El concepto de Marketplace como plataforma web adquirió gran relevancia tras el surgimiento de la Nueva Industria 4.0 provocada por el desarrollo de la transformación digital. Destacados marketplaces como Amazon, Alibaba o Ebay have been able to make the most of this type of business by responding to an increasingly dynamic economy. Moreover, this type of platform is the result of the continuous search for zero marginal cost, i.e. to minimise their costs by making the most of each of their available resources.

On the other hand, this sector, as detailed in the analysis by Baker Tillyis continuously growing thanks, in large part, to the aforementioned digital transformation brought about by the insertion of digital technologies in the industry.

The ultimate aim of these marketplaces, as their name suggests, is to offer a platform where sellers and buyers can meet so that the former can satisfy the needs of the latter through their offer.

So what is the difference between a marketplace like Amazon and a physical shop? The breadth of the offer. In a physical shop such as a bookstore, there is only space to store and display a limited number of items, so the bestsellers are offered and those with very low sales turnover are discarded.

On the other hand, Amazon revolutionises the offer known until now by eliminating the barrier of a physical sales space, being able to offer a wide variety of books and not only the best sellers. This type of offer is better adapted to the needs of customers, as a greater variety makes it possible for consumers to find items with specific characteristics that are better adapted to their needs.

This type of platform not only benefits consumers but also some suppliers such as, following the previous example, the more unknown writers. In a physical shop there would be no place for them, but in a marketplace they can put their books on sale and the cost for a web platform to have one more or one less copy for sale is almost zero.

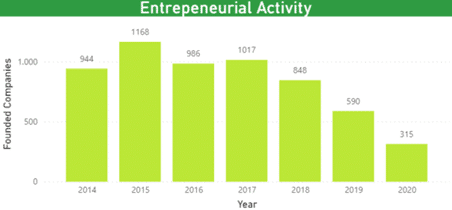

The first graph shows the number of companies founded in the last 7 years. Although it is true that there is a negative progression, it does not detract from the fact that the numbers are very high, reaching, for example, in 2015, almost 1,200 companies founded.

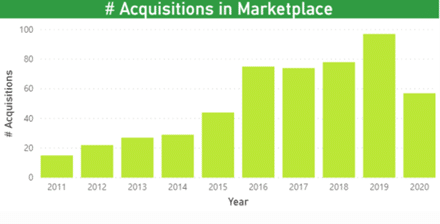

The second graph shows the number of marketplace acquisitions made in the last 10 years. Here we can see the growth of this sector more clearly, with a total of 97 acquisitions in a single year (2019).

In this article we will focus on a recent acquisition: the purchase of eBay Classifieds by Adevinta. Beforehand, we will briefly define both companies.

AdevintaAdevinta, founded on 1 April 2019, following the reorganisation of Schisted into two companies (Schisted and Adevinta, both with different strategies) has been listed on the Olso stock exchange since 10 March this year, with Schisted as the majority owner. Adevinta is a marketplace specialist that helps local digital marketplaces thrive through global connections and knowledge networks. Their platforms unlock the full potential of every person, place and thing, helping local communities to thrive and, as they say, leave a positive footprint on the world.

For its part, eBay Classifieds is a global collection of local brands that aims to create connected commerce, empowered by people, supported by technology and open to all. Its brands include BilBasen, DBA, 2dehands/2emememain, eBay Kleinanzeigen, Gumtree, Kijiji, Marktplaats.nl, Mobile.de , Motors.co.uk and Vivanuncios offer online classified ads in more than a thousand cities worldwide.

Adevinta announced the acquisition of eBay Classifieds Group on 21 July 2020 for a total of $9.2 billion, making it the most expensive acquisition in 20 years.

This acquisition gives Adevinta the opportunity to consolidate its position as a leader in the online classifieds sector and to have a global presence in 20 countries. As they comment in the acquisition announcement, it significantly expands their presence in new markets with high growth potential. (Click here for more information. here for details of the communiqué).

For its part, eBay remains enthusiastic about the proposed combination of Adevinta and eBay Classifieds Group. The two companies are currently aiming to close the transaction in the second quarter of 2021 for the agreed $9.2 billion.