DTM, simply defined, stands for Digital Transaction Management and is concerned with the management of various document-based transactions in a completely electronic manner. It helps in the digitisation of documents and thus the digital transformation of the company itself. Some of the benefits offered by this type of business is the automation of routine processes or the consequent acceleration of the company's profits, as automation reduces costs across the board.

At the same time, it is worth noting that DTM companies do not only involve documents, but also people, data or pure transactions, as mentioned above. Examples of DTM include electronic signatures (eSignatures), a very important segment within the sector, data analytics, authentication through AI or biometric identification, among others.

The opportunities in the sector are numerous as shown in the full report. Covid-19 has had a positive impact on the sector as it has helped accelerate the shift to digital in many companies, driving growth in the DTM sector.

On the other hand, the use of new technologies offers unique opportunities in the applications offered by companies dedicated to handling digital transactions. Blockchain is an example of such technologies. Blockchain is the main trend in the sector in terms of new technologies, in addition to the increase in secure payment applications, facial or voice recognition, etc.

In turn, as shown in the study, the sector that has most recently implemented DTM has been the Health sector. This sector, due to Covid-19, has been overwhelmed in many aspects, one of them being data and information management. In this sense, the applications offered by DTM companies have greatly helped to overcome this, managing and automating many processes or documents.

Our expert analysts have segmented the industry into four major groups, with their sub-segments:

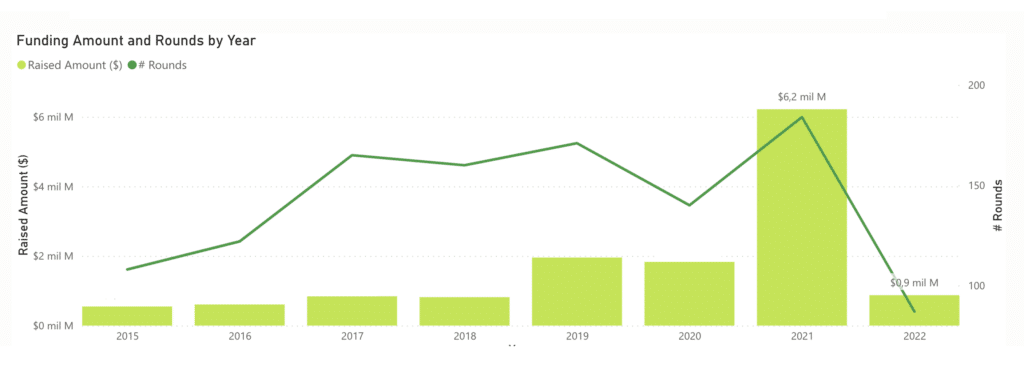

In terms of funding received, as shown in the report, in all three stages (innovation, growth and consolidation) the number of rounds has increased, in turn increasing the amount of funding received. In turn, the three main subcategories mentioned in the report have also seen an increase in the amount of funding raised, with the number of rounds decreasing in some cases, which may show some maturity in these sub-sectors.

The latest rounds in the sector have been executed by companies more focused on process security, such as Ethopass (authentication expert) or Passbase (digital identity provider). Both companies, in this case, raised rounds in the early stages. On the other hand, it is worth mentioning a round raised in December by Incode Technologies, which raised $220M in a Series B round on 7 December. This company is also dedicated to the verification of transactions through biometric signatures.

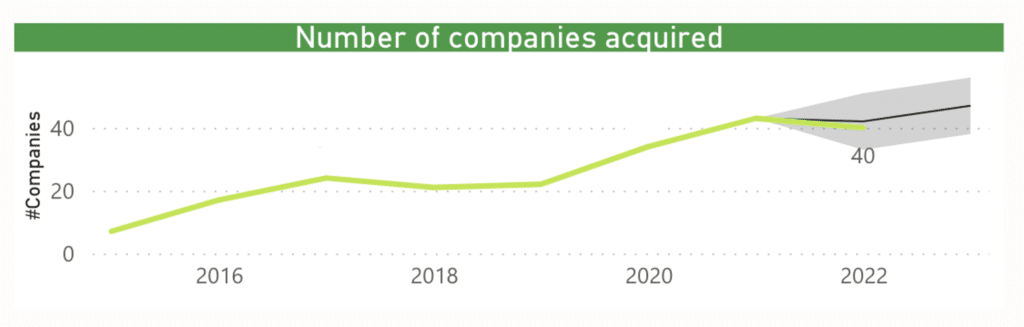

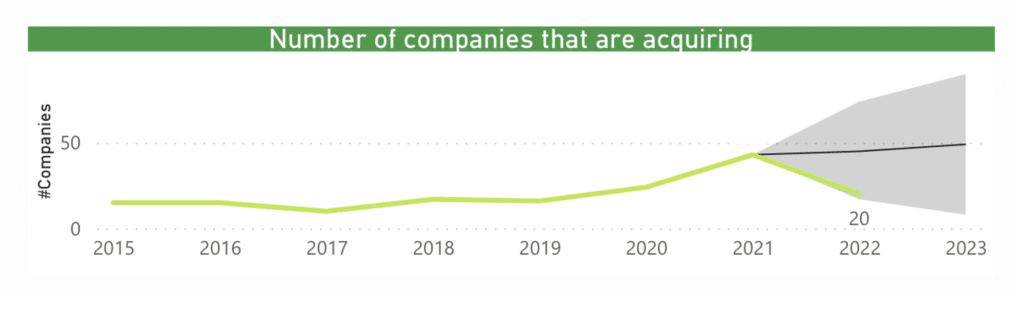

In terms of acquisitions, as shown in the report, the number of companies acquired in the sector has increased considerably in the last year, reaching almost five times last year's level. And as for the number of companies acquired by DTM companies, more of the same. In this case, the total number of transactions has tripled compared to 2020.

Recent transactions in the sector have been mainly between companies in the sector, such as Sift's acquisition of Keyless and ScureAuth's acquisition of Aceceptto.

Finally, the study presents the type of companies that have recently gone public. In the last two years, 4 companies have gone public. The well-known Penneo or Plurilock exits in 2020. Most of the DTM companies listed are those related to authentication, the most mature sub-sector within the DTM industry.

INDEX DTM - Digital Transaction Management