The Manufacturing Industry or Industrial Manufacturing sector uses raw materials to produce goods that are then, after transformation through machinery, tools and technology, sold to distributors who are in charge of the final commercialization . The manufacturing industry belongs to the industrial sector, also known as the secondary sector, a market that began to develop during the First Industrial Revolution.

This sector could be classified according to two types of criteria: dividing the companies according to the product manufactured or depending on the raw materials obtained. The first criterion consists of light products, such as consumer goods, or heavy products, durable goods. On the other hand, the second is classified according to whether they are extractive companies (extracting natural resources and transforming them) or manufacturing companies (transforming these raw materials into finished products).

On the other hand, the segmentation of this industry is divided into the different sectors in which this industry is present: automotive, food, aviation, electronics, etc.

As shown in the Investment Analysis, the total figures present in the sector demonstrate that it is a consolidated market both at present and in the future, which gives rise to investment opportunities in its variants with better future projection. Current trends make it clear that investors and technology companies are looking for the digital transformation of the industrial manufacturing sector,which translates into a growing and continuous investment in this market. At the same time, the existing trend of using clean and renewable energy is a crucial factor for the future of the sector, given that social and climate responsibility is increasingly being sought.

In terms of investment numbers, the last 5 years have seen 54% of the total financing rounds in the sector and 72% of the total amount raised, reflecting an investment boom with a promising future. On the other hand, the number of acquisitions follows this same trend reflecting in the last 5 years about half of the acquisitions made in the sector.

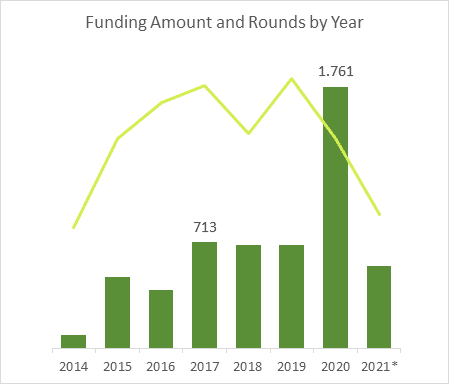

As discussed above, funding rounds offer an investment opportunity in the sector as they have been increasing over the last few years. As shown in the graph below, over the last 5 years the funding received in the Industrial Manufacturing sector has remained constant, although the number of rounds fell in 2018.

On the other hand, 2020 is an atypical year due to the macro round conducted by the Swedish company Beijer Ref in which it raised $1.1 billion thanks to EQT's investment. Unless there is another macro round in the sector, 2021 presents a lower fundraising forecast than the previous year. Despite this, as you will see in the Investment Analysis, the forecast for the number of rounds and the proceeds raised is higher than 2018.

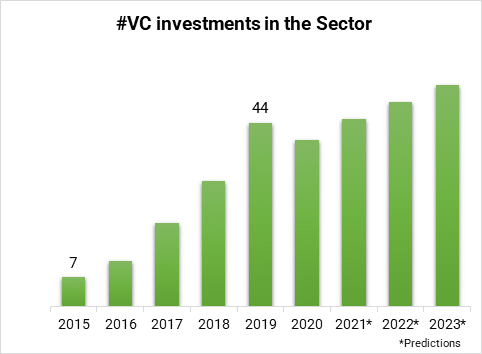

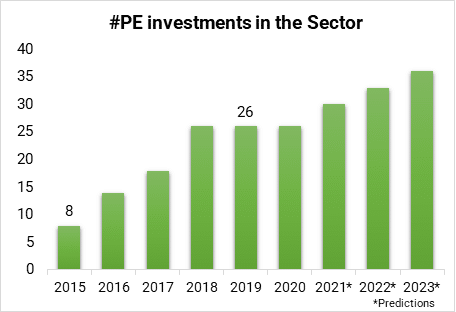

In terms of the number of investments made, we will focus on those made by Venture Capital and the various Private Equity firms that invest in the sector.

Starting with the VCs, we can see in the table the great growth that their investments in the sector are experiencing. Techstars, Rusnanom Desjadins VC, are some of the most active Venture Capital in this sector. For the near future it is expected that investments by this type of investors will continue to increase.

On the Private Equity side, the values are somewhat smaller than the previous ones, but follow this positive trend for the future. Some of the most active PEs are Siparex Group, BWK, S-UBG Group or the aforementioned EQT.

Nearly half of the acquisitions of companies in the sector have been made in the last five years, indicating future investment potential. On the other hand, there have been 634 acquisitions by companies in the sector, mostly from the United States, of other companies.

During the last year, the companies that have made the most acquisitions, closing 2 operations, have been Indutrade, KPS Capital Partners and Platinum Equity. The first of these is a Swedish industrial company and the last two are two U.S. private equity firms.

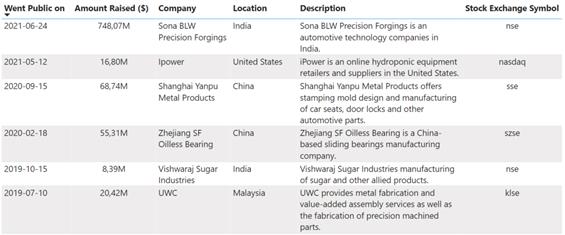

On the other hand, in terms of IPOs throughout history, China is the country with the most public companies, followed closely by India, which has almost 50% of the companies in the sector listed. As shown in the Investment Analysis, it is worth noting the small number of US companies that have carried out an IPO.

This table shows the latest IPOs conducted in the sector:

Finally, the market analysis shows an overview of the situation of the sector in Spain. With 137 companies classified in this sector, only one of them has carried out an IPO: Acerinox, which went public in 2000. On the other hand, it has a high number of financing rounds, almost double the number of existing companies. The median of these operations is almost 13 million dollars.

Feed Summary

Investment Trends

3. Exit Outlook

4. Spanish Overview

5. About Baker Tilly