In this new post we will focus on developing the Global Financing of the Cloud Computing sector and identify the main countries in which companies in the sector are present.

The Cloud Computing industry, or Cloud Computing, is that technology that allows you to remotely access your own software or stored files over the Internet. The main advantage of this type of service is that you do not need to install any application on your own computer. Like Baker Tilly has defined in its market study of this sectorCloud computing is a market that has been enhanced during the pandemic as more and more companies have found it necessary to use the cloud in their day-to-day business.

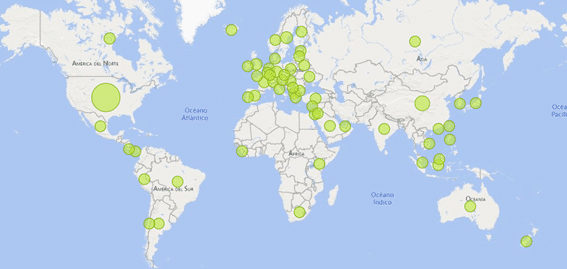

Today, there are 8,482 companies engaged in providing Cloud Computing services. These companies are present in 102 countries around the world. This in itself is already an indicator that the sector is quite present in the global market. As the map in the following image shows, we can see that in every European country there is at least one company in the sector.

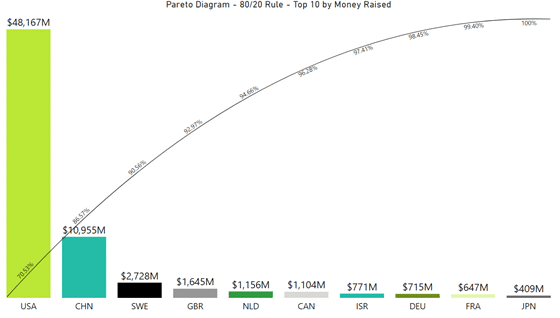

In terms of global funding for the Cloud Computing sector, the top 10 countries with the most funding are led by the United States, as shown in the graph below (a Pareto diagram). The amount raised by US companies exceeds 48 billionthanks to the completion of 4,013 rounds of financing. There is a big difference with China, the second country with the second largest amount raised, which totals almost 11 billion dollars. It should be noted that the financing obtained has been thanks to the execution of only 674 rounds. Analysing the 10 countries with the largest funding, we can see that the United States accounts for 71% of the global market. And if we add China, both countries account for almost 85%!

To put this in context, the average round in the United States is around $12 million, and the average round in China is around $16 million. Although these countries are in the top 2, the country with the highest average fundraising per round is Sweden. Sweden is the country with the third highest amount of money raised and the 12th highest number of rounds raised, with only 61 rounds. Despite this, it averages $44 million raised per round, making it the country with the highest ratio.

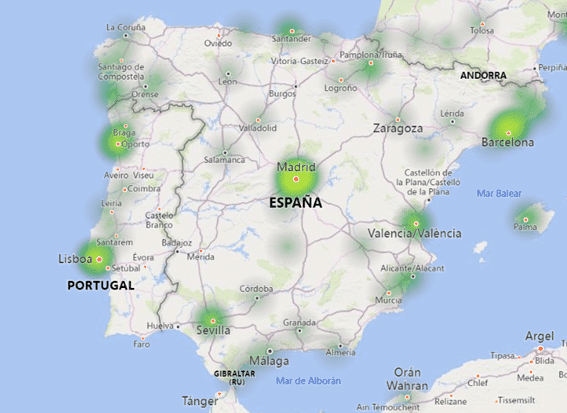

Analysing Spain, we observe that there are 160 Cloud Computing companies, of which only 26 have received funding, raising a total of more than 122 million dollars, through 59 rounds, being the fifteenth country in global funding in the Cloud Computing sector.

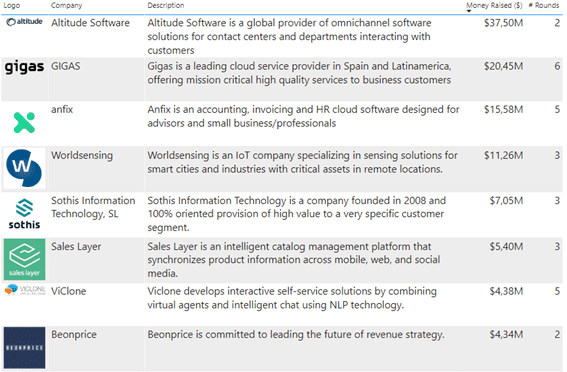

On the other hand, of these 160 Spanish companies, only one is public. This is the Madrid-based company GIGAS. Founded in 2011, it specialises in the provision of convergent and comprehensive communications and cloud services for companies. It is present in Spain and Latin America. It has been listed on the Spanish stock exchange since November 2015. It is worth noting that in 2018 it carried out two acquisitionsSVT Cloud Security Services, a Catalan company, and Ability Data Services, a Mexican company.

He has had five investors in his lifetime (Caixa Capital Risc, InvereadyCabiedes & Partners, Bosal Capital and Bonsai Ventures Capital SCR), all of them Spanish investors, with the exception of Bonsal Capital, a US investment firm focused on the education, healthcare and cloud-based cybersecurity sectors.

On the other hand, analysing the country as a whole, we observe that Madrid and Barcelona are the cities with the greatest presence of the sector. Although it is true that Madrid (58 million dollars) has more than twice as much funding as Barcelona (26 million dollars). Seville and Valencia are much smaller.

Finally, it should be noted that there are 9 companies founded in the last 3 years (Napptive, GoBeCloud, Jotelulu, Nextmol, ungoiti, MyKeys, RADIAN, Seqera Labs and Simpled), of which only three have received funding (Napptive, Nextmol and Seqera Labs). This is a great opportunity to invest in this type of Cloud start-ups, with a very promising future.

The following table shows the top Spanish companies by financing received.

Note: all data in the different images or graphs are obtained from Crunchase.