When someone is a first-time buyer, i.e. someone who takes the initiative in wanting to take over a certain company, many questions arise about what to do, where the pitfalls are and also where the success of a buyout lies that makes me grow. The main idea of this text is to answer these questions from our experience and so that it can be useful to know where the key points for a successful takeover are.

Table of Contents

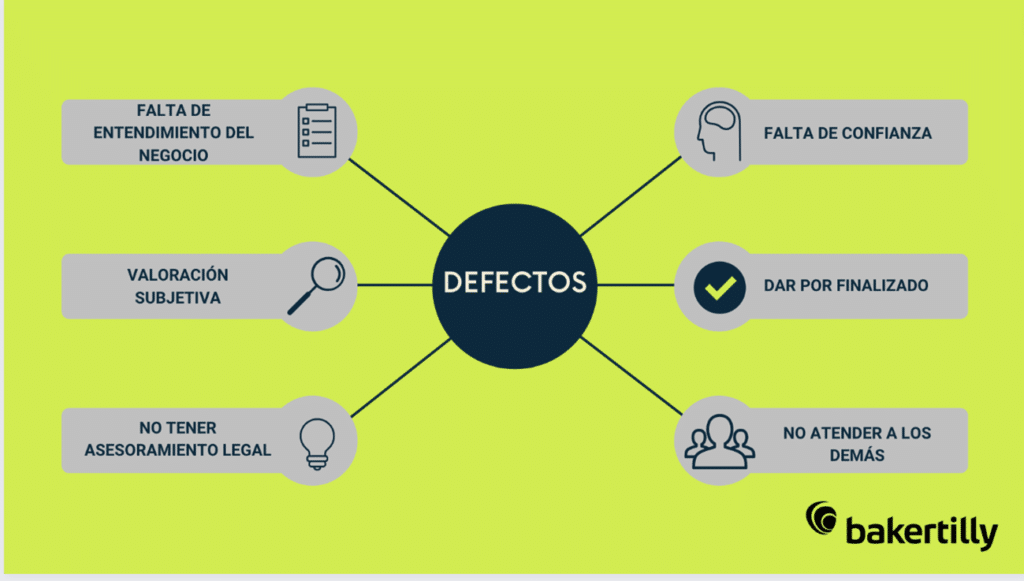

This section consists of the 6 factors for which an acquisition usually goes wrong. Many of them are generic and we may think that we already know them, however, the most general and obvious ones are usually the ones that generate the most reasons for failure:

It is very important for the buyer to understand the operation of the business it wants to acquire, as well as the sector in which it operates. This is particularly important when acquiring a company in an unfamiliar industry or in a different geographic area than the one in which the company operates. In fact, as Warren Buffet famously says: "The first requirement for investing in a company is that it must be in a business that it can understand.". And the fact is that in Baker Tilly Global Deal Advisory we believe that numbers are a reflection of reality, but numbers are not reality, reality is in the business.

Because overvaluation of target companies is very common, it is highly advisable that the buyer, once he has selected a target company, should consult a professional valuation firm to calculate the target value of the company.

It is advisable to consult a legal advisor specializing in M&A activities to advise on best practices and models to follow. In addition to providing financial advice on the purchase, we also have a team for due diligence services and legal advice at Baker Tilly.

This part is a matter of honesty, but it also makes negotiation much easier if both parties trust each other. Working with trust in the other party speeds up the process, is in the best interests of both parties and, above all, makes it easier for both parties to benefit. If, on the other hand, the other party is distrusted, this generates continuous stoppages in the process, subjective factors and the possibility of parallel actions that damage the negotiation to the point of breaking it.

In this type of process there may be several moments in which it seems to conclude. Either for better or for worse, and the truth is that most of the time it never happens as we think it will. So until all the paperwork is finished, you have to go on as if nothing has happened.

Even though it may be a busy time, it is very important to continue to take care of the tasks and the agents we work with. In other words, we are trying to make a purchase, but we have to continue to maintain the day-to-day business. Having an advisor to offload some of the work involved in the purchasing process helps us not to neglect our day-to-day business.

Making an acquisition is not just about taking two organizations and combining them or simply deciding which company I want and moving on. It is something more complex, that is why from Baker Tilly Global Deal Advisory we want to recommend you 4 keys to success:

Although the word SMART sounds very repetitive, it is key to the objectives of an acquisition. They must be specific, measurable, achievable, important and time-bound. Setting measurable goals and objectives allows people to know what a successful integration will look like and how long it will take. This allows the acquisition to go more quickly and smoothly.

Having a clear focus allows better decisions to be made more quickly. In short, it will provide the infrastructure and resources necessary to deal with a large volume of work, integrating processes, people and systems.

This is probably the most important factor in getting the negotiation right. Financial analysis is usually simpler or easier to get right. However, human analysis is somewhat more complex and companies often do not give it the importance it deserves.

It is important that throughout the process we maintain clear and transparent communication with the people involved in the process and that when the time comes to finalise the process, we have prepared the communication of the transaction to employees, customers and suppliers.

At Baker Tilly, we can advise you on how to ensure that your process of buying a company is a success!