PopPlaces.com, the Spanish marketplace dedicated to renting commercial space for days for pop-up stores or events, is making progress in its international growth and has completed the merger with the German company Go-PopUp.

PopPlaceswhich was born in 2014, is the first marketplace Spanish for rental of spaces by the day. It is especially designed for traders to make pop-ups. Through the website, the owners of premises can advertise their spaces with images and explaining the characteristics, the days available for rent, and the price.

Pop-places was accelerated by Connector and has received two small rounds of investment since its foundation. Investors include Carlos Blanco, Elena Gómez de Pozuelo and Marc Vidal.

The PopPlaces business model consists of charging a 15% commission to the owner and 5% to the person renting the premises.

Until now, Popplaces had 1,200 spaces in Spain, mostly in Barcelona and Madrid. At the beginning of 2016, Pop Places signed an international business alliance with other companies in the sector in France, Italy, Hong Kong and the current partner, Go-PopUp.

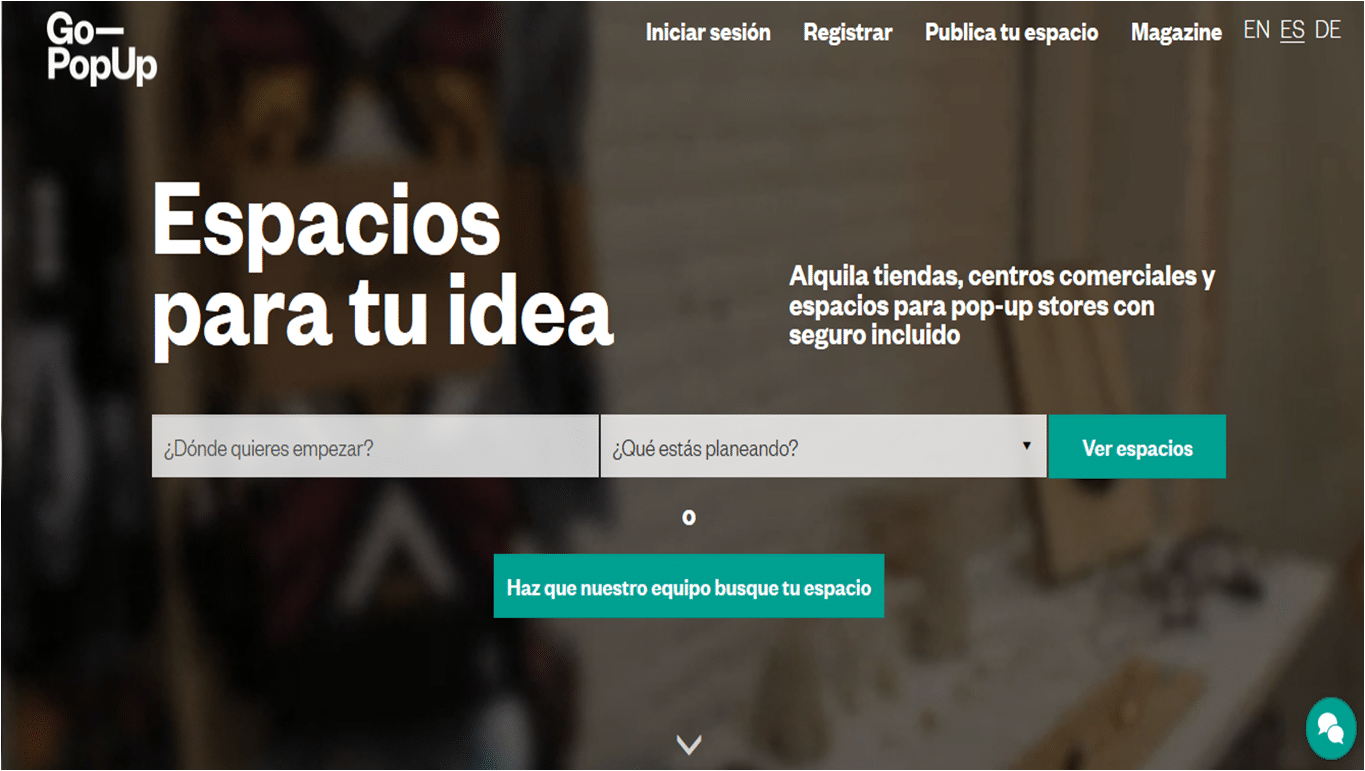

Go-PopUp, based in Berlin, operates in the same area as Pop Places and was the European leader in the sector. It also operated in Asia.

Within our scope of Corporate Finance in Spainwe have analysed the merger between the two companies. The newly created company will take the name of the German company, Go-PopupThe company will be more international, although it will be based in Barcelona. Go-Popup has 5,000 commercial spaces all over Europe, 1,500 of them in Spain, where it will be based in Barcelona. is present both in high street stores and in almost every shopping centre in the country, as well as other countries such as Germany, France, Italy, Austria, the Netherlands and Asian countries such as China (Hong Kong).

Among the objectives of the new company are opening up new markets to give more space options to the brands that work with it, especially in large cities in Europe, Asia and Latin America, said David Pérez, co-founder of the Spanish company Pop Places.

The combined turnover of the two companies in 2016 was one million euros -Pérez said he expects to close 2017 by tripling that amount to three million euros.

Go-Popup now plans to close an investment round in order to realise its growth plans.

Splio, the retail marketing software receives €10M

Telefónica buys German big data company to understand consumer behaviour.

If you are looking for investors, you want to buy or selling a companyplease contact us. Abra-Invest has a team of experts in each area at your disposal. Call +34 946424142 or fill in the contact form below.