from various investors, thanks to a total of 15 funding rounds. In 2021, it has already completed three rounds, the largest it has raised so far. On 8 January, it raised €88 million thanks to the contribution of 7 investors, notably InfraVía Capital Patners as lead investor, an independent investment company specialising in the infrastructure sector.

Two months later, on 9 March, it raised two more rounds. A slightly smaller €83 million round by the well-known investment management company BlackRock and the other explained in the next section.

Finally, we would like to highlight the last financing round held on the same day, 9 March, which, with a total raised amount of 100 million euros, is JobandTalent's largest financing round to date. This round involved only one investor, Softbank Vision Fund, corporate venturing Softbank fund that aims to invest in foundational companies and platforms that SoftBank believes will revolutionise and innovate the world of tomorrow.

What is Corporate Venturing? Click here

The image shows the evolution of the company in terms of funds raised through the different rounds of funding raised so far. It can be clearly seen that it has a positive progression which indicates that the company is expanding.

These new investments are made with the aim of continuing this growth and expansion of its global presence. It is also to strengthen its unique proposition and to help regenerate that process, which as they say, is still a traditional process. As can be seen, in turn, in the graph, Jobandtalent is betting on this growth by raising funds from a total of 24 investors, highlighting its nine main ones: DN Capital, Atomico, Kibo Ventures, SEEK, Qualitas Equity Partners, the aforementioned Softbank Vision Fund, BlackRock and InfraVia Capital Partners and, finally, Pelayo Cortina Koplowitz, an individual investor.